A game-changing move for NatWest's share price

24th April 2023 07:37

by Alistair Strang from Trends and Targets

A few months after pulling back from a multi-year high, NatWest shares may have found a bottom. Independent analyst Alistair Strang runs his software again to see if the bounce might have legs.

Understanding if a trend line is important can often be the most important facet of trading. After all, everyone wants a better clue as to the direction a price or market is heading.

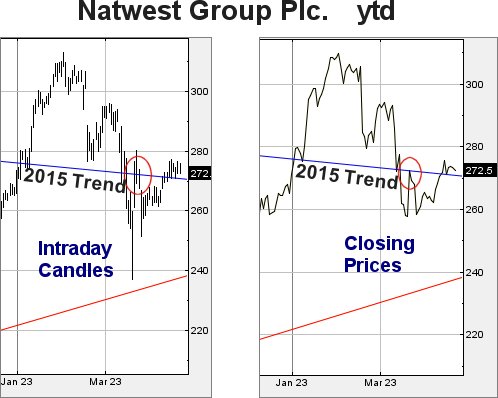

NatWest Group (LSE:NWG) has a Blue downtrend, one which dates back to February 2015 and usually, with this year's chaotic banking share movements, our inclination would be to dismiss the trend as irrelevant.

However, share price movements with NatWest in the last few weeks give a justifiable reason to avoid rushing into any quick decision.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

The two chart extracts below show, hopefully quite clearly, why we’re opting to take such a stance. In March, NatWest's share price tumbled below this particular trend line, rather neatly hitting out target “bottom” of 238p and bouncing a bit. The ricochet stopped and closed the next session at 272p, literally exactly at the level of this eight-year old trend.

For whatever reason, the market ensured the share failed to close above the trend, but on 12 April, it appears the share price gremlins had a change of heart, opting to gap the price above the historic Blue downtrend and in the sessions since, ensured the trend line remained inviolate.

It begs the pretty obvious question, does the market intend for NatWest to now gain in value, the price being carefully maintained above Blue for the most recent seven sessions?

Source: Trends and Targets. Past performance is not a guide to future performance.

Should this prove to be the case, we can calculate the next port in NatWest’s storm at 307p, as there are several indications the market wishes NatWest to head upward!

In the event our 307p level is exceeded, our secondary works out at 351p sometime in the future. This would prove to be an important, almost game-changing move for the share price as it’d find itself solidly above many of the highs since 2015, allowing an overdose of optimism to make itself felt.

However, we always attempt to provide a converse argument. For the market to emulate this sort of move, NatWest needs to close below Blue, presently 270p, as this risks promoting a route down to 235p with secondary, if broken, at an eventual 205p and hopefully yet another bounce.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.