GlaxoSmithKline results trigger yo-yo session

There is clear disappointment with these numbers, but the shares might still be cheap.

5th February 2020 14:33

by Graeme Evans from interactive investor

There is clear disappointment with these numbers, but the shares might still be cheap.

GlaxoSmithKline (LSE:GSK) investors were in a need of a pick-me-up today after the pharma giant forecast lower earnings per share and yet another 80p a share dividend for the year ahead.

The blue-chip company's results for the final quarter of 2019 were also underwhelming, with the 21% decline in earnings per share to 24.8p slightly larger than City forecasts.

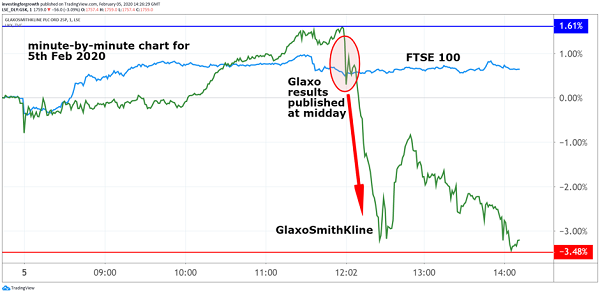

Shares were volatile in the aftermath of the midday results announcement, falling over 3% to 1,760p in the minutes after the midday announcement, only to steady later on before another lurch lower. However, they remain 16% higher over the past year as investors continue to back the strategy of CEO Emma Walmsley as she looks to focus on advancing the group's R&D pipeline.

She said today:

“In 2020, our first priority remains innovation, to progress our pipeline and support new product launches.”

As this pledge will result in increased investment over the next two years, Walmsley admitted that earnings per share are likely to decline by between 1% and 4% in 2020. UBS analysts had previously forecast a 2% fall in what they expect to be a “trough” year for Glaxo.

Source: TradingView Past performance is not a guide to future performance

The current period will also be significant for the start of a two-year project to split Glaxo in half, through the value enhancing separation of the consumer healthcare division into a standalone business. This will leave Glaxo as a biopharma company focused on science related to the immune system, use of genetics and new technologies.

Glaxo said today that one-off costs to prepare the Sensodyne-to-Panadol consumer healthcare business for separation were likely to be between £600 million and £700 million. The operation now also includes Pfizer (NYSE:PFE) brands such as Advil and Centrum after the two companies completed a joint venture deal in August.

The new-found strength of the consumer healthcare arm was highlighted in today's full-year results, with revenues up 17% to almost £9 billion in 2019 and up by 37% in the fourth quarter. The three-month figure was flat on a pro-forma basis, however, with strong growth in oral health offset by declines in other categories.

Vaccines sales grew by 19% to £7.1 billion, primarily due to £1.8 billion of revenues for shingles product Shingrix. Other recent product launches in the shape of respiratory prospect Trelegy and HIV treatment Juluca failed to prevent revenues in the pharmaceuticals division from falling 4% to £4.6 billion in the fourth quarter.

UBS said last week that the HIV business had the potential to return to modest growth in the coming years, with Shingrix poised to see high single digit sales growth. Demand currently outstrips supply, so with new manufacturing facilities expected by 2024 UBS thinks the shingles vaccine has the opportunity to deliver £4 billion of sales by 2026.

The Swiss bank had a price target of 1,950p prior to today's results. It noted that the market's implied 20x price/earnings multiple for the consumer healthcare arm left the rest of Glaxo on 13.2x, which it said looked to be cheap against stocks with similar trajectories.

Today's 80p a share annual dividend, which Glaxo hopes to repeat again this year, means the company has kept its shareholder pay-out unchanged since 2014.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.