A good value mid-cap share worth buying

PZ Cussons is at a bit of crunch point, but where there's a crunch, there may be an opportunity.

25th October 2019 15:51

by Richard Beddard from interactive investor

PZ Cussons is at a bit of crunch point, but where there's a crunch, there may be an opportunity.

Jeepers, Richard. PZ Cussons on a multiple of 12 times adjusted profit? Never thought I'd see the day.

Me neither. For the avoidance of doubt, that's an enterprise multiple of 12 times adjusted profit after tax. It wasn't long ago that investors thought the trusted owner of a fistful of famous brands was worth nearly twice as much. Times change...

Not just times, surely. What's gone wrong?

As far as I can see, there are broadly two sets of problems: those that afflict all consumer goods brands even giant ones like Unilever (LSE:ULVR) and Procter & Gamble (NYSE:PG), and PZ Cussons' (LSE:PZC) dependence on a growing Nigerian market, which goes back 135 years.

Do tell... What's up with Nigeria?

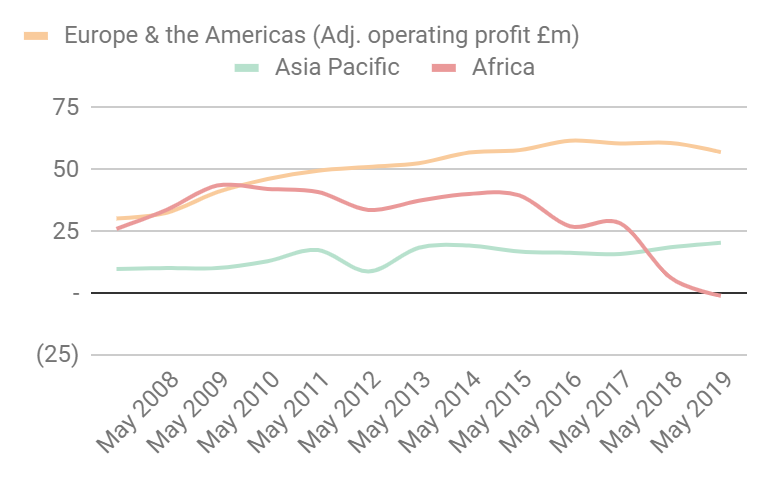

At the risk of sounding glib, what isn't up with Nigeria? After the oil price crashed in 2014, the Nigerian economy started shrinking and it hasn't really stopped. Corruption, sporadic conflict in the north of the country and the ebola outbreak have all weighed on prosperity. The result is high levels of inflation and a much devalued currency. Fast growing populations in fast growing economies like Nigeria were PZ Cussons' not-so secret weapon when the Nigerian economy was booming in the naughties. But today the Nigerian population isn't spending as much, and the currency it uses isn't worth as much.

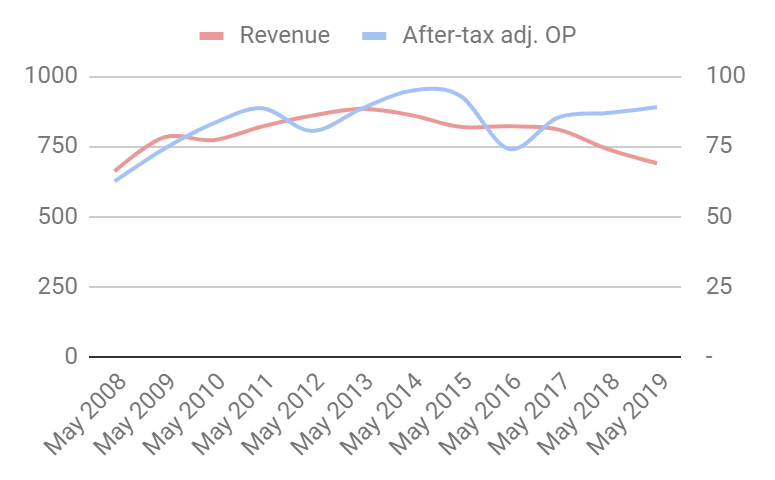

Since 2014, PZ Cussons' revenue has declined, profitability in Nigeria has collapsed into losses, and the company's immediate prospects for growth lie elsewhere, possibly Asia and the USA.

So far, so bad... What's up with brands?

At the risk of oversimplifying, it used to be that we had a fairly limited choice of big brands, which the brand owners furiously advertised to brainwash us into loyalty. Two things seem to have changed that.

First, there are discount retailers who have introduced their own brands, usually aping the famous brands in terms of product and packaging. We've realised there isn't much difference except the price. Retailers can also offer much more choice on the Internet, which increases competition, and brand owners are having to learn new tricks to ensure their products get seen by customers.

Yikes! Good old PZ Cussons has been stymied here, it's been stymied there, it's being stymied everywhere! What is it doing about it?

After years of cost-cutting, it has decided that streamlining its supply chain, manufacturing, and administrative functions will not get it growing again. It has accepted the Nigerian economy will remain moribund for the foreseeable future and that people are not prepared to pay a premium for a famous brand, when a discounter's product does a perfectly good job.

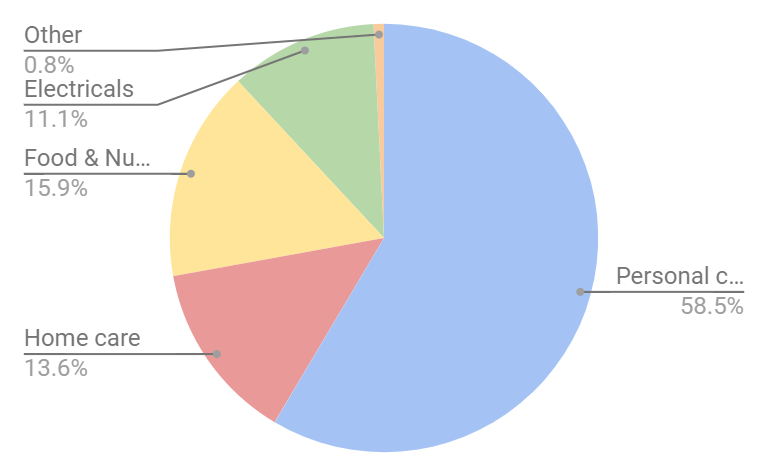

It has launched a new strategy: to focus, scale and accelerate. That is, it will jettison less profitable brands, mostly in the food and nutrition and home care categories, and invest the proceeds in 10 high margin brands and three Nigerian joint ventures that are proving resilient, one manufactures fridges and washing machines, and the other two sell palm-oil based cooking oils and spreads.

Eight of the core 10 brands are in the personal care and beauty category, like Imperial Leather and Original Source, market leading soaps and shower gels, and St Tropez, the number one fake tan. Cussons believes we are still picky about what we spread on our skin.

So personal care and beauty is in, what's out?

As I said, household cleaning products and foods. The core 10 brands include only one brand in each of these categories: Rafferty's Kitchen, Australia's favourite baby food (30% market share), and Morning Fresh, its favourite washing up liquid (40% market share).

There are brands in every category at risk, many of them Nigerian. The big loser, though, could be milk, which is a bit embarrassing as PZ Cussons' two most recent acquisitions were the half of the Nutricima joint venture it didn't already own and five:am. Loss-making Nutricima manufactures milk based brands in Nigeria and fiva:am, an Australian yoghurt brand is not thriving either. In 2019, PZ Cussons' wrote off £22.3 million of intangible assets acquired with five:am in 2015. I suppose the good news is personal care and beauty are already responsible for nearly 60% of revenue, so PZ Cussons is focusing on its biggest and most profitable product category.

But, as you say, an embarrassing volte face?

Yep. The company's long standing chief executive Alex Kanellis has admitted as much. In a chatty Q&A in the annual report he said the company he has run since 2006 had invested in too many categories and initiatives.

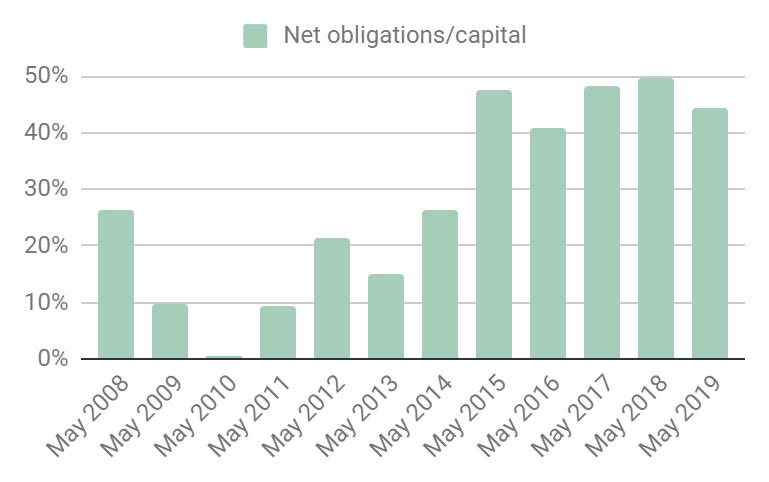

While it takes courage to admit you got it wrong, I don't think the company has much choice. It has cut costs, including investment, and still it can barely pay the dividend out of free cash flow. Until 2018, when PZ Cussons' froze the dividend, the company had grown it in each consecutive year for more than four decades.

Now it has decided investment is the way forward it must fund it. There are a number of ways it could: a dividend cut from this stalwart would upset a lot of shareholders. So would selling more shares. PZ Cussons is already carrying substantial financial obligations because it borrowed money to make acquisitions earlier this decade:

The least-worst option is to sell off less profitable brands because it might actually improve the business. In the long-term that may benefit shareholders, employees and customers.

So it's going to divest and invest. In what exactly?

On divestments, it has got off to a flying start raising over £50 million from the sale of Minerva, a business that sold olives to the Greeks, and Luksja, a Polish personal care brand.

On investment, PZ Cussons is promising innovation. It trumpets reformulated Foamburst variants of Imperial Leather and Original Source soaps in its annual report, which together have won a 74% share of the "premium foaming shower category" in the UK by lathering up bathers. The company is now adopting the patented technology in other products and brands. It also promises to introduce its brands into new markets. For example it wants babies all across Asia to be eating Rafferty's Garden.

Sounds like PZ Cussons is at a bit of crunch point?

I think so. And where there is a crunch, there may be an opportunity...

Great, let's score it then...

Does PZ Cussons make good money?

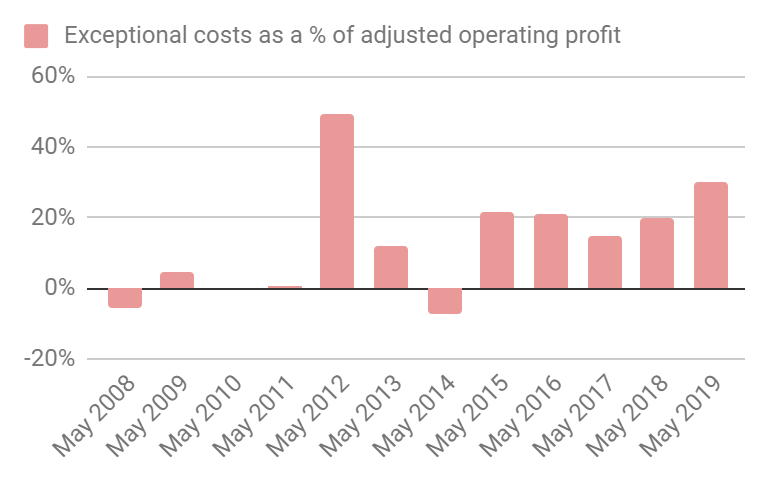

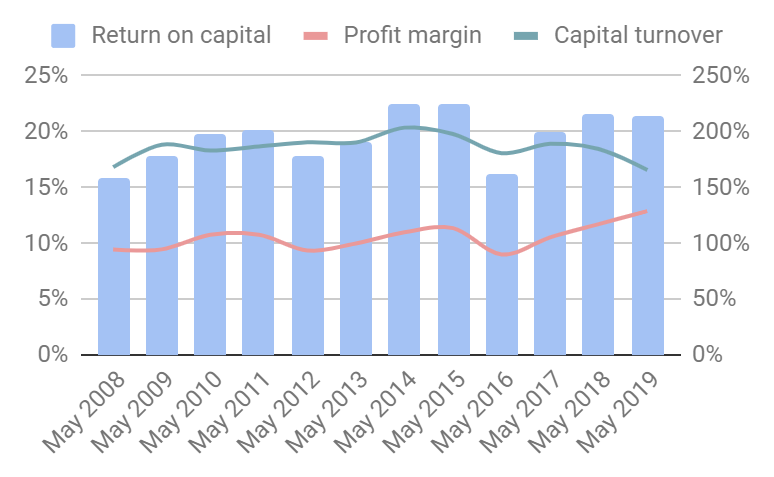

Yes, but with a big caveat. Return on Capital and profit margins are high, but the company has treated restructuring costs as exceptional in the adjusted profit figures used here even though it has restructured in eight of the last 10 years.

That said, after-tax return on capital over the last decade has been 20% and after-tax profit margin is consistently in the low double digits.

Average free cash flow return on capital is a more pedestrian 13%.

Score: 1

What could prevent it from growing profitably?

It isn't currently growing...

Prolonged recession in Nigeria, and competition from alternatives online and discount retailers, remind us that manufacturing and selling so-called fast moving consumer goods can be a capricious and competitive business.

Score: 1

How will it overcome these challenges?

The new strategy addresses the risks. PZ Cussons is scaling back in Nigeria while continuing to invest in its market leading businesses in readiness for economic recovery. It plans to return to growth by developing better products and managing retail and distribution partners so its brands are put in front of customers. It will finance the investment by divesting lesser brands.

Score: 2

Will we all benefit?

Probably. The annual report communicates the company's strategy and culture well. It is committed to "doing the right thing" and "leaving a legacy for the next generation we can be proud of". It claims to have an open culture, to be big on training and development, and to be a great place to work. It is taking strides to source palm oil sustainably and reduce plastic packaging.

I have mixed feelings about the chief executive, who does not have a particularly large shareholding and receives impressive levels of pay, but he is liked by the workforce. Despite five years of restructuring, 75% of reviewers on recruitment website Glassdoor approve of him, and 73% would recommend the company to a friend.

Score: 2

Are the shares cheap?

Yep. As I said at the beginning, an enterprise multiple of 12 times adjusted profit. Who'd have thought it?

Score: 1.8

A score of 7.8 out of 10 means PZ Cussons may well make a good long-term investment, but since this is my first good look at the company, I make that recommendation tentatively.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.