A growth company that’s helping save the planet

16th June 2021 10:01

by Rodney Hobson from interactive investor

Generating attractive profits while doing good is a great combination for investors argues our overseas investing analyst.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Channelling water and recycling plastic are two of the biggest environmental issues facing the planet. A company that does both – and generates cash in the process – has to be a potentially attractive investment.

Advanced Drainage Systems (NYSE:WMS) is not a normal water supply and waste disposal company. It specialises in products for handling stormwater and septic waste, two vital but niche services that tend to be downplayed by traditional operators in the sector.

It is also the second-largest plastic recycling company in North America, collecting 500 million pounds of single use plastic from roadside collection points every year, and turning the waste into pellets that are extruded into pipes that are designed to last up to 100 years. It claims its processes eliminate the creation of 750 million pounds of greenhouse gas emission annually as well as reducing the demand on landfill sites.

- Market snapshot: US policymakers under scrutiny as UK inflation jumps

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Check out our award-winning stocks and shares ISA

In addition to recycling household plastic such as shampoo and washing up liquid containers, ADS collects industrial plastic waste, for example discarded vehicle parts.

The thermoplastic corrugated pipes it produces have a wide range of uses, in agriculture, aviation, mining, housebuilding, transport and healthcare. Sales are in North and South America and Europe, though there should be scope to expand into other parts of the world. Close competitors use concrete rather than plastic so do not have the same green credentials.

Latest quarterly figures, to the end of March, were slightly disappointing. Earnings per share came in at 23 cents, vastly better than the 1 cent recorded a year earlier but below analysts’ forecasts. However, ADS has a record of surprising on the upside in the past, so possibly the analysts were tempted to err on the side of over-optimism this time. Revenue was certainly up to expectations at $443.8 million compared with $370.8 million last time.

- Three reasons ESG fund sales are booming

- Young investors more drawn to ESG funds than over-55s

- Ethical investing jargon buster: all you need to know

The company’s big attraction is that it is throwing up cash, and although most of its profits are being ploughed back into the business – capital expenditure this year will be nearly double that in 2020 – there is plenty to be returned to shareholders. The quarterly dividend has just been increased from 9 cents to 11 cents and an extra $250 million has been allocated to the share repurchase programme.

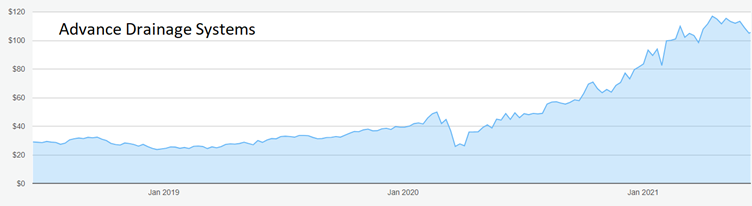

Source: interactive investor. Past performance is not a guide to future performance

ADS makes its investments work, so the chances are that earnings and dividends will continue to grow, if anything more rapidly than in the recent past. Not many American companies are so keen to reward shareholders, but ADS has been paying dividends for seven years and will not break that trend.

As the US economy recovers, so too will spending on infrastructure and housing. A remarkably large proportion of new housing over there, possibly as much as a third, is connected to septic tanks. ADS thinks that proportion will grow as people move out of cities into more rural areas. This is a big potential market and the $1.1 billion that ADS paid two years ago for Infiltrator, a specialist in handling wastewater for building not connected to sewers, could prove an astute move.

- Bill Ackman: I think this could be the Black Swan event of 2021

- Stockwatch: a great company you might never have heard of

Although the shares have come off the boil recently, they are still trading at four times the level of five years ago, so admittedly the best chance to buy has long since gone and, at around $107, they offer a yield of only 0.4%.

However, investing is about the future, not about handwringing over missed opportunities, and it is highly likely that the upward trend will resume. Even if the shares plateau for now, the rising dividend will bring its own rewards.

Hobson’s choice: Investors may prefer to see if the stock settles back further, but if you see ADS as an exciting possibility in a world coping with climate change and environmental issues then buy below the recent peak of $115, which could still prove to be a short-term ceiling.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.