Has Land Securities share price crash gone too far?

With shops shut and offices empty, many property firms now trade at big discounts to net asset value.

12th May 2020 13:02

by Graeme Evans from interactive investor

With shops shut and offices empty, many property firms now trade at big discounts to net asset value.

Land Securities (LSE:LAND) traded at a whopping 55% discount to its net asset value (NAV) today after the commercial landlord revealed in painful detail how Britain's lockdown is hitting its estate.

Shares in FTSE 100-listed Landsec sunk another 15% to 537.4p, with annual results writing down the value of its portfolio by 8.8%, or £1.18 billion to reflect declines for retail and leisure assets amid the early impact of Covid-19 and ongoing structural challenges.

The blue-chip stock is now back close to its low point for the Covid-19 crisis of just under 515p, seen in early April, when it revealed it only collected 63% of its quarterly invoiced rent in March. With Landsec expecting that June's quarter will be even worse, it should come as no surprise to income investors that there was no final dividend alongside today's £837 million loss.

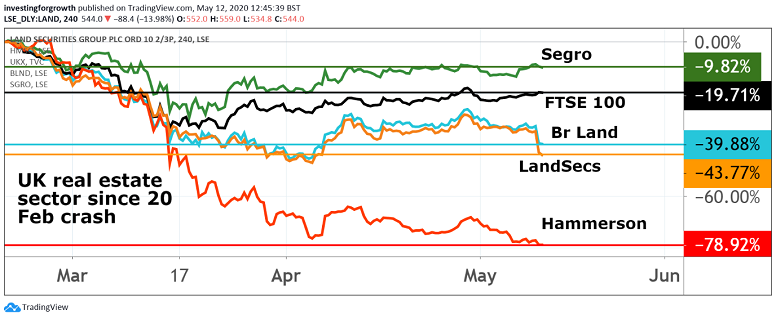

The 44% battering for Landsec shares since mid-February is only exceeded among top-flight property stocks by shopping centre rival Hammerson (LSE:HMSO), whose shares are down by around 80%. British Land is off 4%, including a fall of 9% today.

Source: TradingView. Past performance is not a guide to future performance.

In contrast, warehouse landlord Segro (LSE:SGRO) is still paying its dividend as it benefits from a diverse selection of tenants, many of them supplying critical goods and services such as Sainsbury's or Amazon.com. Segro is now worth £9 billion, compared with Landsec's £4 billion.

Landsec’s NAV per share of 1,192p, which is the industry key benchmark showing net assets attributable to shareholders, was down 11.6% on a year earlier in today's results. This was 4% below the consensus forecast.

Analysts at Morgan Stanley expect the NAV to remain under pressure, but said the current sharp discount failed to reflect Landsec's strong balance sheet or the opportunity for new CEO Mark Allan to reset the group's future.

They said:

“We expect a deep recession to drive down NAV for longer, but argue that the shares are overly discounted for their return profile on offer, in particular in the context of the strong balance sheet the group has maintained in recent years.”

This was demonstrated by Landsec’s “severe but plausible downside scenario”, under which it is braced for a 75% reduction in rent receipts from retail and specialist tenants, and a 20% reduction in rent receipts from office tenants over the next year.

Throughout this the group has sufficient cash reserves, with its loan-to-value covenant remaining less than 65% and interest cover above 1.45x, for a period of at least 12 months.

Allan, who was previously at Unite and St Modwen Properties, said today it was “prudent to plan for more business failures and higher vacancy rates” across the portfolio, in particular leisure and retail. He adds that the company does not expect to see the economy recover to pre-Covid-19 levels before 2022 at the earliest.

Only essential services like supermarkets and pharmacies have been open at its retail destinations, with four of its retail assets shut completely. An £80 million fund has been created by Landsec to assist tenants who are hit particularly hard by Covid-19.

The office segment has seen a less pronounced immediate impact, although, with the majority of employees working from home, there has been less than 10% usage of its office space.

- Chart of the week: is bombed-out BT finally a massive buy?

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Most of the valuation deficit is attributable to the retail segment, which suffered a 20.5% decline over the 12 months due to ongoing structural changes being exacerbated at the year end by the early effects of Covid-19.

Office assets proved more resilient, increasing in value by 1.9% as rental values rose by 4.6% and yields expanded slightly.

Morgan Stanley last night had a price target of 740p, whereas counterparts at UBS were at 1,100p for an updated 9% discount to net asset value. They said Allan's arrival last month looked to be well timed, adding:

“With his background in operational real estate (student housing) and other alternate sectors, the new CEO could bring sweeping change when needed.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.