Have multi-asset funds performed as expected in 2020?

It’s often said that multi-asset diversification serves investors well. Hannah Smith number crunches.

24th September 2020 14:14

by Hannah Smith from interactive investor

It’s often said that multi-asset diversification serves investors well. Hannah Smith crunches the numbers.

Multi-asset funds are supposed to give investors the best of all worlds. They offer diversified portfolios that give you one-stop shop exposure to equities, bonds and alternatives. In theory, this means that you might have a more defensive portfolio of uncorrelated assets, which holds up well in a downturn. We crunched the numbers to see how the four Investment Association mixed-asset sectors held up during this year’s sell-off in March, during the recovery period since, and over the whole year so far to see if performance met expectations.

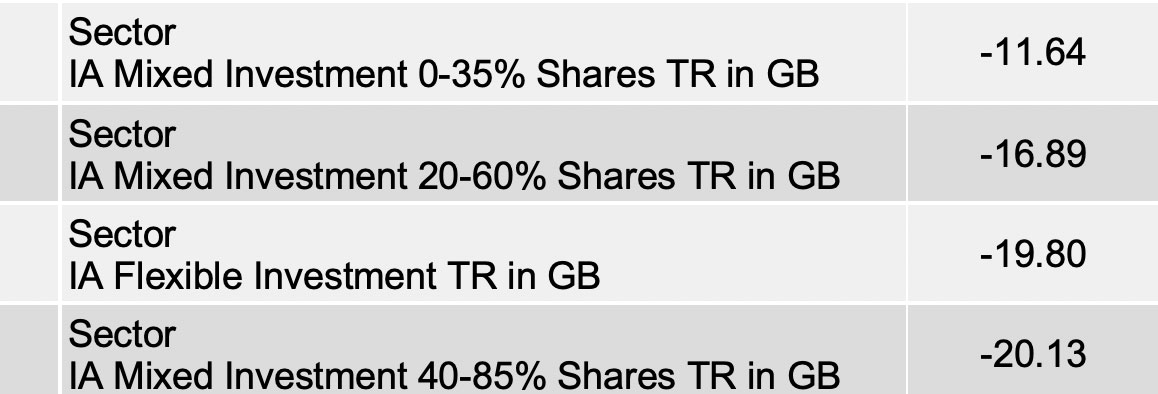

During the worst period of the Covid-driven sell-off, 24 February to 23 March this year, the mixed-asset sector with the highest allocation to shares fell the most. The average fund in the IA Mixed Investment 40-85% Shares sector shed 20% over that month, compared to a 30% fall for the FTSE 100. Mixed Investment 20-60% Shares fell 17%, and Mixed Investment 0-35% Shares, the sector with the lowest weighting to equities, fell the least to lose 12%. The IA Flexible Investment sector also posted nearly a -20% return.

Multi-asset funds bounce back

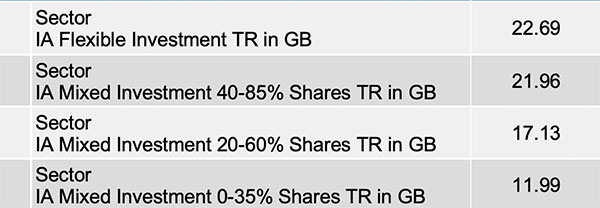

How have they recovered since that challenging month in markets? Between 24 March and 15 September, the Flexible Investment sector has come back strongest, gaining 23%, while the Mixed Investment 40-85% Shares sector is up 22%. Mixed Investment 20-60% Shares rebounded 17% while, as you might expect, the sector with the lowest weighting to equities performed the least well of the four peer groups, up 12% versus a 12% gain from the FTSE 100.

“On the face of it, these sectors have performed as expected,” says Shauna Bevan, director at RiverPeak Wealth. “The higher the equity weighting, the greater the loss during the February to March sell-off but that greater exposure to risk has been rewarded with a swifter recovery since then. The Flexible sector was true to its name by losing slightly less than the 40-85% Shares sector but generating greater return in the recovery period.”

Not many fund managers made any major position changes in an attempt to weather the market storm, says Danny Knight, head of investment directors at Quilter Investors, and this has served them well during the rebound.

“I haven’t been aware of any managers that made big structural moves through that sell-off, and that’s been reflected in the fact that some of the managers that did worst in the sell-off have been some of the strongest out of the recovery.”

‘You can’t buy the average’

Some investors can become rather fixated on sectors and averages, warns Knight, when actually a sector average performance figure doesn’t tell you all you really need to know. “You can’t buy the average. It’s not investable,” he says. Plus, there can be a huge difference between the best and worst performer within a peer group. “The headline hides a whole plethora of insight. As a sector, the average doesn’t mean anything when you’ve got a massive divergence beneath the surface.”

Bevan agrees, pointing out the wide range of performance numbers within the 40-85% Shares sector, where the best-performing fund, Baillie Gifford Managed, returned 20.81%, while the worst-performing fund declined by more than 18%. The Baillie Gifford fund has a weighting to shares at the upper end of its range, and has also benefited hugely from its high-growth style bias and exposure to tech stocks and names such as Tesla (NASDAQ:TSLA).

“Another fund with a similar asset allocation will have fared much less well if it had more of a value-oriented approach,” says Bevan. “The upshot is that, while it is perhaps reassuring to note that traditional asset allocation in terms of the equity/bond split has delivered returns in line with expectations, it is crucial to look under the bonnet at the individual funds that make up the sector.”

- Top-performing fund, investment trust and ETF data: September 2020

- ii Super 60 investments: Quality options for your portfolio, rigorously selected by our impartial experts

Funds flat year-to-date

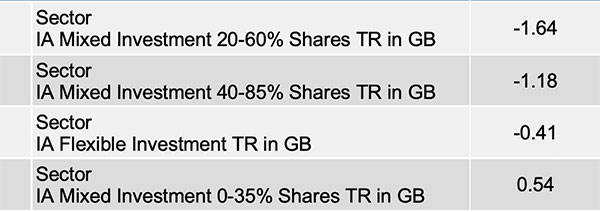

Looking at the year as a whole, the trough and subsequent rebound that we have seen mean that overall, multi-asset funds have been pretty flat. Mixed Investment 0-35% Shares made a slight positive return over the year to 15 September, while the other three sectors recorded slight negative returns.

The more cautious 0-35% Shares sector protected well in falling markets but has risen less far when markets began to rise once more, notes Bevan. “Since the start of the year, it is the only sector to have generated a positive return but I would expect this to change if market continue to rise and it will likely lag,” she says.

Did diversification deliver?

You might expect multi-asset diversification to serve investors well, but actually diversification doesn’t always work in extreme market conditions, says Knight. “Everybody would have been better to have government bonds and US exposure. Any other sort of diversification potentially has been a detractor. Ordinarily, in normal market environments, diversification does hold you in good stead, but during that week between 16 and 23 March we saw panic-selling and challenging liquidity. You have to give some dispensation there for how markets behave in those environments, rather than saying that diversification didn’t deliver as strongly as it could have done where it wasn’t a normal environment,” he adds.

Worst period of the sell-off: 24 Feb to 23 Mar 2020

Since markets have recovered: 24 March to 15 Sept 2020

Overall for the year so far – incorporating sell-off and market rebound – 1 Jan to 15 Sept 2020

Source: FE Analytics

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.