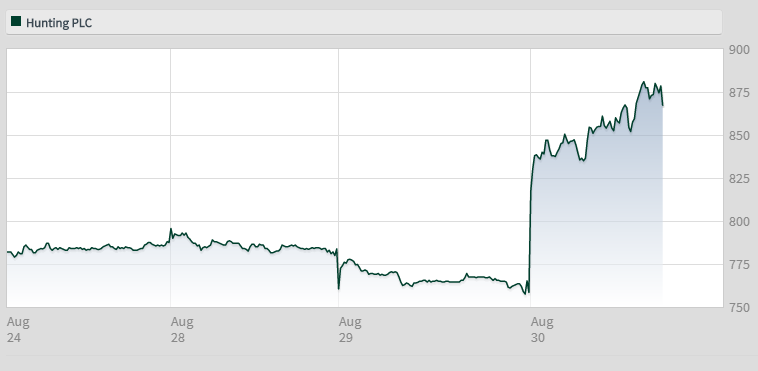

Here's what's behind Hunting's 16% surge

30th August 2018 14:48

by Graeme Evans from interactive investor

With the oilfield services sector enjoying a purple patch, Graeme Evans explains why the shares could go even higher.

Fresh from Petrofac Ltd reassuring update yesterday, it was the turn of Hunting to impress in the oilfield services sector today by reinstating its dividend and delivering consensus-beating results.

Shares shot up as much as 16% to leave the FTSE 250 Index company trading at within sight of the 900p threshold breached in 2012 and, briefly, in May of this year.

Even though the stock has now risen 45% so far in 2018, making it one of the best performing on the London market, analysts at RBC Capital think Hunting has the potential to go further to as high as 930p.

RBC's analysts said:

"We continue to like the company as it remains one of the highest leveraged UK-listed names to US onshore drilling activity."

This reflects the ongoing benefits of Hunting's largest ever acquisition, when it bought Titan in 2011 in a deal that significantly boosted the company's exposure to the US shale boom.

Source: interactive investor Past performance is not a guide to future performance

Chief executive Jim Johnson described today’s results for Hunting Titan as "outstanding" following a 62% jump in revenues, buoyed by the strong market environment for US onshore.

With the WTI oil price trading in the range of $60 to $75 per barrel, demand for hydraulic fracturing equipment, including Hunting’s perforating systems, has exceeded management’s expectations.

Johnson also noted improving profitability for Hunting's US operations, driven by stronger offshore sentiment. However, the company remains cautious on the outlook outside North America, amid continued trading losses.

Group revenues still jumped 39% to a forecast-beating US$442.8 million for the half year, while the gross margin rose from 22% in 2017 to 31% this year.

The improvement enabled the company to reinstate its dividend at 4 cents a share. This was better than the 2 cents forecast by analysts and is expected to consume about $6.6 million of cash.

Hunting scrapped the dividend in July 2016 in the face of discussions with its lenders over banking covenants. This was at a time of depressed oil prices, with the company facing a near 40% drop in annual revenues and the prospect of cutting its workforce by around 45% over 18 months.

Analysts at Arden Partners today praised Hunting for executing "an admirable turnaround" since then, helped the by US shale boom in the Titan business.

They noted the increasing need for oil and gas sector investment by operators in order to maintain production, but added "this has not yet resulted in the new activity required to be meaningful for Hunting's business."

Arden increased its price target by 100p to 850p, which is based on a price earnings multiple of 25x in 2018 and 20x in 2019.

UBS, which has the same price target, noted that Hunting's shares have underperformed the European oil services sector by 13% in the three months leading up to today's results.

Hunting dates back to 1870s and joined the London Stock Exchange in 1989.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.