How easyJet beat French strikers

18th July 2018 11:32

by Richard Hunter from interactive investor

Despite a number of clear headwinds, easyJet is on track to post better-than-expected full year results. Richard Hunter, head of markets at interactive investor, has the details.

The stars are aligning for easyJet this year, as a number of factors are playing into its hands.

The demise of competitors such as Monarch, Air Berlin and Alitalia has opened up the field, ancillary revenue has increased due to a change in passenger behaviour (increasingly paying for additional baggage and allocated seating) and load factors remain high.

Passenger numbers increased by 9% during the third quarter, and this combination of tailwinds has enabled the group to increase revenues by 14% in the period and, equally importantly, upgrade profit guidance for the full year from £530-£580 million to between £550 million and £590 million.

In turn, this should increase the dividend payment, even if the projected yield of 3.3% is not especially inspiring. As the summer season gets into full swing, further grounds for optimism persist.

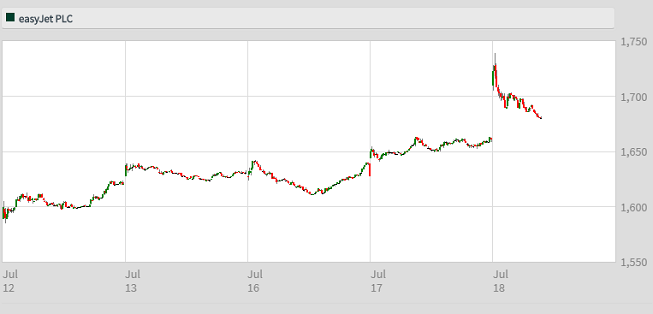

Source: interactive investor Past performance is not a guide to future performance

All is not straightforward, however, as ever in the airline industry. Factors out of easyJet's control such as the cost of fuel and foreign exchange movements can be exacerbated by widespread industrial action, as has been the case in Europe, particularly of late in the likes of France and Italy.

In addition, the operation in Germany has yet to financially wash its face, although there are clear signs of progress.

Elsewhere, costs in general need to be tightly controlled in a notoriously cyclical industry, and easyJet will have its work cut out in keeping the lid on costs within its control in the event of a future downturn.

Nonetheless, this is a positive update and the early market reaction has clearly recognised the achievement. This move adds to a share price which has gained 15.5% over the last year, as compared to a 3% hike for the wider FTSE 100, and with the outlook being upbeat, the market consensus of the shares as a cautious buy may need to be nudged rather higher.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.