How much further do equities have to run?

A panel of five experts share their views on the first quarter of 2020.

11th February 2020 10:05

by Jim Levi from interactive investor

A panel of five experts share their views on the first quarter of 2020.

The “bears are capitulating,” declares Connor Broadley’s Chris Wyllie. That sounds like the rallying cry of a raging bull. It is not: Wyllie sees the wave of optimism that had stock markets roaring ahead in the closing weeks of last year as a reason to be cautious.

The bulls may have been emboldened and the bears have shown signs of giving up, but new eruptions threatening over Iran remind us that everything in the garden is not rosy. Moreover, Wyllie points out that the recent rally is underpinned by little of substance. “When we look at the fundamentals – our underlying growth indicators for the world economy – we are not very much more confident.”

Aberdeen Standard’s Richard Dunbar is in a similar mood. “When we look at the prospects for this year we can see low interest rates, low inflation and low growth as far as the eye can see,” he says.

“That may be good for risk assets, but low inflation and low growth combined make it very difficult for most companies to grow their earnings.”

He acknowledges there is more optimism, but believes expectations should be scaled back for this year after such a strong performance in 2019. The MSCI World index, taking in equity markets in more than 20 countries, had its best year last year since the crash: it gained 23%.

Schroders’ Keith Wade forecasts sluggish growth (1.8%) for the US too this year, and believes interest rates there may have to be cut again in April to revive momentum. Coutts’ Monique Wong thinks the market is “already pricing in one more cut this year”.

Wade remains positive on equities and has tweaked up his global growth forecast slightly to 2.6%.

“But when you think about what really drives equity markets, you cannot see 2020 being so good. After all, at the beginning of 2019 markets were expecting US interest rates to rise to about 3%. They ended up at 1.75%. That is quite a big difference, and that is what drove a re-rating [of equities]. That pivot in interest rates won’t be at work this year.”

Wong says the story of the global economy this year will essentially be one of mid-cycle recovery.

“Things are stabilising and showing signs of green shoots, especially in China. I do not see a recession this year, but we cannot put off recession for ever.”

Keep some powder dry

Rob Burdett at BMO Global Asset Management keeps his cash score high at 9. The crisis over the US killing of Iran’s military chief underlines the risk of the proverbial bumps in the road. “We expect more volatility in 2020, with a possible correction of more than 10% at some point,” he says.

“So we will want to keep some dry powder for buying opportunities on setbacks.”

After an exceptional performance last year by Wall Street – the S&P 500 rose 30% and the technology-heavy Nasdaq nearly 37% – our panel has taking up a holding position. There are no changes to the scores, and two members – Wyllie and Burdett – remain underweight. “America certainly shows it has the most flexible economy,” says Burdett.

“Against expectations, corporate earnings have grown, inflation is under control and interest rates are expected to move down. But the issue of valuations has now come sharply into focus.”

Rotate into US cyclicals

Keith Wade thinks this could be another good year for US technology companies.

“We have recently been rotating to some of the more cyclical areas of the US market, but I think this year we will be looking again at those longer-term secular growth stories. Earnings growth has got to be the main driver of US equity markets this year.”

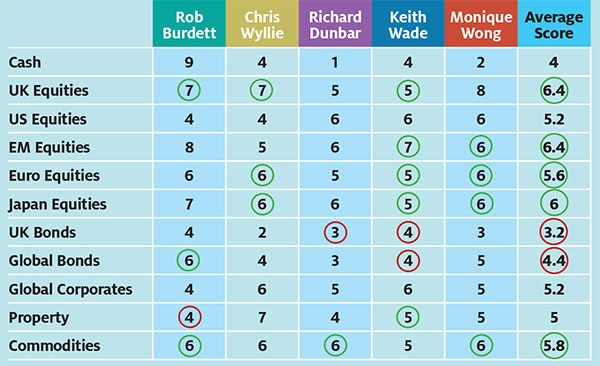

Our scorecard clearly shows that since the November issue, average scores for the UK, Japan, emerging markets and Europe have all increased while the score for the US has stayed frozen. You could almost say that the panel members are singing from the same hymn sheet, although some are more positive than others.

While Wong holds her US score at 6, she is moving her scores for Europe, Japan and emerging markets all up a notch. “I think any rise in Wall Street is going to be modest this year, but hopefully some of the other markets will do better as the mid-cycle recovery in the global economy gets under way,” she comments.

Neutral on Europe

There is no great enthusiasm for European equities, but at least now none of the panel members is underweight. Along with Wong, both Wade and Wyllie have edged up their scores. “We need to be in those equity markets when they participate in global recovery… if it comes through,” says Wyllie.

“If you include the UK, about 10% of our overall portfolio is in European equities now, which is probably more than most fund managers would have.”

Enthusiasm for the emerging markets sector is at its highest for some time, reflecting the view that Asian markets – they make up 70% of the sector – will benefit most from Trump’s rapprochement with China. “We don’t know what is in Trump’s mysterious mind,” Wade admits.

“We have been trying to put a rational framework around it, but we believe this year the trade tensions with China will wind down because the president will be focused on fighting the Democrats.”

Wade is hoping for a weaker dollar because the strength of the dollar has lately been sucking liquidity out of emerging markets. Monique Wong expected the dollar to have weakened sooner against a background of lower interest rates, slower growth and big trade deficits. “Maybe you need to see an actual recovery in global growth before the dollar starts to weaken,” she says.

Wyllie is more cautious, holding his EM score at 5. “Most institutions are now fully invested in emerging markets and we feel the story of a weak dollar sending emerging markets higher has been over-egged. We have become much more selective.” However, he has been buying Korean equities, which he expects to benefit from the cyclical recovery.

None of the panel members seems to have anything negative to say about Japanese shares. Dunbar and Burdett are already overweight, while Wong, Wade and Wyllie are all topping up their holdings and the average score has now crept up from 5.4 to 6.

Changes in the way companies are owned and managed make Japan an attractive long-term place to invest, according to Dunbar. “It will also benefit from a US-China trade settlement,” he says.

“The market offers good value and is somewhat detached from other markets and shows greater stability.”

UK government bonds are now the least-favoured section of the market. Wade joins the rest with an underweight position. “We think Boris Johnson plans to spend heavily and that could drag the gilt market lower,” says Burdett. Wong cut her score last time and has considered taking it down to 2, but holds it at 3 for now. “A Tory government running higher deficits and planning fiscal stimulus does not make UK bonds appealing,” she says.

Wade thinks the low yields now on offer in global bonds makes them look very expensive too. He cuts his score from 6 to 4. “Equities may be getting a bit ahead of themselves, but you get a useful risk premium when you look at how low government bond yields now are.” But Burdett moves in the opposite direction to Wade. Raising his score on global bonds from 5 to 6, he says: “A rise in interest rates looks less likely now.”

Corporate bonds continue to attract support as a portfolio diversifier, but Burdett thinks the risks of defaults on so-called ‘zombie’ companies may increase with global recovery.

Property subdued

Enthusiasm for the property sector remains muted. Keith Wade has tweaked up his score from 4 to 5 on the prospect of the government spending more on regional development. Rob Burdett takes the opposite tack with a cut from 5 to 4.

“We want property as a diversifier, so we hold funds investing directly in bricks and mortar, mostly in the UK, and here there are a number of issues which worry us – notably in retail.”

Wong, too, sees the diversification benefits. “We regard property as a great diversifier, but you need to take a long-term view with property even more than with equities,” she says. “Property was an excellent diversifier in 2018, as the sector gave positive returns when equities and bonds were falling; it was not a great diversifier last year, and who can say what will happen this year? However, a Conservative majority in the election is certainly a market-friendly result for the sector.”

The deepening crisis in the Middle East inevitably sent oil prices higher, while gold touched a seven-year high. Three panel members have raised their commodities scores and four of them are now overweight the sector. Last year saw all precious metal quotes improving, while industrial metal prices – from aluminium to zinc – all declined. Burdett thinks a recovery in these metals is on the cards.

UK equities enjoy fear-of-missing out flourish

Fear of missing out (FOMO), gripped financial institutions towards the end of last year and led global equities to close the decade in a remarkable bullish flourish.

The FOMO phenomenon was clearly in evidence in a recent Bank of America Merrill Lynch survey of 230 top fund managers: cash levels in their coffers showed the biggest monthly drop for three years in November, and overall cash balances were at their lowest since 2013.

Our panel see strong signs that FOMO is now making a big impact on UK equities. Until recently global fund managers have seen Britain as a side show and found it hard to see why they should own UK shares. Brexit, political uncertainty, a weak currency and our low productivity all put them off.

The clearcut verdict of the general election in December may be changing all that. The pound has been recovering and one of the best-performing stock market indices anywhere last year was the FTSE 250 index. It is the repository of many leading companies with most of their assets and operations in the UK. It gained 29% – perhaps a pointer to a wider reassessment.

Monique Wong has been consistently supportive of UK equities for a long time, with a score of 8. That patient support is now paying off. “When you come to the UK to buy British companies you get a 20% discount voucher,” she claims.

“There are still problems for Boris Johnson negotiating Brexit, but there is much less uncertainty. UK equities are so under-owned and sterling is still cheap.”

Her arguments have finally won over Rob Burdett and Chris Wyllie, who have both raised their scores from 5 to 7, while even Keith Wade cannot resist the momentum and ends his underweight position with a 5. Burdett abandoned his neutral stance in the autumn. He says:

“Expect more corporate deals. Property transactions will speed up and postponed capital spending will now go ahead.”

Chris Wyllie also began buying UK shares again in the autumn. “The pound’s recovery and the opinion polls were strong indicators of the direction of travel,” he says. He even saw bullish implications in the decision by M&G to ‘gate’ its property fund because of the pressure of redemptions just before the election. “It was a sign that even UK investors were giving up on the UK because of the jitters over a possible Corbyn government,” he argues.

However, Richard Dunbar is unmoved by all this optimism. “For financial markets the election result was a moment of euphoria,” he says. “For me, euphoria is a warning signal. So after a very strong run both in the currency and in the [equity] markets, we are looking to take profits. We will keep our score at 5…for now.”

He takes the view that the so-called Brexit discount on UK shares may remain for a time. “Many international investors are not happy with us leaving the EU and there will certainly be problems with the Brussels negotiations,” he says.

Scorecard: Tilt to buoyant equities

Note: The scorecard is a snapshot of views for the first quarter of 2020. How the panellists’ views have changed since the fourth quarter of 2019: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader. BMO has £187 billion in assets under management.

Chris Wyllie is chief investment officer at Connor Broadley, a financial planning and investment management firm with £400 million under management.

Richard Dunbar is deputy head of global strategy at Aberdeen Standard Investments, which has some £610 billion in client assets under management.

Keith Wade is the chief economist and strategist at Schroders. The asset management company has around £400 billion in assets under management.

Monique Wong is a multi-asset investment manager at Coutts, the private arm subsidiary of RBS bank, which has some £17 billion of assets under management.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.