How rule-based investing can improve your profits

12th November 2014 13:19

by Stockopedia from interactive investor

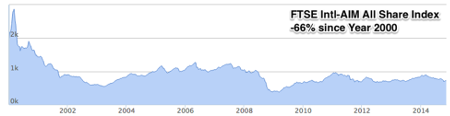

The junior AIM market has yet again drawn a blank in what's been a dismal year for stock pickers. The news that the average AIM stock has fallen by 15.5% this year is galling, but unlikely to put off the hordes from trying again next year. Why is it that a market that has failed investors so consistently for the last 15 years proves so compelling for so many?

The only answer can be the allure of lottery type payoffs for the occasional picks that go right. Sadly most seem to conveniently forget that the average lottery ticket loses 70% of its value. Albert Einstein once said "the definition of insanity is doing the same thing over and over again and expecting different results". Surely it's time for many to reconsider their process?

Over the next few months in this new column for Interactive Investor I'll be illustrating how investors can put together investing strategies that have a positive, rather than negative, expectation of beating the market.

We will be doing this by applying time tested screening rules to filter the universe of AIM and LSE listed shares down to investable portfolios and tracking the results over time. It's a process that has worked for many great investors (from Benjamin Graham to Joel Greenblatt) for many systematic equity hedge funds (from LSV to AQR). It can work for your portfolio too.

How the stockmarket works

How the stockmarket works is an open secret, passed down through generations of investors. It was Ben Graham, the father of Value Investing and the tutor of billionaire Warren Buffett, who once said "in the short run the market is a voting machine but in the long run it's a weighing machine". What he meant by this was that while stories drive stocks in the short term, statistics drive stocks in the long run.

Punting on the best story may be a great game for AIM investors on bulletin boards, but it's a process that fails to align itself in a consistent, disciplined fashion with the drivers available in the stockmarket.

What are these drivers? They are known as the Value and Momentum effects. The Value effect profits from the tendency of valuations to revert to their averages, while the Momentum effect profits from the tendency for prices to trend.

Value investing profits from cheap stocks tending to outperform expensive stocks, while Momentum investing profits from leading stocks tending to outperform lagging stocks. Contrarians love value investing, traders love momentum. If you are going to design a strategy to beat the market it's best to align with one or both of these key drivers of stock returns.

Filtering the market

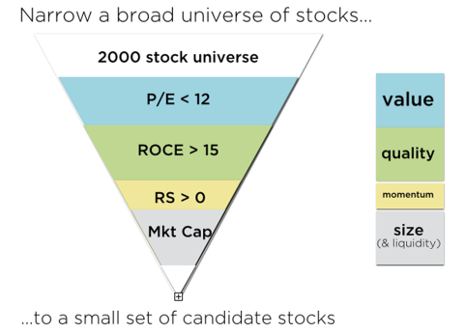

A "stock screen" is simply a set of rules that seek to filter the market in a consistent, reliable fashion (using fundamental and technical data) to find stocks with a high exposure to one or other of these core drivers. While the intricate terminology of fundamental and technical analysis (e.g. P/NCAV, P/E, P/B, ROCE, Relative Strength) may be arcane and offputting to the uninitiated - the terms can be easily understood when categorised relative to these wider themes.

Every week in this series we'll be introducing a stock screen, and explain each of the rules in plain English in reference to these core ideas. We'll be building core value and momentum strategies, while showing how growth and income strategies are related to these ideas too. We'll be introducing some of the history around these strategies, and the famous investors who have contributed to their development while sharing the performance we've been tracking on the Stockopedia.com website.

Someone once said to me "there's no such thing as a private investor, there are only gamblers". I don't believe this is true. Private investors do not have to be the suckers they are made out to be by the investment industry.

Warren Buffett, the greatest investor of all time once said "I don't try to jump over seven foot bars, I look around for one foot bars that I can step over"... learning that lottery tickets don't pay, but compounding capital in good, cheap shares does is the key to stockmarket success.

Next week we'll kick off the series by looking at deep value strategies, find some UK listed bargain shares and how Benjamin Graham kick started an entire industry of security analysis - stay tuned.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ed Page Croft of Stockopedia.com, the rules-based stock market investing website. You can click here to read Richard Beddard’s review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a 2 week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

● For more info about Stockopedia's StockRanks, please download a free guide.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

About the author

Edward Page Croft is the CEO and founder of Stockopedia.com. His background is in wealth management and engineering, having worked as a private client broker at Goldman Sachs before founding Stockopedia.

He graduated from Oxford University with first class honours and is a Zend Certified PHP Engineer. Edward writes regularly for This is Money, Business Insider and the London Stock Exchange's Private Investor Magazine. He is the author of several ebooks including "How to Make Money in Value Stocks".