How to steady your investments amid market turmoil

With ISA season 2020 approaching, how should investors go about tweaking their portfolios?

24th February 2020 10:48

by Tom Bailey from interactive investor

With ISA season 2020 approaching, how should investors go about tweaking their portfolios? We explain and offer some undervalued asset ideas.

Most investors agree that it’s important to occasionally rebalance a portfolio. On the one hand, it minimises risk by reducing exposure to higher-flying holdings bid up by the market. On the other, it is a way to implement a contrarian investment strategy that takes profit at market high points and buys in during market lows. So, with the ISA season approaching, how should investors go about rebalancing?

First, it is important to understand when rebalancing adds outperformance and when it doesn’t. For rebalancing to work, the returns across the different asset classes in your portfolio should be similar. If one asset class produces a consistently higher return than others, overall returns will be harmed by rebalancing away from it.

Next, there should be relatively low correlations between those asset classes. Without low correlations, investors won’t benefit from rebalancing into underperforming asset classes that could subsequently outperform top performers.

Better balanced?

The importance of these two features has been demonstrated in a study by Sigma Investing. The study looked at several portfolios over the period 1975-2004. The first portfolio in the study consisted of 40% US large-cap equity, 20% international equity, 20% emerging market equity and 20% treasuries.

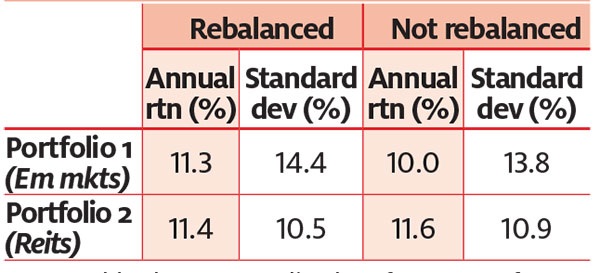

As expected, the portfolio produced stronger returns with regular rebalancing. Over a 30-year period the portfolio produced an annualised return of 11.3%, compared with a non-rebalanced portfolio’s 10%, as the table below shows.

Rebalancing doesn’t always pay off

Note: Table shows annualised performance of two portfolios over 30 years from 1975 to 2004. Source: Sigma Investing.

However, crucially, the two key conditions were met in the first portfolio. According to Sigma, the four asset classes provided returns within the relatively narrow range of 9%-10.7%. At the same time, they were relatively lowly correlated over the period under scrutiny.

To demonstrate the importance of these characteristics, the second portfolio substituted real estate investment trusts (REITs) for emerging market assets in the line-up. Over the 30-year period, REITs had a much higher annualised return than the other assets, at 15.2%. As a result, rebalancing produced a slightly lower return than a portfolio allowed to ‘drift’ (11.4% versus 11.6%).

This was due to rebalancing away from the stronger-performing REIT asset class. However, the loss of emerging markets increased the overall correlation of the portfolio constituents (as shown by the lower standard deviation figures). So what does this mean for investors?

Unfortunately, predicting whether a specific asset class will perform significantly better than another with any certainty is impossible. The key lesson is that rebalancing will not always produce outperformance over certain periods if a specific asset class provides returns significantly above those produced by other assets in a portfolio. That said, without knowing which asset class that will be, rebalancing is still the better option.

Ben Carlson, director of institutional asset management at Ritholtz Wealth Management, says: “You’ll never achieve perfect optimisation.” In other words, rebalancing is an acceptance that the future is unknowable.

With all this in mind, we can conclude that it is important to have a diversity of assets that have low correlations with one another. Bonds and equities usually have little correlation. Conversely, stocks in a given industry are likely to move in line with one another.

Of course there have been anomalies in the behaviour of asset classes. In 2019, for example, equities and bonds largely moved in conjunction with each other – an unusual occurrence. Ian Forrest at the Share Centre says.

“You can get odd times and changes in correlations, but these usually don’t last very long. Unless investors are very short-term, it is not a concern for them. They need to avoid being swayed too much by short-term anomalies.”

The case for low-correlating assets is part of a broader argument about the merits of diversification. So long as an investor runs an appropriately diversified portfolio, there should be sufficient non-correlation among assets to make rebalancing worthwhile.

Again, however, the relationship between asset classes can change over time. For example, as emerging markets move away from being commodity export-dependent towards becoming technology and consumer-focused, the way they react to global macroeconomic events is likely to change. Investors should continue to question why certain assets are more or are less correlated with others and whether that relationship is changing.

Rebalancing routes

There are various ways to rebalance. One of the most popular ways is to set a target asset allocation mix and periodically return to it (perhaps every year). This is an approach advocated by Vanguard and is a selling point of its LifeStrategy funds. James Norton, a senior planner at Vanguard, says: “If you have determined that an 80:20 equity bond split is right for you, it’s important to keep your allocation broadly in line with that. Over time this will require regular rebalancing – by taking profits on assets that have outperformed and buying more of those that have done less well, for example.

“Rather than being driven by greed or fear when markets are rising or falling, sticking with a pre-determined rebalancing process should keep you on track.”

Alternatively, investors may set up an allocation threshold: a point at which they sell or buy based on how far an asset is deviating from an intended allocation.

There is also a more subjective approach to rebalancing: a strategy where investors reduce their weight to a certain sector in accordance with their own judgments. They may deem an asset class to have become too expensive and decide to take profits, or they may look ahead and anticipate that their current holdings could face pressure.

Vincent Ropers, co-manager of the Wise Multi-Asset Growth fund, says his fund has recently sold some gold and infrastructure to take profits. He notes that while he is still positive about both assets, their performance has exceeded expectations over the short term. He says: “We have added to our cyclical exposure, particularly in unloved UK, European and emerging markets.”

John Husselbee, head of multi-asset at Liontrust (LSE:LIO), says he has been rebalancing away from the US because he expects lower performance there in future. He says:

“For us the question of taking profits or adding exposure has a clear answer: reduce US equities and buy pretty much any other market, primarily on valuation grounds.”

An indispensable tool for investors

Rebalancing is an important tool for managing risk and also for maintaining a contrarian investment footing. Commenting on the former, Wise’s Vincent Ropers says: “It is the most natural way of managing risk, because it forces us to keep the winning positions – which by definition become larger and larger – to a reasonable size (particularly at a time when they are most vulnerable) while reinvesting in the holdings that offer a greater margin of safety.”

Regarding the latter, Ben Carlson says: “Most of the time rebalancing means you’ll be slightly out of line with conventional wisdom. Where rebalancing is likely to matter the most is during bear markets or market bubbles, because it will require substantial selling of what has worked and buying of what hasn’t. This is where it really matters.”

Much to be gained from portfolio rebalancing

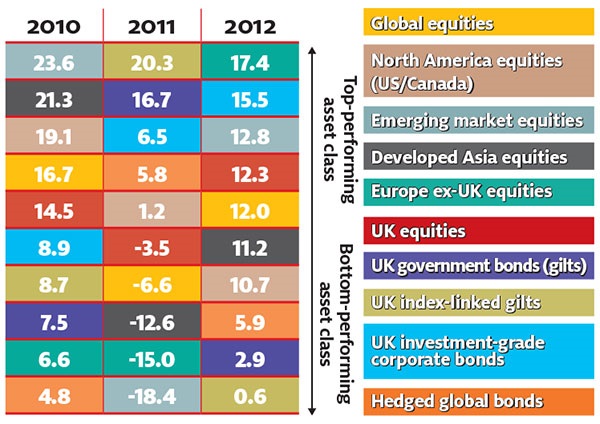

According to data supplied by Vanguard, emerging market investments yielded a return of 23.6% in 2010, making the asset class one of the best performers in the year. But had you let this winner run, you would have suffered an 18.4% loss in 2011. Returns recovered somewhat to deliver a 12.8% gain in 2012, but the asset class fell in value again in 2013 by 5.3%.

If you had instead rebalanced your portfolio, you would probably have sold down some emerging market holdings at the end of 2010 after those stellar gains, and used the profit to buy into some of the asset classes that saw lower returns that year, including Europe ex-UK equities and UK government bonds.

By doing so, you would have been able to avoid some of the pain of 2011’s emerging market falls by not being too overweight. You would also have enjoyed strong gains from gilts in 2011.

Your European equities would have seen further losses in 2011. However, sticking to rebalancing principles, you would have reinvested some of the 2011 gains from your UK bond holdings to boost exposure to Europe and emerging markets – benefiting from 2012’s rallies.

Key bond and equity index returns (%) ranked by performance

Notes: UK equity is defined as the FTSE All-Share Index, Europe ex-UK equity as the FTSE All World Europe ex-UK Index, developed Asia equity as the FTSE All World Developed Asia Pacific Index, North America equity as the FTSE World North America Index, emerging market equity as the FTSE Emerging Index, global equity as the FTSE All World Index, UK government bonds as Bloomberg Barclays Sterling Aggregate Gilt Index, UK index-linked gilts as Bloomberg Barclays UK Government Inflation-Linked UK Index, hedged global bonds as Bloomberg Barclays Global Aggregate Index (hedged in sterling), UK investment-grade corporate bonds as Bloomberg Barclays Sterling Aggregate Non-Gilts – Corporate Index. Returns are denominated in sterling and include reinvested dividends and interest. Source: Vanguard calculations, using data from Barclays Capital and Thompson Reuters Datastream.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.