How Vodafone can be worth 40% more

31st August 2018 17:07

by Lee Wild from interactive investor

It's one of the highest yielding blue-chips and a favourite among investors, but the shares have been terrible performers. Lee Wild hears from one analyst who thinks there's real value here.

Vodafone shares have been a chronic underperformer for a number of years now, and it seems the telecoms goliath can do nothing right.

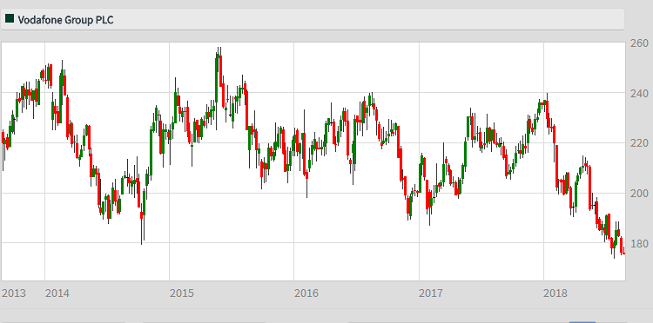

Trading at 240p around the beginning of 2018, the share price currently languishes at multi-year lows, dipping below 164p briefly Friday.

This comes as the firm completes the merger of its Indian unit with Idea Cellular and a day after Vodafone's Australian joint venture announced a A$15 billion merger with TPG Telecom.

Source: interactive investor Past performance is not a guide to future performance

"European telcos and Vodafone continue to underperform, as the sector (and Vodafone) lack catalysts, earnings estimates continue to drift, and questions are raised on dividend sustainability," explains Maurice Patrick, an analyst at Barclays.

The broker trims its price target for the shares by 10p to 230p to factor in the recent slump in Turkish Lira and South African Rand. That still implies potential upside of 40%.

Vodafone could also generate as much as €12 billion of new money if it decides to sell its 55,000 mobile phone towers, each worth around €250,000. If €10 billion was returned to shareholders via share buybacks, equivalent to about 20% of the shares in issue, free cash flow per share could increase by 18%, reducing leverage to improve dividend cover.

- Chart of the week: Here's when to buy Vodafone shares

- Vodafone's 7.5% yield is 'too cheap'

- Dividend alert: Three high-yielding bond proxies flash red

Mobile peers across Europe – in Italy, France, Spain and Portugal – are already monetising tower estates, freeing them up to focus on selling services rather than managing a network.

"Vodafone offers 2018e 7% dividend yield, and yet many seem to question its sustainability, not just its potential to grow," writes Barclays. "They question if Vodafone can monetize data, does convergence present a risk, will regulatory headwinds ever end, will cost cutting be net vs gross, will capex stop increasing, could [it] merge with Liberty Global? We see this as a backward-looking view."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.