Howden Joinery: why this is a ‘top four’ stock

Even now, Howdens is one of the highest-ranking stocks in our companies analyst’s coverage.

3rd April 2020 16:12

by Richard Beddard from interactive investor

Even now, Howdens is one of the highest-ranking stocks in our companies analyst’s coverage. Here’s his thinking.

In their book “Radical Uncertainty”, Mervyn King and John Kay distinguish between puzzles and mysteries. Puzzles are defined problems with solutions but, outside of academia, humanity mostly faces ill-defined problems with indeterminate outcomes, aka mysteries.

Mysteries can be as novel as the progression of the Covid-19 pandemic, as timeless as whether to get married, or as pertinent to this article as determining how a company should make money.

The authors say, “We approach mysteries by asking ‘What is going on here?’, and recognise that even afterwards our understanding is likely to be only partial.”

Strategies should not be mysteries

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Earlier this week a reader with a long-term investment horizon wrote to express his frustration that companies are not more explicit about their strategies. Strategies are the way firms deal with the mysteries of business, and in determining strategy, they must answer the question “What is going on here”, and then do something about it.

My correspondent thinks companies with good strategies are reluctant to disclose them for fear of being copied. But I am less charitable and think if companies cannot articulate a coherent strategy, they don’t have one. The difficulty, of course, is we’re probably both right, sometimes.

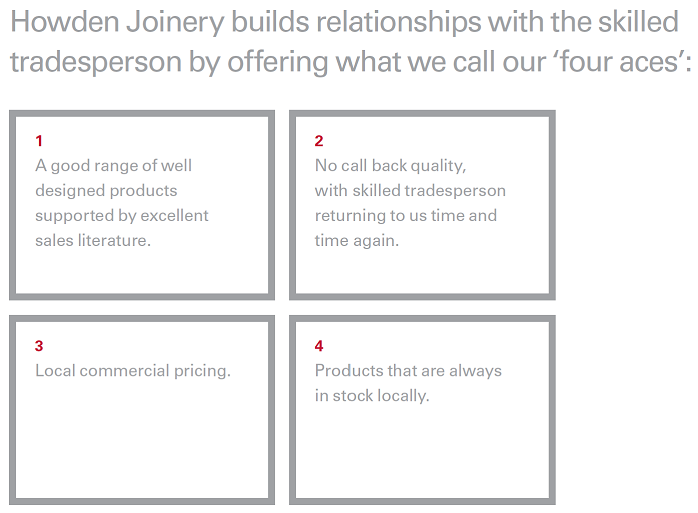

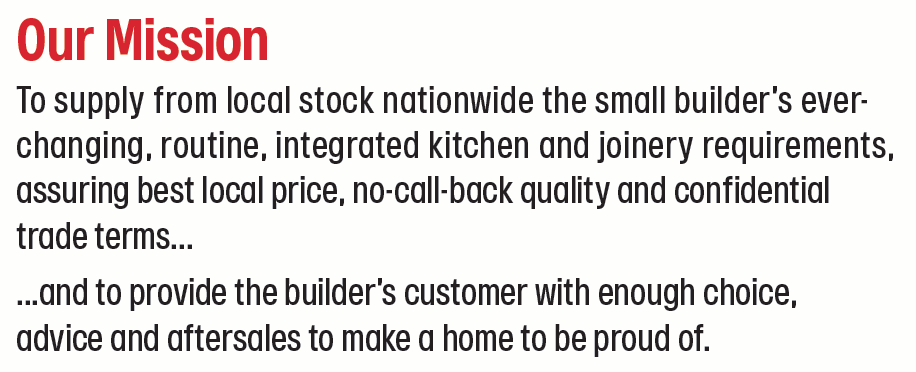

As luck would have it, I was preparing to write about Howden Joinery (LSE:HWDN), which has a well-established strategy that flows from its policy of only supplying the trade (small builders).

Back in the 1990’s Howdens’ founder realised small builders were not served well by established kitchen companies who supply both retail customers and the trade, like Magnet (his previous employer), so he set out to do something different.

I have written about Howdens strategy a number of times. Howdens makes no secret of it. In fact, it all but provides a blueprint for copycats. By keeping prices confidential, Howdens enables small builders to decide their own profit margins.

By extending them credit, they can complete a job and get paid before having to pay Howdens. By keeping everything in stock, small builders know work won’t be delayed if plans change and they unexpectedly need a kitchen component.

By offering depot managers sometimes ‘life changing’ incentives and the autonomy to set prices and hire staff, Howdens encourages strong relationships with local builders.

The payback for Howdens’ devotion to builders is repeat sales, which is why trade customers are so much more valuable than retail customers, and low costs, because Howdens operates from lightly manned sheds on the outskirts of towns and cities and does not itself employ retail sales staff or delivery drivers.

Howdens’ mizzle thrush strategy

Maybe, I wrote to my correspondent, Howdens is happy to share its strategy because it is so strong it will put off competitors. With a 30% market share of UK kitchen sales, and a much bigger share of trade sales, Howdens already has the know-how, the distribution, the supply chain, the economies of scale, so it is shouting its strategy from the rooftops.

Fair enough, replies my correspondent with a brilliant analogy: Howdens’ strategy is like the mizzle thrush “who sits on the top of one of our trees and sings his heart out. A display of confidence and strength to deter others who fancy the same tree.”

But this, he says, is the result of a strategy hatched long ago that has brought the company to its current position. If my correspondent were “Mr Howden”, he would be asking “what next?”

What next?

It’s a good question. I think there is nothing wrong with the answer “more of the same”, unless the company faces new uncertainties. Howdens still innovates to make sure products are appealing and tradesmen can sell them to us, and it makes them easier to fit, so they appeal to the builders themselves.

It revamps its depots and tweaks its supply chain to make them more efficient, extending the advantages the strategy has created.

Established strategies are less mysterious than new ones, which helps us identify them, but as long as they are being refined and adapted to new threats, they will still be effective. Rarely, perhaps, the answers to the mystery of strategy are hidden in plain sight.

Howdens has been upfront about its strategy, at least since 2006 when it published its first annual report independently of MFI, a furniture retailer and Howdens’ now defunct former parent.

Source: Galiform annual report 2006

Then, Howdens had 382 depots earning £733 million revenue and today it has more than 700 earning nearly £1.6 billion in revenue.

Source: Howdens annual report 2019

But there is another aspect to Howdens’ strategy, which is to roll-out new depots, bringing it within range of more builders. In last year’s annual report, we learned a bit more about Howdens’ strategy to overcome an obvious threat: 85% of customers are within five miles of a Howdens and the UK is filling up with depots (the company says it expects to grow to about 850).

Howdens told us it had developed a new smaller depot format to fill in gaps and supply rural areas, and that it had chosen France, where it trades as Houdan, as the focus of its expansion strategy outside the UK, having established that like the UK 25 years ago, small builders are not well served by existing fitted kitchen suppliers. The fact that Howdens has trialled stores in a number of Western European countries and has operated in France since 2005, gives me confidence it is thinking about “what’s next?”.

Howdens opened five new depots in France in 2019 bringing the total to 27:

Source: Howdens annual report, 2019

The pre-existing 22 depots are profitable enough to cover the costs of a larger organisation, and it plans to open about five more depots in 2020 (as of February, although 2020 may well be a year that things do not go according to plan). One sign that a customer is following a well-defined strategy is that it is making choices, and, consistent with the focus on France, Howdens closed trial depots in Germany and the Netherlands.

While the future is a mystery, Howdens’ strategy is not. The most mysterious bit about it is the French expansion, and the revelation that it is profitable is an encouraging start. But do the numbers confirm the strategy has been working?

Numbers confirm the story

Companies are still publishing their results for periods that predate the Covid-19 pandemic, but they feel a lot less relevant now we know that for many their next set of results will be much worse (but due to the unfathomable pandemic we don’t know how much worse). Some Howdens depots are currently open, but I imagine the company is far from operating normally.

In response to the big mystery facing all companies, the economic consequence of the pandemic, I’m focusing on two numbers: net financial obligations and free cash conversion, as companies with few obligations and strong cash flows are most likely to survive a period of low or no revenue, and recover when customers return from isolation.

In the year to December 2019, Howdens broke records in terms of revenue, profit, and cash flow. It had no borrowings at the year-end and a substantial cash balance, more than enough to see it through a normal year without recourse to borrowing.

After roughly capitalising operating leases and adding the value of Howdens’ pension deficit, net financial obligations at the year-end were 39% of operating capital.

The company was highly profitable in cash and accounting terms earning a return on capital of 23%, just above Howdens’ long-term average. Cash conversion was 80% of profit, substantially above the company’s long-term average.

Howdens’ cash conversion has been weaker in the past because it was a smaller company and paying more money into its underfunded pension scheme. With the deficit currently standing at £57 million it would be tempting to think two more years of £30 million payments would bring about the deficit’s end and the need for further payments.

Large pension funds are mysteries though, the value of their assets and liabilities are influenced by factors like interest rates and longevity, we struggle to predict. Deficits have a tendency to yawn wider just when we think they’re about to close.

To resolve mysteries we must use judgement, and my judgement is Howdens is a well-managed company in a strong competitive and financial position. This gives me confidence it should be able to face down the economic threat posed by the virus, keep the pension fund at bay, and continue its expansion in France.

A share price of 512p values the enterprise at nearly £3.4 billion, about 14 times adjusted profit. Good value, I think, for long-term investors.

Finding fault

This is how I scored Howden:

- Does Howdens make good money? [2/2]

- What could stop it growing profitably? [1/2]

The pension fund saps money that could otherwise be invested or returned to shareholders.

Howdens is still at an early stage in its French expansion and we don’t know whether it will ever be similar in scale to the UK (where 39 stores opened in 2019)

- How does its strategy address the risks? [2/2]

- Will we all benefit? [2/2]

- Are the shares cheap? [1.4]

Howdens scores 8.4/10. It is ranked fourth in my Decision Engine. I think it’s a good long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.