Hugh Young on the shakeup at Aberdeen Standard Asia Focus

This manager wants 'nice little businesses run by honourable people that should grow over the years'.

16th August 2019 11:00

by Cherry Reynard from interactive investor

This manager wants 'nice little businesses run by honourable people that should grow over the years'.

The Aberdeen Standard Asia Focus (LSE:AAS) trust has had a facelift in recent months. Previously, the Aberdeen Asian Smaller Companies investment trust, it has tightened up its portfolio, reducing the number of holdings and increasing concentration in higher conviction names. The change, so far, appears to be bearing fruit.

At the request of the board, Hugh Young, Aberdeen Standard's head of Asia and the architect of the group's investment process, took personal control of the trust in its new guise. He had some interest in doing so – the trust is the largest holding in his own pension fund, a reflection of the trust's strong long-term growth and his own conviction that this part of the market is poised to deliver strong returns.

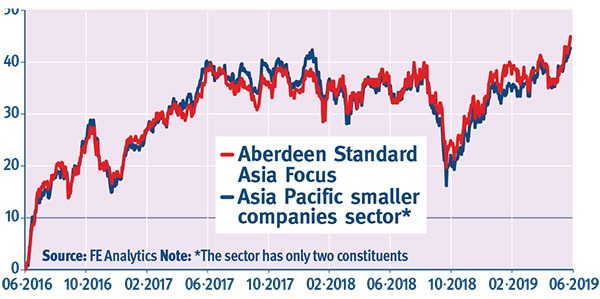

The changes are relatively new, having been in place since November 2018, but appear to have made a difference. The trust is now doing well over six months, one and three years, over which time it has gained 44.5% (to 21 June). Some of this has come from a narrowing of the discount to net asset value, which has been as wide as 17%, but now sits around the 12% mark as investors have welcomed Young taking the reins.

Young is characteristically modest about his role in this turnaround. Having spent much of his working life trying to get away from the culture of 'star' managers, the last thing he wants is to be seen as one.

"Certainly, we sharpened it up," he says, "but I think performance would have improved even if changes hadn't been made. The markets turned our way a little bit – they moved to a more value, fundamental style and away from momentum and technology-driven markets."

The trust has also done well from its relatively high weighting to Indian equities (currently 15% of the portfolio), which have benefited from a post-election bounce as prime minister Modi was re-elected.

In recent years, the fund's relative performance had been hit by the strength of Chinese stocks and, in particular, the strength of large technology companies such as Alibaba (NYSE:BABA) and Tencent Holdings (SEHK:700). These saw a similar phenomenon to US technology, rising rapidly before selling off significantly in the volatile conditions towards the end of last year. The trust hadn't participated meaningfully in either China or tech, because such companies do not meet its quality growth criteria.

Zero exposure to mainland China

Young hasn't changed his thinking on China. Even if there is innovation emerging, there simply aren't the right type of companies. The trust still has zero exposure to companies listed in mainland China.

"We do have companies in Hong Kong that generate profits from China and we're not anti-China, but finding small companies that we're comfortable with there is difficult." Too often, they lack the accounting rigour, management team and transparency that the team is seeking.

The trust adopts the Aberdeen investment process, which focuses on quality growth companies with capable, trustworthy management teams, bought at attractive valuations and held for the long term. The team also has a strong focus on corporate governance – another reason for the low weighting in China. It is looking for companies with an identifiable core franchise, recurring earnings growth, a strong and transparent balance sheet and a history of good treatment for minority shareholders.

Young believes it pays to be conservative in an area as potentially speculative as Asian smaller companies: "We may have had the odd screw-up or disappointment, but we haven't had a company go bust." He believes, as investors, they need to ask themselves whether the company will deliver and make profits, rather than whether they simply have an exciting product.

As such, while the trust is invested in smaller companies, they are not speculative start-ups. Their market capitalisation can be as low as £200 million and won't be higher than £1.5 billion, but they will have real earnings and cash flows. As a result, the trust has higher weightings in areas such as property, consumer goods, financials and manufacturing.

"Most of our companies are market leaders but may be operating in a small field. Virtually all are well-established businesses in strong positions, generating cash and selling at reasonably cheap valuations. They can be illiquid [difficult to trade], which is why it is important that this is a closed-ended fund."

Far from being highly risky, many of the companies in the portfolio are sitting on net cash. Valuations look conservative at around 12 times earnings. Counterintuitively, many of the companies are also paying a decent dividend, but the dividend yield on the trust is only around 1.2%.

That said, since the shake-up, the trust has exited some of its more mature holdings where the longer-term growth trajectory wasn't as clear. Young says that they can stay invested in companies that move out of the small company area to ensure they are not forced sellers, but they need to ensure that they will continue to deliver strong growth.

Divestments included companies such as Castrol India and Heineken Malaysia, which had performed well for the trust, but where growth had started to tail off. In their place have come the largest online retailer in Taiwan, Momo (NASDAQ:MOMO), and Singapore's AEM Holdings (SGX:AWX), a 'test-handler' manufacturer that has embedded itself in chipmaker Intel's global supply chain. Young believes these companies should prove stronger over the long-term.

"Most of the businesses in which we're investing are very solid. They are typically family-controlled, which adds a layer of safety. They are market leaders in small geographies or small sectors of particular businesses. They may be a leading company making widgets for the Apple iPhone camera. It's all they do, but they're very good at it.

"With companies we hold, investors might not recognise the name, but it will be the leading supermarket in Malaysia, for example."

The names in the portfolio share some characteristics with UK smaller companies. They tend to be more domestic in focus, without significant cross-border trade. More recently, this has been a notable advantage, insulating the companies from the problems of the trade war between the US and China. It has also helped with the diversification of the trust, meaning the companies held are often exposed to idiosyncratic factors rather than the ebb and flow of the global economy.

Equally, Young has been cautious on manufacturing and "pretty careful" about investing in companies that are doing well simply because labour is cheap.

For Young, a lot of the growth for this part of the market is likely to come down to the emerging consumer story in Asia. This remains intact whatever the latest tweet from the White House, he believes. The sector split is the outcome of stockpicking rather than deliberate.

"We have 18% in consumer stocks and 20% in financials which are also linked to the growth of the consumer."

An eye for good-quality local banks

The trust's weighting in financials includes "good-quality local banks doing plain vanilla banking". Its largest holding is Indonesia's Bank OCBC NISP, which it has held for over two decades. This continues to prosper as Indonesia develops and grows. Young expects Indonesia to be the world's fifth largest economy in 20 years' time and Bank OCBC NISP would be a clear beneficiary. The trust also holds Thailand's diversified financial company Aeon Thana for similar reasons.

That said, he is also keen to point to the variety of businesses in the portfolio – a port operator in the Philippines – Asian Terminals, for example, or Hana Microelectronics, an electronics manufacturing company.

How does the Asia market look today relative to its peers? Quite cheap, says Young, at around 13 times earnings:

"The companies themselves look in good shape, with net cash at the balance sheet level. At the back end of the Asian crisis, we saw if they had debt, they were doomed. As such, they are wary of debt. That means if things go horribly wrong, we're quite comfortable that the companies in the portfolio can weather the storm".

Young sums up the trust's objectives: “We just want nice little businesses run by honourable people that should grow over the years.” It's an admirably straightforward approach.

Key facts about Aberdeen Standard Asia Focus

Launch date: 01/10/1995OCF: 1.22%Size: £418.7mNet gearing: 0.4%Current discount to NAV: 11.2%Average discount: 12.2%3-year share price return: 44.8%3-year NAV return: 3.2%Yield: 1.19%Notes: Data as at 20 June. Source: FE Analytics

Invests in family-controlled market leaders

Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.