IHT: regular gifting could cut your bill by up to £37,000

With pensions due to become subject to IHT from April 2027, interactive investor calculations reveal how regular gifting could save your family thousands in tax.

6th May 2025 14:32

by Myron Jobson from interactive investor

- Making regular gifts using annual gifting rules means you won’t trigger an IHT bill, even if you die within seven years

- Regularly using your £3,000 annual gifting allowance could save £7,200 in IHT

- Giving gifts from surplus income could reduce the IHT bill on your estate by £26,800 - assuming £10,000 is gifted annually over seven years

- Making small gifts of £250 to six people could save £3,000 in tax

- Married couples and civil partners can each use the available IHT-exempt gifting allowances, effectively doubling the potential tax-free gifts each year

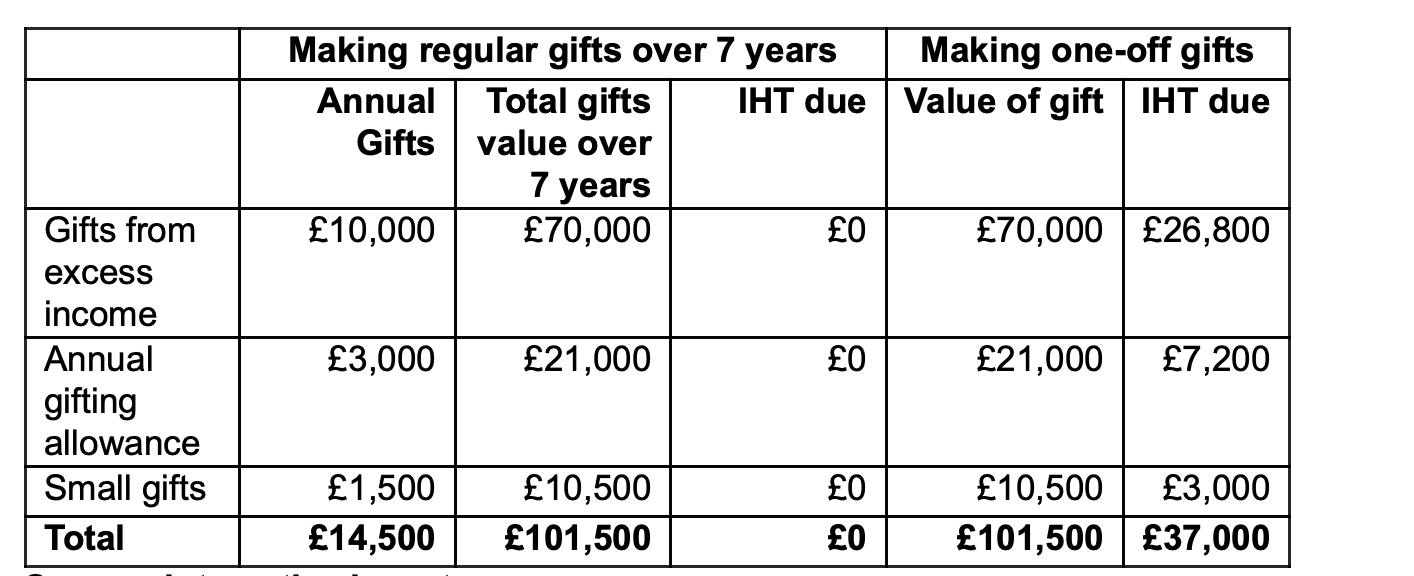

With inheritance tax (IHT) receipts reaching another record high of £8.2 billion between April 2024 and March 2025, and with pensions due to become subject to IHT from April 2027, new calculations from interactive investor reveal how making regular gifts using IHT gifting exemptions – rather than a one-off lump sum – could save your family up to £37,000 in tax.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

There are several gifting allowances exempt from IHT, including the annual exemption (£3,000 per tax year), the small gifts exemption (up to £250 per person), and regular gifts made from surplus income.

If you die within seven years, gifts made outside these exemptions may be subject to IHT. However, no tax is due on any gifts if you survive seven years after making them.

Making regular gifts over seven years vs one-off gifts

Source: interactive investor

Assumes the nil rate band (£325,000) and residence nil-rate band (£175,000) has already been used. Assumes one year of carry-forward allowance has already been used

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “The importance of effective IHT planning is only set to grow, especially with pensions being brought into IHT calculations from April 2027. For those looking to reduce the impact of IHT on their estate, using the range of exempt gifting allowances can be a more tax-efficient strategy than relying on larger one-off gifts.

“Not only are these exemptions immediately outside the estate for IHT purposes, but they could also result in significant tax savings if you were to pass away within seven years of making the gift.

“Married couples and civil partners can each use the available IHT-exempt gifting allowances, effectively doubling the potential tax-free gifts each year. By regularly using these exemptions, couples can effectively hedge their bets against the seven-year rule – gradually passing on wealth in a tax-efficient way, rather than depending on large lump-sum gifts that may still be caught by IHT if they die within seven years.”

Using the annual gifting allowance

- Making full use of the £3,000 annual exemption over seven years could save £7,200 in IHT. This assumes one year of carry-forward allowance has already been used

Myron Jobson says: “Using the annual gifting exemption is one of the simplest ways to reduce inheritance tax. Even if you die within seven years, there will be no tax to pay. You can also carry the allowance forward by one year, so you could gift £6,000 this tax year if you didn’t use the exemption last year.

“And don’t forget, couples can double their allowance – allowing up to £6,000 per person each tax year – which means you could give away £12,000 between you and immediately reduce your estate for IHT purposes

Giving regular gifts from surplus income

- Gifting £10,000 annually from surplus income over seven years could save £26,800 in IHT, compared to gifting the same amount as a lump sum (£70,000)

Craig Rickman, Personal Finance Expert, interactive investor, says: “Any gifts given from surplus income (i.e. income not spent on living costs) are immediately excluded from your estate for IHT purposes – even if you die within seven years.

“This little-known rule is powerful yet underused – only 430 families claimed this exemption in the 2022–23 tax year. For example, if you earn £30,000 after tax and spend £20,000, you could give away £10,000 with no IHT implications.

“However, it’s essential to keep detailed records to prove the gifts were made from surplus income. Without this, your family could face a tax charge if you die within seven years.”

Making small gifts

- Giving £250 to six individuals annually could save £3,000 in tax over seven years, compared to gifting a lump sum of £10,500

Craig Rickman says: “In addition to the £3,000 gifting allowance, you can also make a series of £250 gifts to different individuals – as long as you haven’t used another allowance for the same person.

“If you gift £250 to six people each year (£1,500), over 20 years you could gift £30,000 tax-free, potentially cutting your IHT bill by £12,000.

“It’s surprising how much even small gifts can add up over time. And when they fall within the IHT gifting rules, they can result in significant tax savings.”

Will I pay inheritance tax?

Most people don’t end up paying IHT on their estate because their assets fall within the available exemptions, known as nil-rate bands.

- Everyone has a £325,000 tax-free nil rate band

- Homeowners who leave their home to descendants can get a residence nil-rate band of £175,000, allowing them to leave up to £500,000 tax-free. This allowance reduces by £1 for £2 your estate exceeds £2 million

- Married couples and civil partners can enjoy two allowances, passing any used nil rate band to their spouse - they therefore can pass on up to £1 million without paying IHT.

- Any assets over the available nil rate bands will be charged 40% IHT

What happens if you die within seven years of making a gift?

If you die within seven years of making a gift, then your family could end up with a bigger IHT bill.

HMRC will look back at gifts you made within seven years of your death - they will be included as part of your estate. For example, if you make a gift of £100,000 and then die after five years, that gift will be added to your other assets to work out any IHT owed.

What about the tapering rules?

The tapering rules are commonly misunderstood and don’t apply to most gifts. They are only relevant if you gift assets worth more than £325,000 in total in the seven years before your death.

Any tax due on gifts over £325,000 will be reduced if you die between three to seven years after making the gift.

Deed of variation

Deeds of variation can be a valuable IHT planning tool, allowing beneficiaries of a will to redirect part or all of their inheritance to someone else - often to children or into a trust - without triggering additional tax consequences, provided it’s done within two years of the original death.

This flexibility can help reduce the value of the beneficiary’s own estate for IHT purposes and, in some cases, lower the overall IHT bill for the family. It’s a practical way to ‘restructure’ an inheritance after death to suit changing family needs or take advantage of tax planning opportunities that weren’t considered in the original will.

Think about your gifting goals

Craig Rickman says: “Before giving money or assets to loved ones, it’s important to take a step back and consider the exact thing that you’re trying to achieve. There’s usually more to intergenerational wealth planning than purely seeking to trim a future IHT bill.

“For example, handing over a one-off lump sum now might help the recipient meet an immediate financial goal, such as buying their first home. If you were to die within seven years, it may not be as tax efficient, but you may decide that’s a risk you’re willing to take.

“The key is to be aware of the IHT gifting options available to you and make an informed decision to suit your specific aims.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.