ii latest coronavirus poll

UK sentiment sours and more flock to investment trusts, our expert shares his views.

26th May 2020 15:43

by Jemma Jackson from interactive investor

UK sentiment sours and more flock to investment trusts, our expert shares his views.

The latest interactive investor poll to gauge investor sentiment amid the Covid-19 pandemic found that sentiment to UK shares has reached a new low as the UK dividend drought rages on.

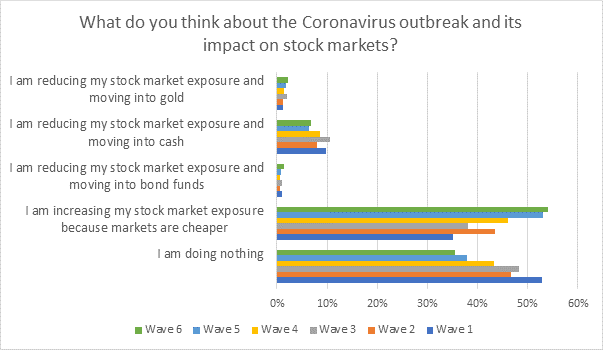

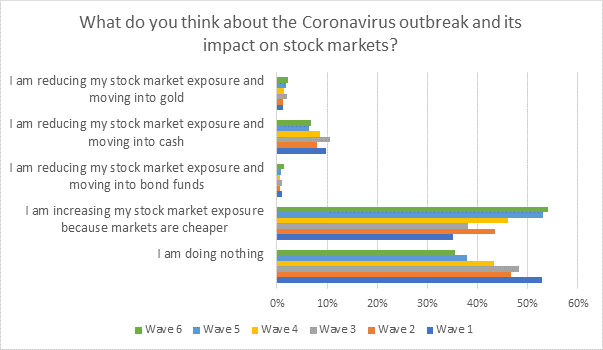

But it is not all doom and gloom. As investors increasingly look to diversify their portfolios overseas, more than ever are choosing to increase their stock market exposure (54%, compared to 35% just three months ago).

The Wave 6 poll* of 708 investors conducted between 22 May to the morning of 26 May 2020 revealed that while still a clear favourite among investors, there was a seven percentage points dip to 57% in the number of people actively investing cash into UK equities, compared to 64% between 1-20 April. This compares to a high of 72% in Wave 3, just two months ago (23-25 March 2020).

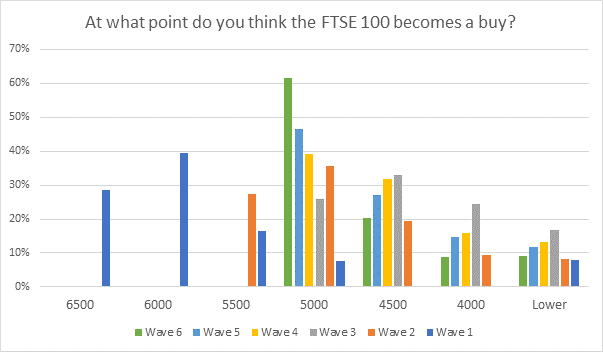

In addition, despite stock markets having made up some of their losses over the past month or so, there has been a 15-percentage points jump since last month to 62% in respondents thinking the FTSE 100 becomes a buy at 5,000. The rest (38%) are waiting for below 4,500.

With a UK dividend drought, it is interesting to see a spike in popularity of Asian, Emerging Markets and European shares which reached survey highs of 10%, 6% and 7% respectively.

The US market, which has been boosted by the performance of technology stocks during the global coronavirus lockdown, has cemented its position as the second most favoured region for those increasing their stock market exposure, reaching a high of 19%.

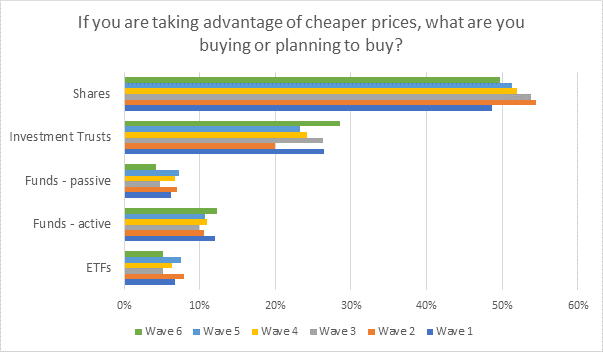

Meanwhile, although investors are still tending to favour direct shares to take advantage of buying opportunities (50%), there has been a surge in popularity for investment trusts (29%, up from 23% in Wave 5 and from 20% in Wave 2 between 11 and 16 March 2020).

Keith Bowman, equity analyst at interactive investor, says: “The move by investors from shares to investment trusts and funds comes at time of heightened risk and uncertainty, with collectives potentially offering an arguably less volatile entrance back into markets.

“A switch from UK to US stocks may signify investors perceived reliability for US companies, particularly technology stocks. The likes of Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX) are both considered Covid-19 winners.

“Increased investor confidence in adding to their investment portfolios comes at a time when the full might of Central Banks has been placed behind markets.

“Hopes for a vaccine and light at the end of the tunnel may also be fuelling investor confidence.”

Active vs passive

There has been a notable dip in the numbers of investors looking at passive funds (4% in Wave 6 from 7% in Wave 5) and ETFs (5% in Wave 6 versus 7% in Wave 5 and a high of 8% in Wave 2), with investors arguably looking for a more hands on approach during uncertain times.

*The Wave 6 poll of 708 investors was conducted from 22 May to the morning of 26 May 2020

The Wave 5 poll of 3,423 investors was conducted from 1 April to late morning on 20 April 2020.

The Wave 4 poll of 2,337 investors was conducted from 25 March to late morning on 1 April 2020.

The wave three poll of 949 investors was conducted from 23 March to the morning of 25 March 2020

Wave two research was conducted between 11 and 16 March 2020 among 2,295 investors.

Wave one research was conducted from 28 February 2020 to the morning of 2 March among 2,337 investors.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.