ii research shows impact of SIPP charges over long term and launches a free SIPP offer

ii is waiving its usual £10 monthly SIPP fee until April 2021, amounting to a £120 saving.

4th March 2020 09:19

by Jemma Jackson from interactive investor

interactive investor is waiving its usual £10 monthly SIPP fee until April 2021, amounting to a £120 saving.

Platform charges can put a serious dent in your retirement plans if you don’t keep on top of them. The difference arguably matters even more for a Self-Invested Personal Pension (SIPP), because there will often be larger sums involved and investors are saving for longer.

interactive investor, the UK’s second-largest direct-to-consumer investment platform, is waiving its usual £10 monthly SIPP fee until April 2021, amounting to a £120 saving.

The offer applies to all new SIPP accounts opened between 3 March 2020 and 3 April 2020, including existing customers who have an ISA and/ or trading account but no SIPP. To view interactive investor’s full charges, click here and to view the current offer, click here.

Charges add up

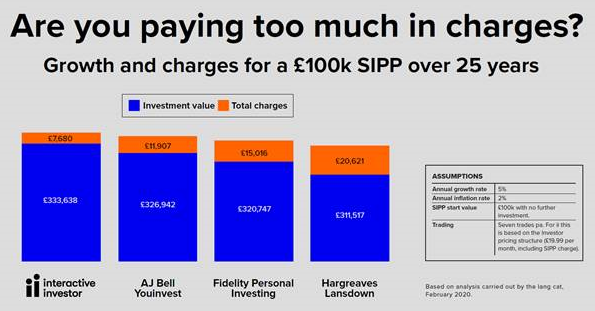

New research carried out by financial services consultancy the lang cat for interactive investor clearly lays out the high price paid by the many investors whose platform fees are percentage based – i.e. who pay more as their assets grow. Unlike most other platforms, interactive investor charges a fixed monthly fee, in pounds and pence.

The research compared a selection of consumer-focused investment platforms charging percentage fees with interactive investor’s fixed fees. See notes to editors for more details.

Moira O’Neill, Head of Personal Finance, interactive investor, explains: “It is commonly assumed that your home is your biggest asset, but often, it’s actually your pension*. The impact of compound interest over a 25-year period of investing for retirement – with often another 25-year investment period extending past traditional retirement age – means charges matter.

“While a percentage fee will better suit those with smaller pots, pension investors should expect their fund to accumulate as they contribute funds and benefit from investment growth over time. As they near retirement, the sums involved may be substantial, with pension millionaires set to be more common in the 2020s. This is where charges can really mount up and the savings for investors who shop around can be life changing.

Research from the lang cat in February 2020, using a £100,000 SIPP pot as an illustration and assuming a 5% annual growth rate, suggests that over 25 years an investor would have £22,000 more in their SIPP with interactive investor compared to our largest competitor. This does not include any special offer, such as the one currently being offered on our SIPP.”

Everything under one roof for £9.99 per month until April 2021

The interactive investor core Investor plan is £9.99 per month, and this includes the trading account, ISA, and customers can have as many free Junior ISAs as they have children. This year, interactive investor permanently scrapped its regular investing fee and we won’t stop there – we are constantly exploring ways to make investing simpler.

Meanwhile, our current SIPP offer is well worth looking at for those thinking of setting up – or moving – their SIPP and it means that for the next twelve months, investors can have everything under one roof for £9.99. Being proactive and getting on top of charges can save you thousands in the long run and add up to life changing amounts.

*House or pension – which is worth more?

While your home might be your biggest asset – those who started investing early and have been disciplined, might find it is their pension. Research by Mathew Yeates at 7IM modelled a useful scenario by way of example: a 25-year-old, earning £25,000 a year, with employer contributions would save 8% of their salary every year into a pension. With a 6% annual return, by age 30, they now earn £28,000, and buy a property worth £110,000, just under four times their salary. Well-disciplined with their money, they keep saving that 8% every year into their pension.

Fast forward to age 65. With the regular pension contributions and portfolio growth of 6% a year, their pension has grown to £432,000. If we assume the house appreciates in line with inflation at 2%, it would be worth only £220,000. Even appreciating at 3% per year, it would be worth only £310,000 – still over £100,000 short of the pension. That is the power of starting early, and letting time and compounding do the hard work.

Of course, achieving 6% per year annual growth in an investment is easier said than done, but it gives pause for thought and illustrates how important it is to start early, and keep on top of those costs.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.