ii view: Ferguson returns to growth in Q1

A previously restored dividend and return to acquisitions suggest confidence in the outlook.

15th December 2020 15:53

by Keith Bowman from interactive investor

A previously restored dividend and return to acquisitions suggest confidence in the outlook.

First-quarter trading update to 31 October

- North American revenue up 3.1% to $5.37 billion (£3.98 billion)

- UK revenue up 5.2% to $569 million (£421 million)

- North American adjusted trading profit up 12.2% to $486 million

- UK adjusted trading profit up 67% to $25 million

- Net debt down 13% from July to $866 million (excluding leases)

Chief executive Kevin Murphy said:

"We are pleased with the revenue growth in the first quarter and today's results further demonstrate the resilience of our business model. We are firmly focused on revenue growth and continued market share gains at the same time as carefully controlling gross margins and costs. This approach has enabled us to deliver robust trading profit growth in the first quarter. Cash generation was good and our balance sheet remains strong. This has enabled us to continue to invest in the business including our technology platforms to drive the best digitally enabled customer relationships and a seamless omni-channel experience.

"Since the start of the second quarter Ferguson has continued to generate low single digit revenue growth in broadly flat markets although we remain cautious on the outlook for the year as a whole , considering current pandemic trends. Despite these potential headwinds the business is in very good shape and we are well prepared should there be any further market related disruption and overall management's expectations for full year 2021 are unchanged."

ii round-up:

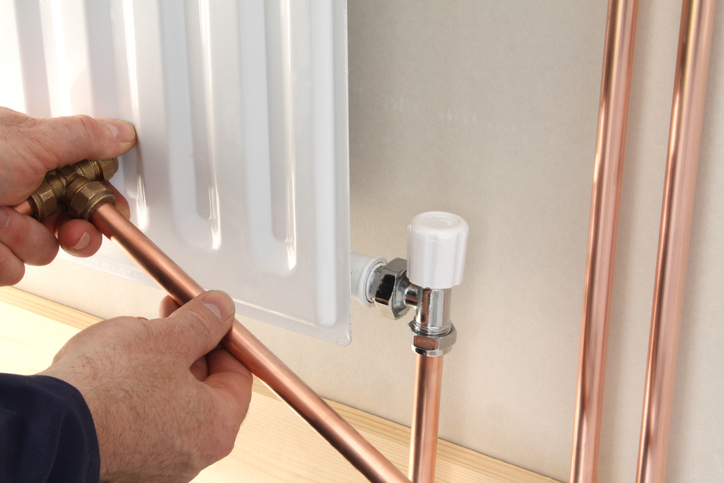

Ferguson (LSE:FERG) is a major trade distributor of plumbing and heating products across the US, UK and Canada.

It employs around 33,000 people across more than 2,100 outlets, generating around 85% of its sales or revenues in the USA.

Management is now working on the separation or demerger of its UK business.

For a round-up of this latest update, please click here.

ii view:

Attention from US activist investor Nelson Peltz brought the company’s then discounted valuation to the wider world. The result is that Ferguson's North American and UK businesses are now to be separated. The North American business is to be listed in the US. Initial plans were for the UK Wolseley business to be listed in the UK. But the pandemic has created economic uncertainty, with management now assessing other separation options in parallel with progress towards the demerger.

For investors, a US stock market listing for Ferguson may not suit all. Some UK-only focused investment funds may need to sell. Accompanying management outlook comments also remain cautious in tone, with the US still seriously Covid challenged. That said, there has been a return to organic sales growth following two previous negative quarters. A recommencement of bolt-on acquisitions also suggests underlying management confidence; a move which follows the previous restoring of the dividend payment. In all, the company appears to remain well-managed and deserving of long-term investor loyalty.

Positives:

- Robust financial position

- Resumed dividend payment

Negatives:

- Cautious accompanying management comments

- Moving towards reduced geographical diversification

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.