ii view: Informa makes huge loss, slashes costs

Shares for this media company have more than halved in 2020. What of the future?

21st September 2020 11:46

by Keith Bowman from interactive investor

Shares for this media company have more than halved in 2020. What of the future?

First-half results to 30 June

- Revenue down 26% to £814 million

- Loss of £740 million, down from a profit of £248 million

- Net debt down 32% to £1.95 billion

- No interim dividend payment

Chief executive Stephen Carter said:

"Despite the first-half disruption to physical Events businesses caused by the pandemic, we are seeing strong demand and resilience in our specialist Subscriptions, Data and Content, reflecting the power of our brands and depth of geographic reach and customer relationships. Encouragingly, we have also seen our physical Events business recover in Mainland China, whilst our increasing participation in virtual events is maintaining our brands, developing our digital services and enhancing our data capabilities.

"The combination of our resilient Subscriptions-led businesses and the actions we are taking position Informa securely through to the end of 2021. We remain confident that Informa will emerge from the pandemic with Stability and Security, delivering long-term sustainable growth and shareholder value."

ii round-up:

Media company Informa (LSE:INF) today reported a first-half loss of £740 million, hit by cancelled trade exhibitions under the Covid-19 pandemic and required restructuring costs as it reduced operations.

It also outlined the next stage of its virus action plan, raising targeted full-year cost savings from £400 million to £600 million and extending its exhibitions postponement programme to mid to late spring 2021.

Informa shares rose by 3% in UK trading having more than halved year-to-date, before quickly resuming their downward trajectory. Shares for fellow exhibitions organiser Euromoney Institutional Investor (LSE:ERM) are down by nearly 40% while shares of advertising company WPP (LSE:WPP) are down by over 45% in 2020.

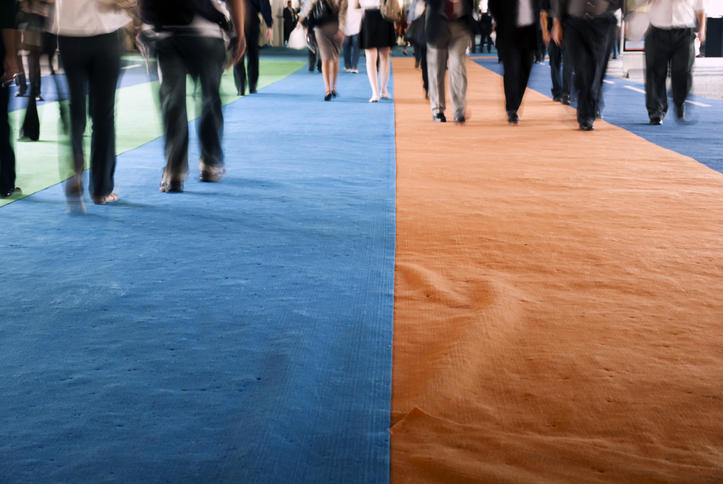

Exhibitions have been almost non-existent since late March except for domestic trade shows in mainland China and outdoor events.

Additional targeted cost savings through staff redundancy and sabbatical programmes and increased financing efficiency are expected to deliver positive monthly cashflows come January 2021, even if physical events remain limited.

Events accounted for around 65% of 2019 group sales, with the balance coming from specialist data and business intelligence subscriptions.

Management now expects full-year revenues of £1.7 billion, down from a summer estimate of £2 billion, the result of additional event postponements.

In April, Informa both suspended its dividend and raised £1 billion via an institutional share sale under measures to strengthen its finances and battle Covid-19.

ii view:

Informa organises international exhibitions and events, along with providing information services and scholarly publishing. At the end of 2019, it boasted a record of six consecutive years of growth in underlying revenue, profit, adjusted earnings and cashflow.

Now, Covid-19 and social distancing have knocked its events related businesses for six, with £1billion-plus of budgeted physical event sales cancelled this year, and more than £450 million since June. Expected full-year revenues of £1.7 billion versus nearly £2.9 billion in 2019.

For investors, Informa’s solid track record offers some longer-term confidence. Moves to further reduce costs and generate positive monthly cashflows come January 2021 should also not be overlooked. But with the dividend suspended and concerns regarding a second virus spike increasing, there appears to be little rush for investors to add to existing holdings.

Positives:

- Subscription sales proving resilient

- A previously strengthened balance sheet

Negatives:

- Suspended dividend payment

- Uncertain outlook for events business given the pandemic

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.