ii view: RELX raises dividend despite exhibition trouble

Exhibitions have been hit, but science, medical and legal information provision all proved resilient.

11th February 2021 16:06

by Keith Bowman from interactive investor

Exhibitions have been hit, but science, medical and legal information provision have all proved resilient.

Full-year results to 31 December

- Revenue down 10% to £7.11 billion

- Adjusted operating profit down 17% to £2.08 billion

- Total dividend for the year up 3% to 47p per share

- Net debt, including leases, down 8% from June to £6.9 billion

Chief executive Erik Engstrom said:

"Early in the year we decided that it was important not to curtail investment in our three largest business areas to offset any potential shortfall in financial performance from Exhibitions. Accordingly, we continued to invest behind our strategic priorities, the organic development of increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to our customers, and we continued to make targeted acquisitions that support our organic growth strategies. Throughout 2020 the three largest business areas continued to perform well, with our focus on analytics driving good growth in electronic revenue."

ii round-up:

Information group RELX (LSE:REL) today upped its dividend for the year by 3% as progress for its core information businesses helped counterbalance its Covid-hit exhibitions division.

A 2% rise in adjusted profit for its scientific, technical & medical (STM), risk & business analytics and legal division to £2.25 billion helped balance a move into a loss of £164 million for exhibitions. That leaves overall adjusted group profit down 17% to just over £2 billion, broadly in line with City forecasts.

RELX shares rose by more than 2% in UK trading, leaving them down by around 12% over the last year. That's better than exhibitions rival Informa (LSE:INF), whose shares have fallen by around a third, and roughly in line with the fall in the wider FTSE 100 index.

STM, risk and legal together accounted for 95% of all RELX revenues during 2020. Revenue from the electronic format, which management has been pushing, generated 87% of all group sales and grew by 4%. Print revenue, accounting for 8% of the total, declined more steeply than in recent years.

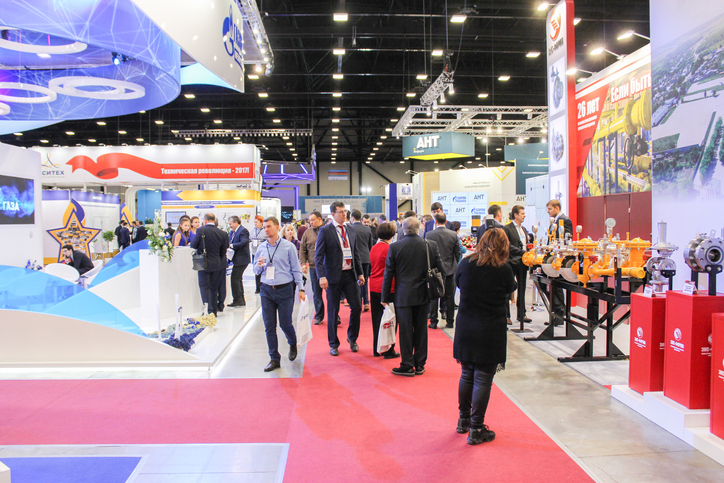

Face-to-face revenues fell by 73%. The Exhibitions business, which accounted for 5% of overall revenues this year, down from 16% in 2019, was severely hit by cancelled events owing to the pandemic. Divisional revenue reduced to £362 million from £1.27 billion in 2019.

A total of 11 bolt-on acquisitions were made over 2020 for a total of £878 million compared with £15 million of assets sold. The dividend increase came against a still suspended share buy-back programme.

Accompanying management outlook comments pointed to another year of underlying revenue and profit growth in 2021 for its three core businesses. That's similar to pre-pandemic trends. The timing and pace of recovery for exhibitions remains uncertain.

ii view:

Formerly known as Reed Elsevier, RELX’s diversity of business and global customer base offer core strengths. It serves customers in more than 180 countries and has offices in around 40 countries. It employs more than 33,000 people of whom almost half are in North America. Just over half its sales come from the USA, around a fifth are made in each of Europe and the Asia with the UK generating just under a tenth.

For investors, the hit to performance from virus induced disruption at its exhibitions business is unwelcome. Ongoing management caution regarding the outlook for exhibitions also needs to be considered. But the division now accounts for under a tenth of sales, while some competitors have been substituting face-to-face with virtual events. An estimated dividend yield of around 2.5% (not guaranteed) is also not to be overlooked in an ultra-low interest rate era. In all, current share price weakness looks to offer opportunity to accumulate holdings in this largely resilient and still generally growing blue-chip business.

Positives:

- Diversity in both business type and geographical region

- Maintained and now growing dividend payment

Negatives:

- Virus hit exhibitions business

- Subject to currency headwinds

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.