Inflation watch: savers are even worse off this month

The cost of living is up, and only 90 deals can beat inflation – and no easy access accounts.

21st April 2021 12:58

by Sam Barker from interactive investor

The cost of living is up, and only 90 deals can beat inflation – and no easy access accounts.

Inflation is the enemy of the saver, especially when it's hard to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar this year.

This is the second article in a monthly series that will examine the effect of inflation on your savings.

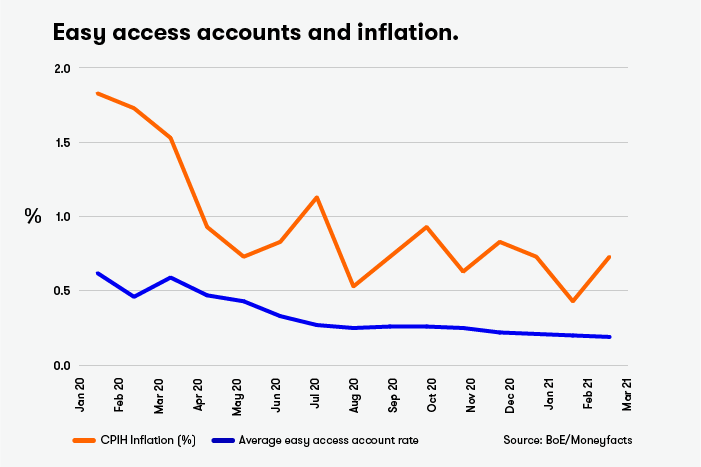

Savers’ cash pots faced worsening erosion in March, as the gap widened between inflation and the interest paid on a typical easy access deal.

Inflation was 0.7% last month, according to latest figures from the Office for National Statistics (ONS), up from 0.4% in February.

This was due to the rising cost of fuel, transport and clothes as the country began to leave lockdown restrictions behind. Optimism during the Covid vaccine rollout, reduced levels of oil production and attacks on Saudi oil installations caused a sharp rise in the price of crude oil in the first quarter of 2021.

However, the typical easy access savings deal paid just 0.16% last month, a small drop on 0.17% in February, according to financial experts Moneyfacts.

Easy access deals are popular with savers as they offer instant access to cash savings.

- UK interest rates, inflation and savings in 2021

- Are you saving enough for retirement? Our calculator can help you find out.

But the 54 basis point gap between inflation and interest on the average easy access account is bad news for savers. Any cash held in a deal with a below-inflation interest rate loses spending power.

Simply, if you open a savings deal paying 0.5% interest in January with £10, your money will have grown to £10.05 by December. But if inflation averages 0.5% in the period, then the extra 5p isn't actually worth anything, as what would have cost you £10 in January would cost £10.05 anyway.

The answer is to shop around for deals that beat inflation, but that is becoming increasingly hard.

Just 90 savings deals meet or beat the rate of inflation now, compared to 326 in February, according to Moneyfacts. No easy access accounts can beat the 0.7% inflation rate.

The best easy access account pays 0.5%, from Virgin Money, but that is only available to its current account customers.

The best rate available to the general public is 0.45%, from Yorkshire Building Society.

Savers must have at least £100 to open the account. But this must be done in a branch or by post, limiting who can take one out. The deal also only allows one withdrawal a year before losing interest.

The second-best deal pays 0.41%, from Paragon. This allows unlimited withdrawals, and must be opened and managed online.

The chart below shows the growing problem faced by many easy access account customers. The interest rate paid by the typical easy access deal has fallen steadily since March last year.

The downward trend will make many savers apathetic towards shopping around for the best deal, and may discourage saving at all.

It also kills any optimism felt by savers since last month, when the gap between inflation and the typical easy access account was at its smallest for a year.

The longer-term view for savings rates and inflation is certainly not optimistic. Inflation is set to rise further this year. The Bank of England thinks it will hit 1.8% in 2021, and it has a general target of 2%.

But savings rates are also likely to remain low for the foreseeable future.

The main reason for low savings rates is that the Bank of England cut the base rate to new depths of 0.1% last March. The base rate is factored into the savings rates paid by banks, and many cut these in response.

With the Bank unlikely to raise base rate any time soon, savings rates will languish too.

- Savings rates already dropping after Bank of England decision

- MPs step in as UK ‘loses’ £50 billion in cash

Rachel Springall, of Moneyfacts, said: “Savers could indeed beat the level of inflation with some accounts today, but it is still expected for the level of inflation to rise beyond the Government’s target of 2% in the coming months.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.