Inflation watch: temporary reprieve for savers

Almost 400 deals can beat inflation at 0.4% today, but the cost of living could rise fast.

31st March 2021 09:57

by Sam Barker from interactive investor

Almost 400 deals can beat inflation at 0.4% today, but the cost of living could rise fast.

Inflation is the enemy of the saver, especially when it's hard to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar this year.

This is the first article in a monthly series that will examine the effect of inflation on your savings.

Savers’ cash pots faced severe erosion in February, despite the gap closing between inflation and interest paid on the average easy-access account.

Inflation was 0.4% last month, according to latest figures from the Office for National Statistics (ONS), down from 0.7% in January.

However, the typical easy access savings deal paid just 0.17% last month, a drop on January’s almost as dismal 0.18%, according to financial experts Moneyfacts. These accounts are popular with savers as they offer instant access to cash savings.

- UK interest rates, inflation and savings in 2021

- Are you saving enough for retirement? Our calculator can help you find out.

The 23 basis point difference between the two figures means the cash reserves of many savers held in these accounts are effectively losing spending power. And they will continue to do so as long as inflation exceeds the interest rates available on them.

But shopping around for the best deals means savers can offset the damaging effect of inflation on their cash.

The current best deal pays 0.5%, from Yorkshire Building Society. Savers must have at least £100 to open the deal, and can only withdraw money once a year before losing interest.

The second-best deal pays 0.45%, from Monmouthshire Building Society. But this pays interest on a tiered basis. Savers get 0.25% on balances between £100 and £5,000, 0.35% on balances between £5,000 and £25,000 and the full 0.45% on deposits of more than £25,000.

However, the deal does allow 150 withdrawals a year.

Analysis from Moneyfacts found 100 savings deals beat inflation at 0.7% last month, and 326 beat it now.

- How to be an ethical saver

- Government to cut red tape on IHT and tax payments

- Check out our award-winning stocks and shares ISA

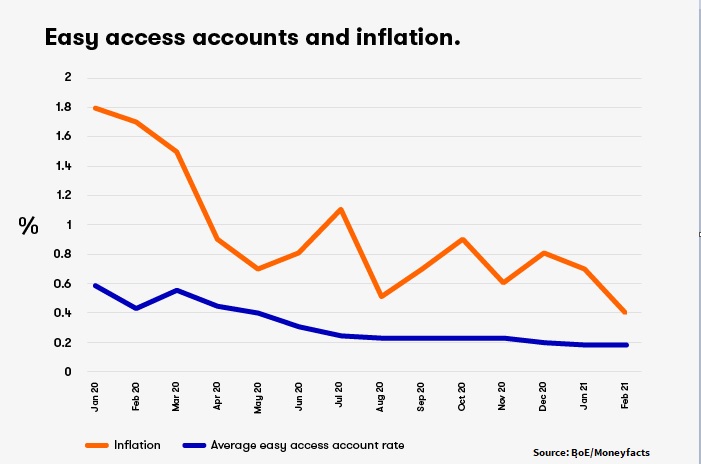

The chart below shows the pain so many easy access account customers are going through. The interest rate paid by the typical easy access deal has fallen steadily since March last year.

However, while inflation has been more volatile with its movements, it has always outstripped interest on savings accounts during the period. The gap in February is the closest it has been in the entire 12 months, but it is still a gap.

Rebecca O'Connor, head of pensions and savings at interactive investor, says: “Inflation will probably be eroding the value of your cash if it’s held in a standard easy access savings account. Even now, with inflation slightly lower. That means it is losing value in real terms.

"There can still be reasons to save into a low interest account, if you need the money really soon for example. Otherwise, your only chance of beating inflation is putting your money away for longer, or investing.”

Cash held in deals paying below-inflation rates will steadily lose spending power. Inflation tracks the rising cost of common goods and services, so if your cash pot does not keep track then you are losing money in real terms.

Simply, if you open a savings deal paying 0.5% interest in January with £10, your money will have grown to £10.05 by December. But if inflation averages 0.5% in the period, then the extra 5p isn't actually worth anything, as what would have cost you £10 in January would cost £10.05 anyway.

- Savings rates already dropping after Bank of England decision

- MPs step in as UK ‘loses’ £50 billion in cash

The main reason for low savings rates is that the Bank of England cut the base rate to new depths of 0.1% last March. The base rate is factored into the savings rates paid by banks, and many cut these in response.

This is a problem because inflation is set to rise further. The Bank thinks it will hit 1.8% in 2021, and it has a general target of 2%.

Rachel Springall, of Moneyfacts, says: “The impact of inflation on savings returns may not be as prevalent today due to the fall, but with the expectations for it to rise above 2% this year, soon there may be not one standard savings account that can fight its eroding power.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.