interactive investor winter portfolios back for a fifth year

26th October 2018 14:56

by Lee Wild from interactive investor

Stockmarket returns over the winter period have consistently outperformed the lazy summer months. Lee Wild explains why and how these two star portfolios exploit the anomaly.

The summer was a fruitless one for many investors. At the end of September, the FTSE 100 traded barely a point away from where it had ended April and, in the three weeks since, it has lost more than 7%. But with the typically stronger winter months almost upon us, interactive investor is busy building a pair of winter portfolios with a track record of market-busting returns.

A curious anomaly exists in the stockmarket, which has proved that buying and selling at two specific dates of the year has historically generated better returns than if you stayed invested all year round. Buying a portfolio of shares on 1 November and selling it on 30 April has outperformed over the last 24 years and provides a clear strategy for investors.

Data from The UK Stock Market Almanac shows that starting with £100 in 1994, an investor who had been invested in the market continuously for the past 24 years would have seen their money grow to £261 (excluding dividends). However, if they had only invested in the market between 1 November and 30 April every year then that £100 would be worth £327. Conversely, if they had chosen to only invest over the summer months they would have lost money; their original £100 would be worth just £73.

According to Stephen Eckett, mathematician and author of The UK Stock Market Almanac, published by Harriman House, winter portfolios leverage off two phenomena.

"The first is the odd feature of shares generally performing better over the winter (November-April) than over the summer (May-October)," says Stephen. "The second is the identification of certain shares that consistently out-perform the market in the winter period. These two features together can be used to create quite a turbo-charged portfolio."

An inspirational strategy

The theory was so compelling that in 2014/15 we constructed two portfolios based on the findings. Screening only the FTSE 350 index, the first portfolio included the most reliable winter performers of the past 10 years – the interactive investor Consistent Winter Portfolio. The second took on a little more risk in return for greater potential profit – our Aggressive Winter Portfolio.

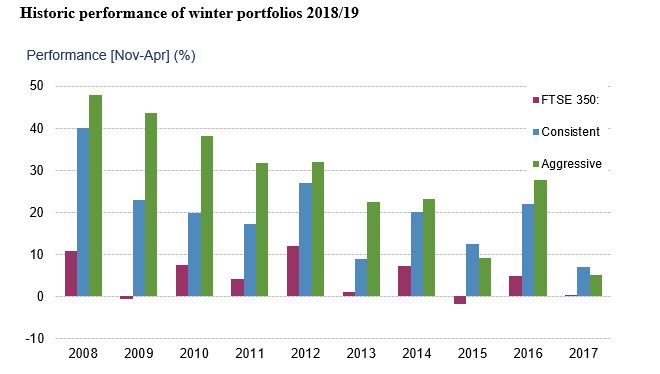

Every one of the five constituents in this year's consistent portfolio has risen in each of the past 10 winter periods, generating an average annual return, excluding dividends, of 19%. That compares with just 4.5% for the FTSE 350 benchmark index.

For some extra zing, we needed only relax the requirement for positive returns, this year to a still-highly-respectable nine years out of the past 10. For a slight increase in perceived risk, the historic average return balloons to a mighty 28.2%, more than six times greater than the benchmark.

Source: interactive investor Past performance is not a guide to future performance

Recent returns

Last year was a tough one - a Santa rally unravelled in spectacular fashion when Donald Trump's tariff idea threatened a trade war with China. The benchmark index ended our six-month seasonal strategy up just 10 points, or 0.25%, from where it began on 1 November 2017.

Our higher risk Aggressive portfolio did much better, up 1.8% for the six-month period, and even the Consistent portfolio, which dipped 0.38%, still generated returns of 1.2% when you factor in dividends.

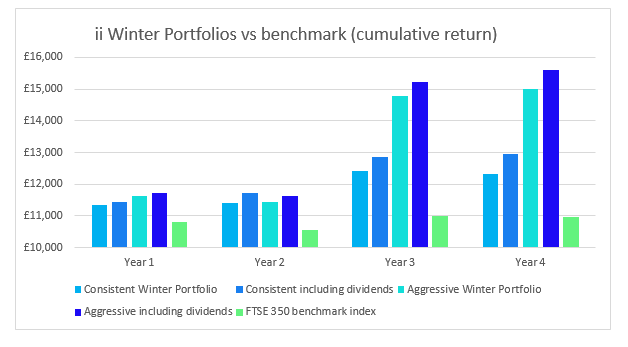

Following the strategy since inception four years ago would have generated more dramatic returns. £10,000 invested in the 2014/15 Winter Portfolio then reinvested each winter would have easily outperformed the FTSE 350 whichever portfolio you'd owned.

Even after 2017's more modest performance, £10,000 invested in the aggressive portfolio four years ago would have turned into £14,999, a return of 50%! Include dividends and it was 56.1%. The benchmark returned just 9.8%.

That £10,000 invested in the consistent portfolio would have become just over £12,300 in Year Four, a return of 23.1%. Add dividends and it's 29.6%.

Source: interactive investor Past performance is not a guide to future performance

Events to watch over the next six months

The summer has been brutal, and equity markets are not out of the woods. There's always something to worry about, of course, and this year is no different with the threat of a no-deal Brexit increasing.

Brexit watchers will know that as well as meetings to sign a deal either in November or December, the final cut-off date for Parliament to see it is 21 January. MPs will vote on what to do if no deal is presented. Assuming no extension, Britain will leave the European Union at midnight on 29 March 2019.

Replacing US elections and triggering of Article 50 last time are concerns about rising US interest rates, higher bonds yields, trade wars, the Italian budget, plunging Chinese markets, turmoil in the Middle East and any number of peripheral issues.

However, these winter portfolios have beaten the market every year - the key objective - and rarely failed to make money for investors. UK stocks are now cheap, and underperformance by the constituents over the summer makes them more attractive for investors now.

Rebecca O'Keeffe, head of investment at interactive investor says: "The theory behind our winter portfolios is impressive and the market analysis suggests seasonal investing is an effective trading strategy. It is also quite compelling to have both a buy and sell date, as we are surrounded by ideas of what to buy, but having a strategy of when to sell is a real advantage.

"There is no doubt that recent market performance has been turned on its head and it is more difficult to have a firm view of what lies ahead - however, seasonality has been a strong indicator in the past and the hope is that it will remain convincing. Although these portfolios are higher risk options and won’t be suitable for all, they may appeal to investors who follow market trends and like the concept of trying to time the market rather than simply staying invested."

On Wednesday 31 October, we will reveal which companies made the final cut and make both the interactive investor Consistent and Aggressive Winter Portfolios available for investors to buy.

Note: Previously, interactive investor has offered customers the chance to buy the five stocks in each of the Consistent and Aggressive portfolios for a £10 flat fee, then usual commission for each stock sold.

This year, following the migration to a new website over the summer, we are still building out functionality, so are currently unable to offer the same deal. This means anyone interested in the portfolios, which are designed to be held for six months from 1 November 2018 to 30 April 2019, will have to buy and sell each constituent individually at usual commission rates.

Constituents of each portfolio will be revealed on 31 October 2018, including links to their respective company pages. The choice to purchase individual lines of stock is that of the individual investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.