interactive investor winter portfolios return for Season 6

After five years of consistently beating the wider stock market, our winter portfolios are back.

23rd October 2019 11:30

by Lee Wild from interactive investor

After five years of consistently beating the wider stock market, our winter portfolios are back to exploit this curious anomaly. Lee Wild talks us through the rationale, how it's done, and why this year might be the most difficult yet.

With the UK's messy exit from the European Union kicked further down the road, uncertainty for financial markets continues. Add the prospect of a pre-Christmas General Election into the mix and matters are complicated further.

Each of our two seasonal baskets of shares have beaten the wider stock market every year since inception, but there are clearly some big risks to this year's interactive investor Winter Portfolios. Uncertainty around Brexit so close to launch date makes 2019 without doubt the most difficult start to this winter strategy so far.

Launching the portfolios on 31 October is not our choice, of course. The strategy is very precise, giving you both an exact entry and exit date. However, despite the obvious additional risk this time, a strong five-year track record of returns has proved you can time investments in the stock market.

The rationale

In 2014, interactive investor learned of an anomaly in the stock market which demonstrates that buying and selling at two specific dates of the year has historically generated better returns than if you had stayed invested all year round.

Data from The UK Stock Market Almanac shows that starting with £100 in 1994, an investor who had been invested in the market continuously for the past 25 years would have seen their money grow to £257 (excluding dividends).

However, if they had only invested in the market between 1 November and 30 April every year, that £100 would be worth £341. Conversely, if they had chosen to only invest over the summer months they would have lost money; their original £100 would be worth just £69.

Seasonality is more pronounced in some stocks than others, though, and we found that including these shares in their own portfolio can significantly increase potential returns over the six winter months. Buying on 1 November (or late on 31st October) and selling them on 30 April provides investors with a clear strategy that's simple to execute and enjoys a successful performance history.

Of course, this strategy is not without risk, none are. But the theory, now backed up by a five-year track record, is compelling.

How do we do it?

Using data supplied by Stephen Eckett, mathematician and co-founder of publisher Harriman House, each year we build two portfolios. Screening only stocks listed in the FTSE 350 index for a greater level of liquidity, the five most reliable winter performers of the past 10 years form the interactive investor Consistent Winter Portfolio. A basket of five typically higher risk/higher return stocks, which still exhibit impressive consistency over the winter months, become the interactive investor Aggressive Winter Portfolio.

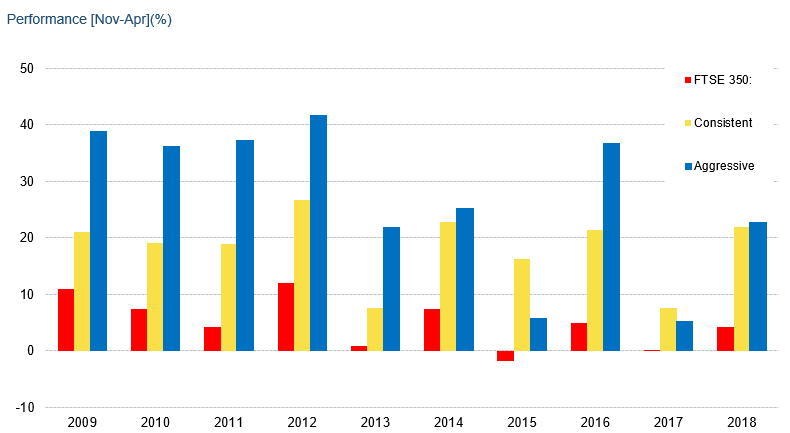

Every constituent in the 2019-20 consistent portfolio has risen during the six winter months each year for at least the past decade. The average return for the period November to April, excluding dividends, is 17.8% versus an average gain of just 5.0% for the FTSE 350 benchmark index.

To access even greater potential returns, entry criteria for the aggressive portfolio for 2019-20 is relaxed slightly. That makes it a little riskier, but even now all five constituents have a 90% success rate generating positive returns over the past 10 winters. The average winter return since 2009 is 27.1%.

Historic performance of winter portfolios 2019-2020

Source: Harriman House Past performance is not a guide to future performance

Investments and the income from them can go down as well as up and you may not get back the full amount invested.

Historic performance

Last year, the 2018-19 consistent portfolio generated a total return (capital appreciation plus dividend income) of 20.3%, and the aggressive portfolio 29%. The FTSE 350 managed just 6.4%.

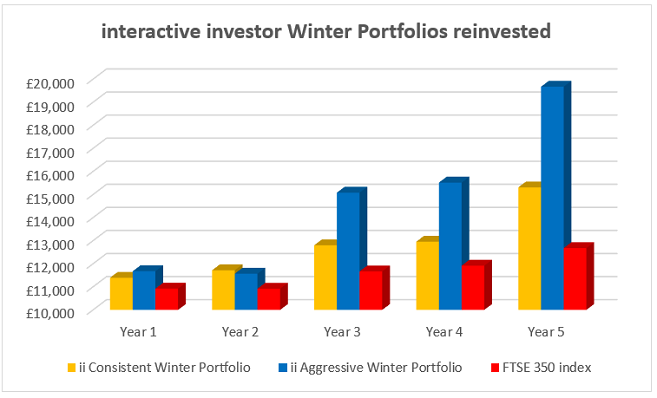

Loyal followers who bought the original aggressive portfolio in October 2014, reinvested the proceeds into the 2015-16 portfolio, then repeated each year, would have generated a total return of 96.7% over the five years, which also factors in commission and stamp duty.

For the consistent portfolio, five-year total return would have been 52.7%, almost double the winter returns generated by the FTSE 350, even when the benchmark index includes dividends but no costs. Had you bought and held the FTSE 350 for the entre five years, total return excluding charges would have been 36.9%.

Of course, seasonal strategies like this have their critics, and there's a well-known saying, especially among fund managers, that it's all about "time in the market rather than timing the market." In many circumstances, they're right.

Investors must remember that these portfolios are designed for a short trading period, so market fluctuations may be more pronounced. They also consist of a very limited number of underlying securities, but the proven consistency of our winter portfolios makes them worth considering as a research or potential trading idea for part of an otherwise broadly diversified portfolio.

Total returns based on £10,000 lump sum at 31 October 2014, sold at the end of April 2015, reinvested the proceeds into the 2015-16 portfolio and repeated the process each year.

Source: interactive investor. Includes buying/selling costs and stamp duty

Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the original investment.

Why does the winter portfolio strategy work?

While there are no conclusive studies that neatly explain the outperformance of stock markets during the winter months, there are plenty of theories, some more plausible than others. There are also some obvious reasons why individual stocks do better at this time of year.

Perhaps the most obvious is that far more money flows into the market over the winter months. This occurs at the end of long summer holidays for big players at financial institutions on Wall Street and in the Square Mile. While the City no longer shuts down for the cricket, horse racing and rowing at Henley, it is probable that some of the big trading decisions are left until everyone is back in the office. Investment strategies deployed in the following months increase liquidity and boost sentiment.

Most investors will have heard of the Santa rally, when equity markets historically have done well in the weeks leading up to Christmas. You could attribute this to seasonal optimism, or possibly end of calendar-year window dressing of portfolios by funds and investment houses. Selling losers and buying successful stocks flatters the numbers that determine City bonuses.

Then, in the spring, at the end of the financial winter, investors take advantage of tax-efficient products in the run up to tax year end. In what is often referred to as ISA season, many investors rush to use their tax-free allowance in the final days, weeks and months of the tax year. So-called 'early birds' then use their ISA allowance as soon as the new tax year begins.

Among obvious drivers of individual stocks or sectors is the retail sector, where investors will guess whether or not consumers are spending heavily on Christmas presents. There are often seasonal swings for the pubs sector too, often dependent on results demonstrating the financial impact of weather, good or bad, on our drinking habits over the summer.

Events to monitor over the six months from November 2019

Every year there are major macro issues which threaten to derail stock market performance over the winter months. These are essential reminders that investing in equities is a high-risk activity. However, winter markets have proved resilient in the past.

A Trump win in the 2016 US presidential election was expected to cause chaos on global financial exchanges. It didn’t. In fact, it had quite the opposite effect. The triggering of Article 50 in March 2017 proved merely a blip, and markets have twice recovered from seemingly catastrophic sell-offs during the winter months, first at the beginning of 2018, then again during the fourth-quarter.

And there are some big risks to the winter portfolio this year!

Between November 2019 and April 2020, investors ought to be aware of some key events which could significantly increase volatility.

A Brexit outcome of any sort and a UK General Election now seem inextricably linked. No one can be sure exactly what will happen, but City traders will not relish uncertainty and the prospect of a Labour government while it continues to support nationalisation of water and rail industries.

Ongoing US-China trade talks have the ability to drive stocks sharply either way, too. Consensus opinion is that Trump will get a deal done with the Chinese, but that he might wait until the run up to the presidential election in November 2020 before pulling a rabbit out of the hat. It’s anyone's guess.

If that's not enough to keep you up at night, consider a slowdown in global economic growth, US interest rate policy, bond yields, a possible US-EU trade war, turmoil in the Middle East, a US earnings recession.

Constituents of the two winter portfolios for 2019-2020 will be revealed exclusively to interactive investor customers prior to launch date, then to all investors during the afternoon of 31st October.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.