Invest in gold and silver to insure against central bank action

Merian’s monetary metals expert Ned Naylor-Leyland outlines his latest thinking and outlook for 2020.

12th February 2020 09:45

by Ned Naylor-Leyland at Merian Global Investors from ii contributor

ii Fiight Club: On 23rd January 2020, interactive investor and Merian Global Investors hosted a joint event at Shakespeare’s Globe, where Merian’s head of UK equities, Richard Buxton, and monetary metals expert, Ned Naylor-Leyland, debated the outlook for the year ahead. Here, Ned provides a recap on some of his latest thinking.

Ned Naylor-Leyland, manager, Merian Gold & Silver Fund

When many of the world’s major central banks hold gold in huge quantities as their “zero-risk” investment of choice (and, indeed, have been increasing their exposures), is it sensible for investors to ignore what has historically been a core asset class, or should an allocation to a monetary metals product that adds diversification be under serious consideration?

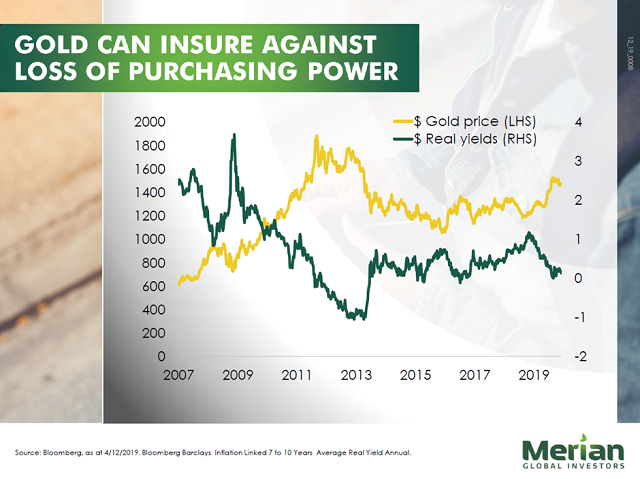

We believe that gold and silver exposure is something from which many investment portfolios would benefit, given its potential to enhance portfolio diversification and to help preserve purchasing power over the long term.

We also feel that focusing on achieving best-in-class exposure to both physical metals and mining equities will prove crucial in the future. With these points in mind, we believe it is prudent and appropriate to avoid less developed and lesser-regulated mining jurisdictions, such as some of those based in Africa and Central Asia, and instead to concentrate investments in the Americas and Australia.

Equally, we believe that exposure to the metals themselves is best achieved through superior quality listed ‘bullion funds,’ rather than the more widely-known physical gold and silver ETFs. In managing our portfolio, we seek to take advantage of the amplified return potential of silver versus gold (in a bull market for precious metals, the silver price typically rises faster than gold, whereas in a bear market it typically falls faster) as a central driver of overall returns.

With the ‘white’ metal (silver) at historically cheap levels relative to its ‘yellow’ brother (gold), and global central banks expanding their balance sheets once more, we believe that investors in monetary metals have cause for optimism as they look to the year ahead.

About Ned Naylor-Leyland:

Ned joined the company in 2015 and manages the Merian Gold & Silver Fund. He has nearly two decades of experience in precious metals investing, having founded a dedicated monetary metals fund in 2009 at Quilter Cheviot. Ned began his career at Smith & Williamson and graduated from the University of Bristol in 1998 with a BA (Hons) in Spanish.

Past performance is not a guide to future performance and may not be repeated. Investment involves risk. The value of investments and the income from them may go down as well as up and investors may not get back any of the amount originally invested. Because of this, an investor is not certain to make a profit on an investment and may lose money. Exchange rate changes may cause the value of overseas investments to rise or fall.

This communication is issued by Merian Global Investors (UK) Limited (“Merian Global Investors”), Millennium Bridge House, 2 Lambeth Hill, London, United Kingdom, EC4P 4WR. Merian Global Investors is authorised and regulated by the Financial Conduct Authority. Merian Global Investors is registered in England and Wales (number: 02949554) and is authorised and regulated by the Financial Conduct Authority (FRN: 171847).

This communication is for information purposes only. Nothing in this communication constitutes financial, professional or investment advice or a personal recommendation. This communication should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the document.

Any opinions expressed in this document are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or companies within the same group as Merian Global Investors as a result of using different assumptions and criteria.