Investor poll: fears, predictions and strategies for 2023

8th December 2022 12:23

by Jemma Jackson from interactive investor

We asked you about the outlook for the year ahead and where you think the FTSE 100 will end 2023. Here are your answers.

- Over half believe the FTSE 100 will be higher in a year’s time

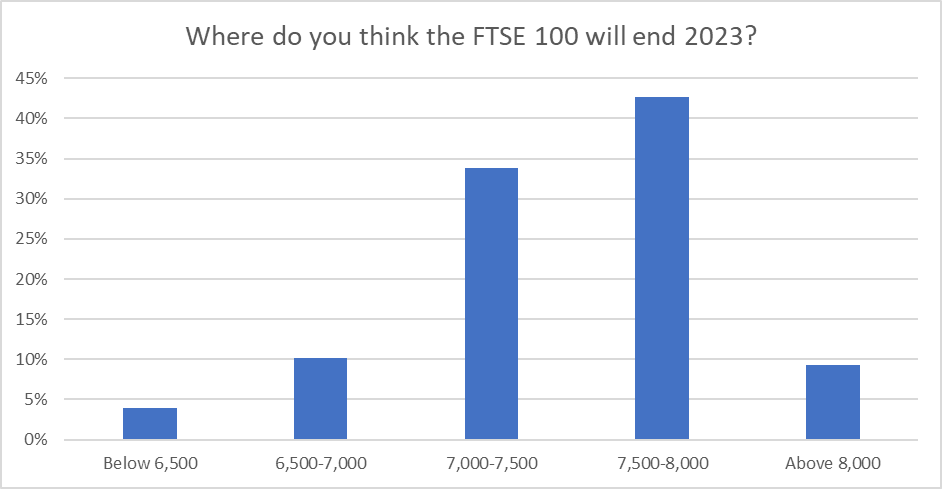

- More than three-quarters believe FTSE 100 will finish 2023 between 7,000 and 8,000.

- UK is the most favoured region

The risk of a global recession remains top of private investor’s minds on a medium term (five year) view, new research from interactive investor, the UK’s second largest direct to consumer investment platform, shows.

interactive investor website visitors were polled between 5-7 December 2022, with 1,500 responses.

But with so many competing global issues, and after a tough year for markets, almost a quarter (23%) of investors are ending 2022 quietly and have no plans to add or change their portfolios over the next few months.

Amongst the more active, 13% are increasing stock market exposure, 8% are decreasing, and 10% say they are reallocating to more defensive sectors. Some 7% are increasing cash exposure, and after a tricky year for multi asset, only 5% are seeking out alternatives.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

Those who are investing right now are tending to stay home, with 50% choosing to invest in UK stocks, with the US the nearest second at 20%. Perhaps correspondingly, over half believe the FTSE 100 will be higher in a year’s time and more than three-quarters believe FTSE 100 will finish 2023 between 7,000 and 8,000.

Lee Wild, Head of Equity Strategy, interactive investor, says: “While we don’t know exactly what will happen next year, we do know that the UK economy will likely spend at least some of it in recession. And that’s by far the biggest worry among respondents to our poll. Recession won’t itself trigger a market crash; performance will depend on the severity of any downturn, and thinking is that this could be a long and shallow recession. That’s been factored into share prices already, so markets will react to surprises, perhaps to company profits, interest rates, the growth outlook or macro events.

“It is interesting to see half of respondents who are investing spare cash into shares are targeting UK companies. Domestic stocks are typically more popular than overseas investments, known as home bias, because they’re better known and often easier to research and understand. However, a fifth of respondents are investing more money in the US where exposure is primarily to growth stocks like the tech sector. Tech has had a torrid time in 2022 but has reacted positively to any hint that the US rate hike cycle is slowing. If rates peak soon or even begin to ease later in the year, growth stocks are back in play.”

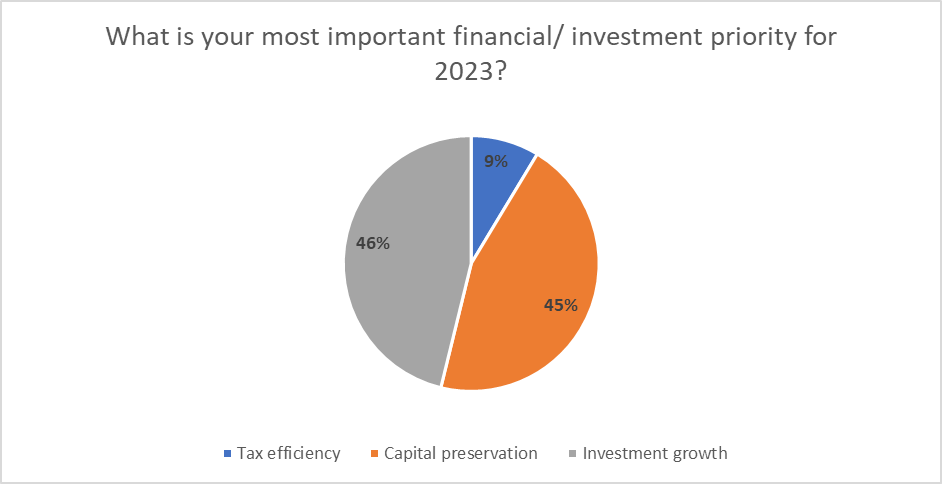

Priorities for 2023

Investors are also torn between investment growth versus capital preservation investment strategies for 2023. After a torrid year for stock markets, 45% favour wealth preservation and 46% favour growth. A not insignificant 9% want to focus on tax efficiency in 2023, with the tax changes in November’s budget a likely contributing factor.

World worries

After recession fears, inflation and rising interest rates was the second most popular answer, with 17% of the vote. Geopolitical tensions, however, closely followed – with 16% of investors saying it was their primary concern towards stock markets over the next 5 years. The Russia-Ukraine conflict is still on investor’s minds too (14%).

Only 4% think the climate emergency as the most significant risk to global stock markets. However, that’s double the 2% in October’s poll and comes one month on from November’s UN’s Climate Conference, COP27.

Only 1% believe that new waves and/or new variants of Covid-19 pose a risk to global markets. Instead, UK political instability was cited as a more significant threat, with 10% of the vote, unsurprising given the turbulence in Westminster over the last few months.

Source: interactive investor poll*

An uncertain 2023 leaves investors waiting on the side-lines

In October’s poll, the majority of investors appeared to be tweaking their portfolio in response to the ongoing market turbulence. Some 60% of respondents said they were making some changes.

This is no longer the case, and December’s respondents told us quite a different story.

Lee Wild comments: “Uncertainty around the outlook is keeping many investors on the side-lines. Over half of respondents either don’t know what they’ll do with their portfolio (31%) over the next few months or plan to do nothing (23%).

“Those who were making changes were mostly increasing their stock market exposure (13%) or reallocating to more defensive sectors (10%). Just 7% said they were increasing their allocation to cash, and 5% said they’re increasing their exposure to alternatives – possibly as a hedge against inflation. ii has seen this reflected in its most recent platform purchases, too.”

Where are investors channelling spare cash? A regional breakdown

When asked ‘if you are investing spare cash into equities, which regions are you investing in?’ the largest percentage of respondents (50%) said the UK. The UK was also the most popular region in October’s poll, where it got 57% of the vote. FTSE 100 dividend payers may be front of mind here.

Once again, the US was the second most popular choice, 20% saying this is where they were channelling spare cash.

Other regions remain less popular with investors; emerging markets had 8% of the vote – a slight increase from 5% in October, closely followed by Asia with 7% and Europe with 5%.

What’s next for the FTSE 100?

ii also asked investors for their prediction for the FTSE 100 by the end of next year.

Commenting on the results, Wild explains: “The FTSE 100 has had a much better year than most of its international peers where stocks trade down over 20% in some cases. An abundance of defensive sectors like oil, defence and tobacco has helped performance, and the index has spent much of 2022 trading between 7,000 and 7,600, a few hundred points either side of where it ended 2021.

"A growth spurt since mid-October has the FTSE 100 currently trading at 7,500, and over half the respondents to our poll believe the index will be higher again in a year’s time. In all, more than three-quarters believe it will finish 2023 somewhere between 7,000 and 8,000.”

Source: interactive investor poll*

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.