IPO tactics: Can you make a killing investing in IPOs?

With IPOs grabbing headlines, Graeme Evans explains how retail investors can play the new issues market.

3rd April 2019 14:26

by Graeme Evans from interactive investor

With IPOs grabbing headlines, Graeme Evans explains how retail investors can play the new issues market.

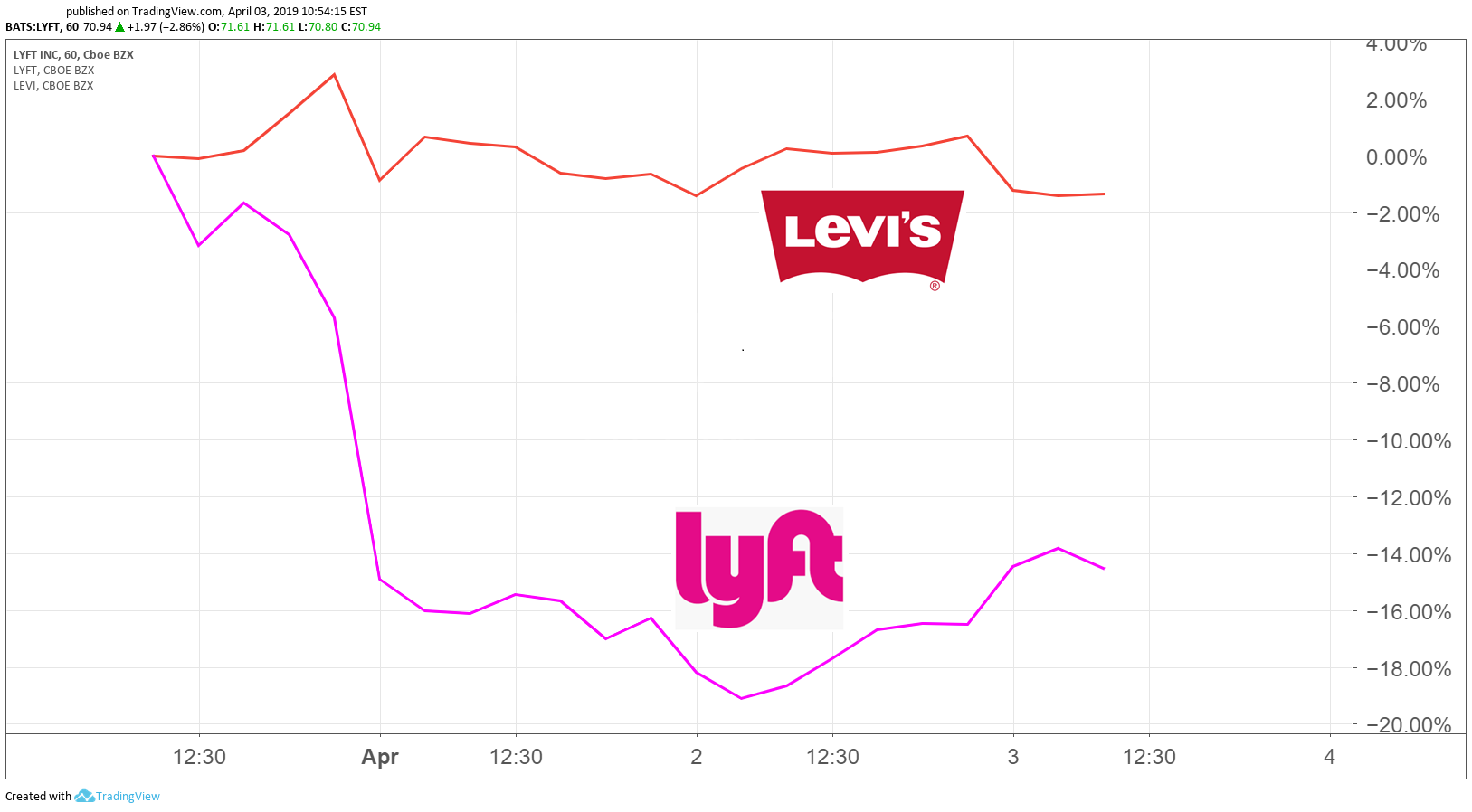

As the first of 2019's planned unicorn IPOs, ride-hailing service Lyft (NASDAQ:LYFT) appears to have done everyone a favour by highlighting the potential rollercoaster ride that awaits unwary investors who become swept up by market hype.

The Nasdaq newcomer exploded out of the blocks last Friday, with its opening price of $72 a share soon $79 on the first day of trading. By Monday, however, Lyft was trading at just over $69 having dropped by as much as 12%.

It's a timely reminder for investors on this side of the Atlantic who may be tempted by forthcoming IPOs from other tech stocks including Uber, Pinterest, Airbnb and WeWork. They will need to do their research, understand the risks, and most importantly avoid getting caught up in the inevitable market hype.

This message was reinforced today by analysts from UBS, who highlight in an investment strategy note how the success or failure of an IPO is never determined on the first trading day. They describe positive IPO first-day returns as "one of the most consistent pricing patterns in financial markets".

Source: TradingView Past performance is not a guide to future performance

Using data sets maintained by the University of Florida, UBS reports that the average first-day return has been consistently in the 10% to 20% range since the early 1990s. The notable exception for returns occurred during the dotcom boom, when they averaged a whopping 71% and 56% respectively for 1999 and 2000.

First-day returns are clearly attractive, but this is usually exclusive to investors who received an initial IPO allocation. In contrast, an IPO buy-and-hold strategy starting at the first-day closing price hasn't fared nearly as well.

From 2000, both the average six-month IPO return and the excess return - measuring the difference between IPO returns and risk-adjusted benchmarks - are negative.

UBS points out:

"In an efficient stock market, a portfolio of IPO stocks shouldn't consistently outperform the market, after controlling for differences in risk. But they also shouldn't underperform on average, which is what they've done over a multi-year period."

While over 60% of buy-and-hold IPOs show negative absolute returns in their first five years, a very small handful have produced total returns over 1,000%.

UBS believes that the "lottery-ticket" chance of investing in one of these extreme winners may contribute to the market overvaluing new public companies in general, leading to the sub-par average long-term returns.

A look at Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR) shows that the first-day return isn't a good indicator of future returns. Twitter had the highest return at 73%, but its total return since the first-day close is down 25.5% versus an 83.4% gain for the S&P 500.

- Nine of the biggest IPOs ever: Are they still a 'buy'?

- Uber IPO: What you get for $120 billion

- Stockwatch: Is Uber the new Amazon?

- you can find out more about IPOs here

Facebook's opening day suffered from technology glitches that contributed to a flat first-day return and six months later its price was down 38.4%. But from the first-day close Facebook has returned 333% versus 154% for the S&P 500. Google's first-day return was 18%, but its price has shot up ever since, with a total return of 2,234% compared to 260% for the S&P 500.

How the current crop of unicorn IPOs fares will have implications for the wider equity market, particularly if a favourable reception helps to support valuations in general.

The current focus is on US-based companies, but a strong performance could encourage other global unicorns to follow suit. There are 333 such tech start-ups worth more than $1 billion worldwide, with 91 in China and 14 in the UK.

UBS says it remains to be seen whether the US unicorns will actually live up to the IPO hype.

"This won't be determined on the first trading day, as past high-profile IPOs have demonstrated. As a result, we believe this year will probably play out as a slow burn rather than as a hot market."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.