Nine of the biggest IPOs ever: Are they still a 'buy'?

Our international columnist and author studies IPO performance over 20 years and which are still a buy.

3rd April 2019 10:55

by Rodney Hobson from interactive investor

Our international columnist and author studies IPO performance over 20 years and which are still a buy.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The much-hyped IPO by US cab-hailing company Lyft (NASDAQ:LYFT) had a nasty sting in the tail. After rising from the float price of $72 to as high as $88 during the first day's trading, the shares fell back to $69 on the second day. It was a timely reminder that IPOs tend to be fully priced, with as much downside as upside potential, at least in the early stages.

With more IPOs planned, including ones for Lyft's larger rival Uber, corporate messaging service Slack, image-sharing platform Pinterest and delivery service Postmates, it's worth looking at how other big-name flotations, mostly high-tech companies, have fared in the longer term.

One point is that investors may have a long wait for a dividend. Many US companies still make no payment to shareholders despite trading for several years.

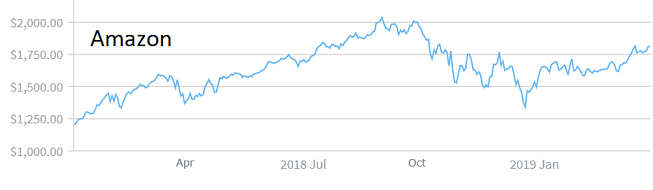

Few floats have been as spectacular as online retailer Amazon (NASDAQ:AMZN) in 1997. The price was set at $18, but three share splits within two years turned each share into 12. Even the dotcom crash in 2000 failed to stop Amazon. Unlike so many tech stocks at that time, it had a genuine business and was generating real income.

Source: interactive investor Past performance is not guide to future performance

The shares currently trade just above $1,800, so each one bought in the IPO is now worth 600 times the initial outlay allowing for the share splits. Net sales increased 31% to $232.9 billion with net income of $10.1 billion in the 2018 year.

The big drawback is that Amazon does not pay a dividend, so everything depends on sales increasing year by year. The outlook for 2019 is more cautious, which accounts for why the share price has come off the top.

Netflix (NASDAQ:NFLX) not only makes great television - House of Cards, Stranger Things, and The Crown to name but two hit series - it has been a spectacularly good investment. The IPO in 2002 was a brave move, coming after two years of falling share prices. It was priced at $15, the equivalent of $1.10 allowing for subsequent share splits. Trading is now at $367.

Internet search engine Google (NASDAQ:GOOGL) floated in 2004 when it was clear that the Millennium bear market was safely over and tech shares were slowly coming back into fashion. The shares were priced at $85 each and 10 years later it issued a newly created non-voting share (NASDAQ:GOOG) free for each share held.

The parent company has been renamed Alphabet. Both classes of share currently trade at just below $1,200. So $85 invested at the float is now worth about 28 times as much, not as spectacular a gain as for Amazon but pretty good going and over a shorter period.

Elon Musk, founder and chief executive of electric car manufacturer Tesla (NASDAQ:TSLA), has put his foot in it recently with indiscreet remarks on Twitter that could be interpreted as creating a false market.

Musk seemed to indicate that Tesla would be taken private again, though that seems highly unlikely.

Tesla floated at $17 in 2010, when electric cars, particularly the driverless versions, were still a risky investment, although that didn’t stop the shares leaping to nearly $24 on the first day.

The dream looks a lot closer now, but sentiment towards the shares has been patchy, with a pattern of three years moving sideways followed by a sharp lurch upwards.

Source: interactive investor Past performance is not guide to future performance

We are currently going through a period of drift, but at $285, Tesla shares have multiplied about 17 times over the past nine years.

Investment will surely mop up all available cash for years to come but the potential rewards are enormous.

Facebook (NASDAQ:FB), the social media site, went public in 2012 long after stock markets had recovered from the 2008 financial crisis.

Source: interactive investor Past performance is not guide to future performance

Facebook shares are now worth $170. They floated at $38 but, like Lyft, it was not an auspicious start: on the second day of trading they slipped to $34. So the shares have now more than quadrupled from the float but Facebook is another tech stock that prefers to plough cash back into the business rather than reward shareholders with a payout.

Twitter (NYSE:TWTR) has recently struggled to hold its own in the increasingly crowded social media market. The shares floated in 2013 at $26 and subsequently fell below that level, although they have recovered to $34 now, a disappointing performance compared to its peers.

Alibaba (NYSE:BABA) is a Chinese conglomerate company based in Hangzhou, but it floated in New York in 2014 at $68. This is another example of shares slipping below the IPO price at some point and they have moved more erratically than most large-scale floats, finally topping $200 then falling back again to around $180, nearly three times the initial value.

Source: interactive investor Past performance is not guide to future performance

Italian carmaker Ferrari (NYSE:RACE) was spun off from Fiat Chrysler in 2015 at $52, the top of the indicated range. Despite concern that plans to boost production would destroy Ferrari's exclusivity, the stock has pressed on to $135.

Source: interactive investor Past performance is not guide to future performance

Ominously, the biggest disappointment has been the most recent high profile float, Snap (NYSE:SNAP).

The parent company of social media site Snapchat was valued at $31 billion after its public debut two years ago at $17 and within days it soared to $29.

Since then the chief financial officer has left abruptly, worries are growing about its profitability and the stock has been heavily shorted on Wall Street. Now the shares trade at $11, giving a valuation of $8 billion.

Source: interactive investor Past performance is not guide to future performance

Hobson's choice: While investing in IPOs can be a leap in the dark there can also be massive rewards for investors who back innovative companies providing products and services in growth sectors. They are not, though, suitable for investors seeking dividend income. Currently, Netflix looks to be the one with momentum, but investors could also consider taking advantage of the recent slide in Tesla and Alibaba.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.