It’s easier than ever to invest in alternative assets. But should you?

Retail investors are being offered access to alternatives – just as institutional ones decide to leave the space. If you fancy picking up those keys, you need to know these ‘dos and don’ts’.

12th September 2025 08:58

by Theodora Lee Joseph from Finimize

- Retail investors are being granted greater access to alternatives – just as leading institutions like Yale retreat, following years of disappointing performance

- The supposed benefits of diversification and alpha from alternatives have tailed off over time, with correlations to public markets spiking in crises and excess returns largely disappearing

- High fees, long lock-ups, and limited transparency mean that many alternative investments deliver little value once costs and risks are factored in.

Alternative strategies were once the preserve of institutional investors. But now, they’re being pitched to everyday investors. And even if you don’t consciously buy in, you might be exposed: the US government has adjusted policies to let pension funds and retirement accounts include private equity and other non-traditional assets. That shift is already happening: a BlackRock survey found that nearly a quarter of retirement plans are considering adding alternatives in the next year, with default target-date funds the most likely vehicle.

At the same time, institutional giants like Yale are backing away from alternatives, disappointed by years of underperformance.

So you have a choice. You either take a cue from institutions and stick to stocks and bonds. Or, you use your newfound access to potentially improve your returns and diversification. If you’re leaning toward the latter, let’s see how you can tilt the odds in your favor.

What counts as an alternative?

Alternatives cover investments outside the classic trio of stocks, bonds, and cash. That includes assets like real estate, gold, rare art, or bitcoin, as well as private markets like venture capital and private equity. Long-short strategies (which aim to profit from both rising and falling prices) count as alternative investments, too.

Why do investors use alternatives?

Traditional investing strategies – such as the 60/40 model – tend to balance stocks (for growth) with bonds (for income and stability). By adding alternatives to the mix, investors can aim to enhance those tried-and-tested approaches. Of course, alternatives each bring their own impact.

Gold’s known as a store of value, while real estate can offer income and inflation protection. Venture capital bets on potential breakout start-ups, while hedge funds try to make returns in any market environment.

Broadly speaking, investors use alternatives to improve their diversification and alpha.

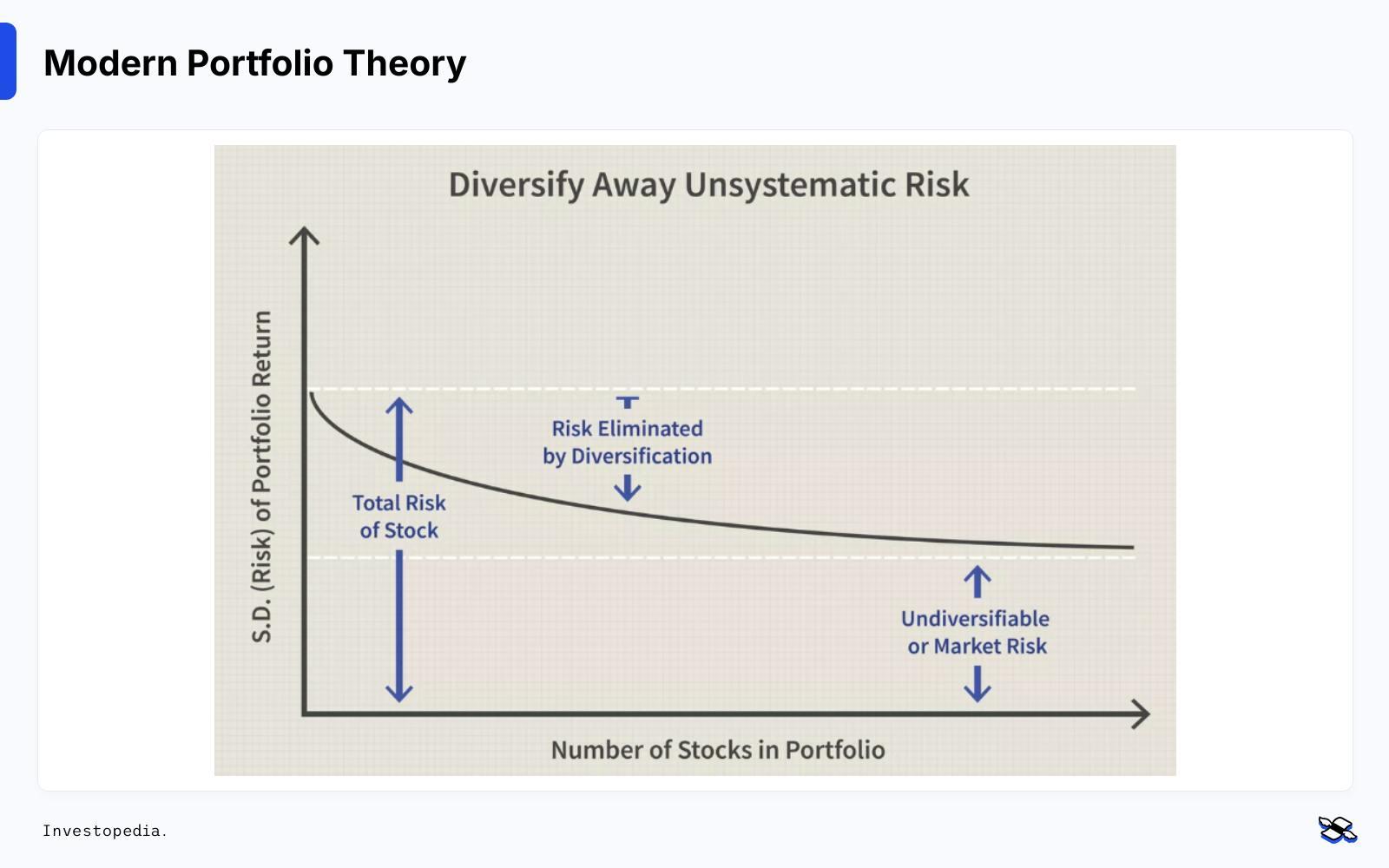

Diversification involves combining investments that thrive in different market environments. Many alternatives move out of step with stocks and bonds. And that’s a huge plus: even if your stocks are struggling, say, rising returns from gold or private equity holdings can balance out your portfolio as a whole. That way, you can improve your potential returns without ramping up your risk.

Modern Portfolio Theory employs the core idea of diversification. The theory: owning a portfolio of assets from different classes is less risky than holding a portfolio of similar assets. Source: Investopedia.

The other part is alpha. That’s a finance term that means beating the market through skill or strategy. Hedge funds, private equity firms, and venture capitalists have long argued that they can do just that by spotting under-the-radar opportunities.

That pitch pulled in major investors. In the early 2000s, institutions like Yale’s endowment started pouring money into alternatives. They were rewarded handsomely, so others – like pension funds, sovereign wealth funds, and family offices – followed.

Has the theory of alternatives worked out in practice?

Investors’ real-world results haven’t always mirrored the ideal theoretical case.

Let’s start with diversification. Many alternative assets do look uncorrelated with stocks… but looks can be deceiving. See, while stocks are priced minute-by-minute in public markets, alternatives are often valued quarterly or via appraisals. That delay creates a smoothing effect: they appear stable on paper – until markets crash. Private equity, venture capital, and some hedge fund assets declined alongside public markets during both the 2008 financial crisis and the 2020 pandemic shock.

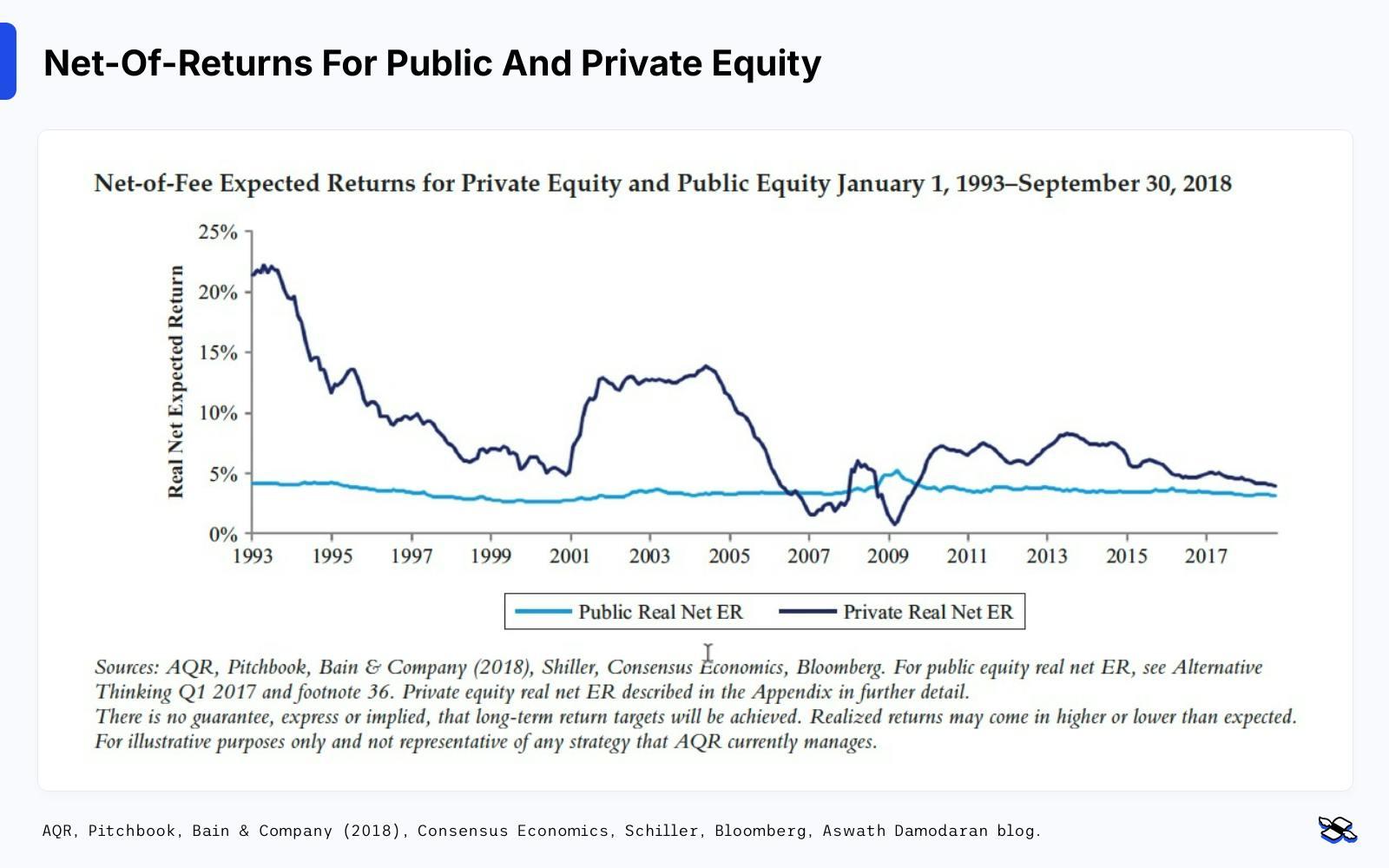

Then there’s alpha. Hedge fund outperformance has steadily eroded: research shows that between 2007 and 2009, their alpha fell to (or even below) zero at times. And after recovering in 2011, the measure has slowly declined again. And while private equity used to easily beat public markets, it’s becoming harder to generate alpha – blame more widespread information, increasing passive funds, and intensifying competition. So now, many managers struggle to justify their fees.

Private equity has struggled to consistently generate excess returns over public stocks. Sources: AQR, Pitchbook, Bain & Company (2018), Consensus Economics, Schiller, Bloomberg, Aswath Damodaran blog.

And those fees are steep. Under the classic “two-and-twenty” model, investors pay fees worth 2% of the assets under management and 20% of the profit – enough to create a heavy drag on returns. So even when the headline performance looks decent, investors can be left with disappointingly thin pay packets.

So, after a long stretch of underwhelming performances, even early adopters are backing off. Yale’s endowment – once considered the gold standard for alternative investing – announced plans to offload billions in private equity holdings this year. That makes sense: outstanding returns (a.k.a. “alpha”) are harder to come by, but alternatives are as complex and costly as ever.

That said, you shouldn’t write off all alternatives due to problems in a couple of pockets. Some hedge fund strategies – especially those designed for volatile or neutral markets – can still add value in certain environments. Gold has remained a potential inflation hedge and a diversifier, particularly during periods of geopolitical tension. And some collectibles – from rare watches to fine art – have delivered solid returns for investors with expertise and patience.

Private equity and venture capital can still deliver strong returns, too. It’s just that your success often hinges on backing the right managers – and that’s something even seasoned institutions struggle with. Plus, these investments come with long lock-up periods and limited transparency, so they’re not ideal if you might need to cash out quickly.

What should you do – and not do?

Alternative investments are being repackaged and marketed to individual investors, often in slick wrappers that promise “institutional access.” So if you’re tempted, this checklist can help you secure the pros of alternatives with limited cons.

Do:

- Consider your liquidity needs. Only commit money you can afford to lock up for years

- Examine the strategy. Make sure you understand exactly how the fund aims to generate returns. If you can explain it simply, you probably understand it well enough to invest

- Compare fees. Some alternatives genuinely add diversification or income – but make sure the fees won’t wipe out the upside

- Diversify selectively. Look for strategies or assets that would truly move differently from your existing portfolio, not just those marketed as “uncorrelated.”

Don’t:

- Assume that history repeats. Outsized returns from the 2000s often reflected a very different (less-crowded) market

- Beware: transparency. If reporting is patchy or a manager won’t disclose holdings, that’s a red flag

- Chase complexity. Complicated doesn’t mean better: if the product pitch sounds like a magic trick, walk away

- Forget the basics. Alternatives should complement, not replace, a solid foundation of diversified stocks and bonds.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.