Japanese funds still worth buying after Abe's re-election

8th October 2018 10:47

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Prime minister Shinzō Abe has been great for the Japanese stockmarket, and shares are up again since he won a third term. Saltydog analyst Douglas Chadwick is so impressed he's switching into Japan. Here's why.

The Nikkei 225 has climbed above 24,200 for the first time since November 1991, that's almost 27 years ago.

The index, which was launched in 1950, is a price-weighted average similar to the Dow Jones Industrial Average and is comprised of the 225 highly liquid stocks of the Tokyo Stock Exchange First Section.

Unlike many of the major stock market indices, which have set new all-time highs at some point this year, the Nikkei 225 peaked at the end of 1989. It saw a dramatic rise during the 1980s, starting the decade at 6,560 and ending it at an all-time high of 38,916, a rise of almost 500%.

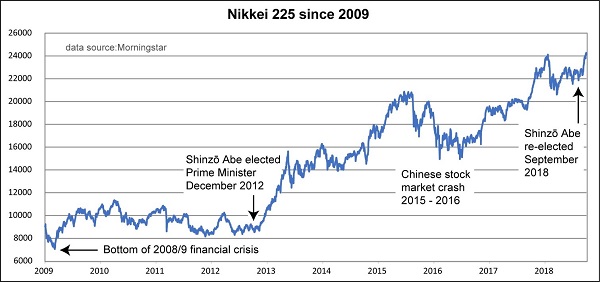

It then ran out of steam. During the 1990s it lost half its value and, in the financial crisis of 2008/09, was hit again, briefly dropping below 8,000. It then stayed relatively level until the end of 2012.

That December Shinzō Abe was elected Prime Minister in a landslide victory for his Liberal Democratic Party, and that's when the recovery started.

Past performance is not a guide to future performance

For the previous 20 years the average inflation in Japan had been roughly zero. Many thought that this uncommonly low inflation rate was harmful to the economy and Shinzō Abe had promised to do something about it.

The 'three arrows' of his policy, Abenomics, were:

• Dramatic monetary easing

• A robust fiscal policy

• Policies for growth to drive private investment

Initially that meant launching an enormous quantitative easing programme, which is still going on today.

It then led to increased government spending with a view to generating growth. The final stage was lowering corporation tax, reducing trading barriers and regulation, and building the workforce.

In the last couple of weeks, we've seen the Japan and Japanese Smaller Companies sectors featuring at the top of our performance tables. Our latest data shows the leading 50% of funds going up by an average of 2.6% over the previous week and 3.7% the week before that.

This ties in with the latest election in Japan which was held on the 20 September. Shinzō Abe was re-elected, after a rule change in 2017 that allowed him to run for a third term, and he now has another three years to continue his economic policies.

Since he took office in 2012 the Nikkei has gone up by almost 150%. There was a dip in 2015/16 when global markets fell, as the Chinese stock market bubble burst, but it then made steady progress until February this year. His recent re-election seems to have gone down well and reinvigorated the markets.

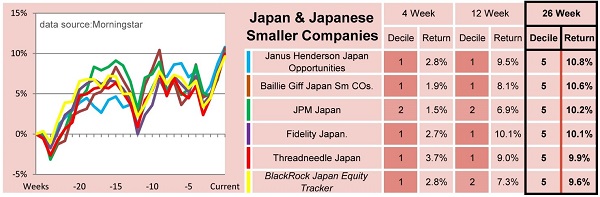

This can be seen in the best-performing funds from these sectors over the last six months.

Past performance is not a guide to future performance

As you can see from the graph, these funds have all had their ups and downs, but have performed well since the election in September.

The same pattern appears in our exchange traded funds (ETF) and Investment Trust analysis.

ETFs tracking the Nikkei 225, the Nikkei 400, or the MSCI Japan Index have all done well and are typically up 3% over four weeks, 7% over 12 weeks, and 9% over 26 weeks. ETFs which have hedged against currency fluctuations have done even better in the last four weeks. The db x-trackers MSCI Japan Hedged ETF is up over 5% in the last month.

The Schroder Japan Growth investment trust is also up over 5% in the last four weeks, but the star performer is the Fidelity Japanese Trust which has gained 7% in four weeks, 6% in 12 weeks, and 14% in 26 weeks.

Its focus had been on Japanese smaller companies, but earlier this year it announced that it was going to change its name from Fidelity Japanese Values to the Fidelity Japan Trust and overhaul its investment policy, switching the company to the mainstream Japan sector.

The Saltydog portfolios have been biased towards funds from the Global, American and Technology & Telecommunications sectors for the last few months. These have been the leading sectors, but they do leave us vulnerable to currency movements between the pound and the dollar as well as the performance of the American economy, and in particular the large technology companies.

We've recently taken the opportunity to reduce our exposure to some of these funds and have made a small investment into one of the funds from the Japanese sectors. If it continues to perform well, we will add to it in future weeks.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.