July’s best performing funds hidden in the specialist sector

Saltydog analyst points out over the past four weeks this type of fund has shone, having risen by 16%.

3rd August 2020 13:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst points out over the past four weeks this type of fund has shone, having risen by 16%.

Having gone up during April, May and June the FTSE 100 index went down in July, losing 4.4% and leaving it 22% lower than it was at the beginning of the year.

The Japanese Nikkei 225 index and the French CAC 40 index also fell last month.

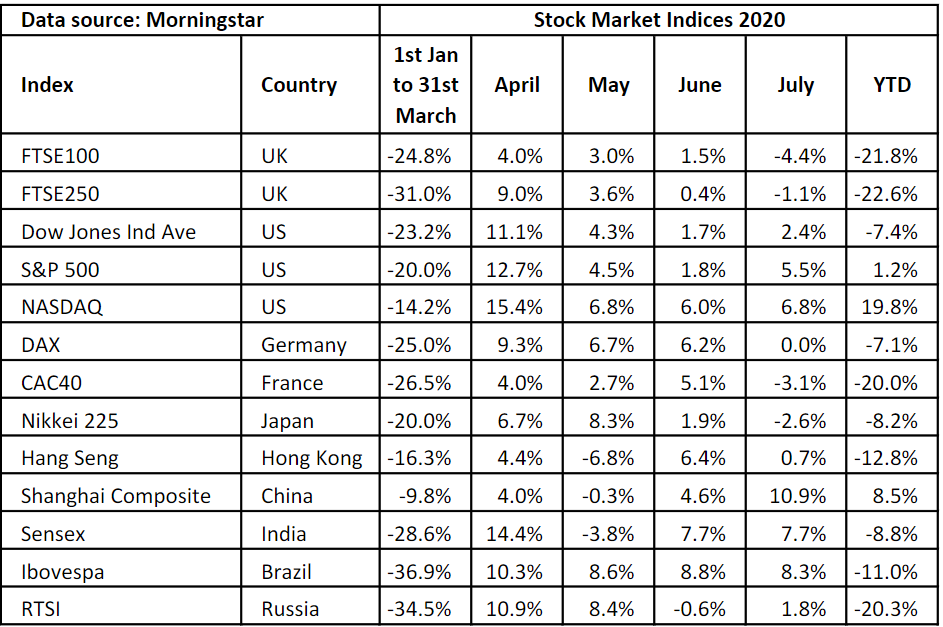

The table below shows the performance of a few of the leading stock market indices so far this year.

Past performance is not a guide to future performance.

They all went down during the first quarter of the year but have since rallied. However, there are signs that the recovery may be running out of steam.

Only two are showing gains over the year: the technology-based Nasdaq index is up 19.8%, and China’s Shanghai Composite index is up 8.5%.

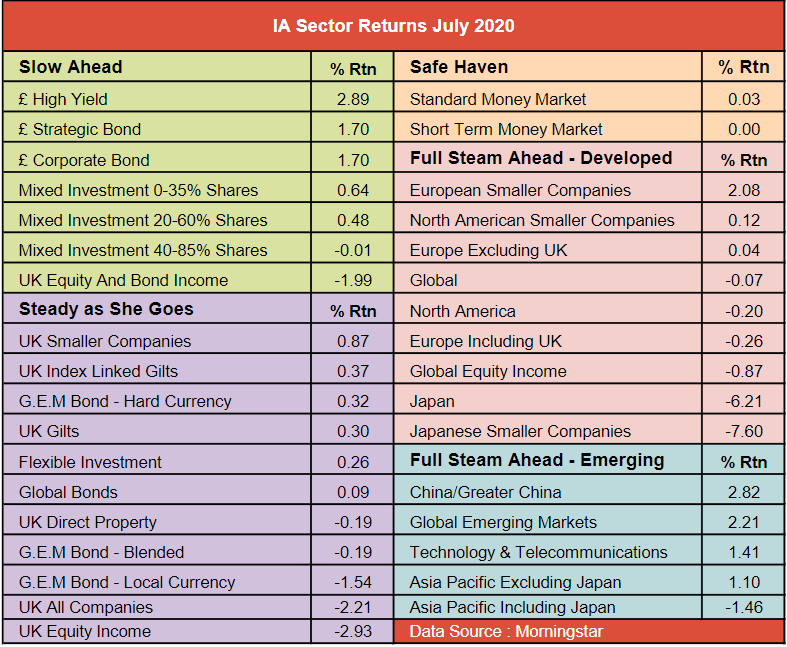

Our sector analysis for July also shows a significant number of sectors making losses.

When we reviewed the sectors at the beginning of last month only three had fallen in June. UK Gilts was down 0.1%, UK Direct Property down 0.4%, and Japanese Smaller Companies down 1.2%.

In July 14 sectors were in the red. Not only were there more sectors making losses, but the falls were more significant. Japan dropped 6.2% and Japanese Smaller companies did even worse, losing 7.6%.

Past performance is not a guide to future performance.

The sectors that did go up also made smaller gains than we have seen in recent months.

In June, the best performing sector, China and Greater China, went up by 10.3%. During July it went up 2.8%.

The best performing sector was £ High Yield, which only gained 2.9%.

So far this year the Technology and Telecommunications sector has made the greatest return, but the rate of growth has been falling. In April it went up 12.3%, in May it made 8.4%, June was lower again at 6.2%, and July was just 1.4%.

The best performing funds over the last few weeks are not even represented in this table.

The sector definitions are set by the Investment Association (IA) and tend to put relatively tight constraints on fund managers.

For example, funds in the IA UK All Companies sector must “invest at least 80% of their assets in UK equities which have a primary objective of achieving capital growth”.

The ‘Specialist’ sector is slightly different. Its definition is “funds that have an investment universe that is not accommodated by the mainstream sectors. Performance ranking of funds within the sector as a whole is inappropriate, given the diverse nature of its constituents.”

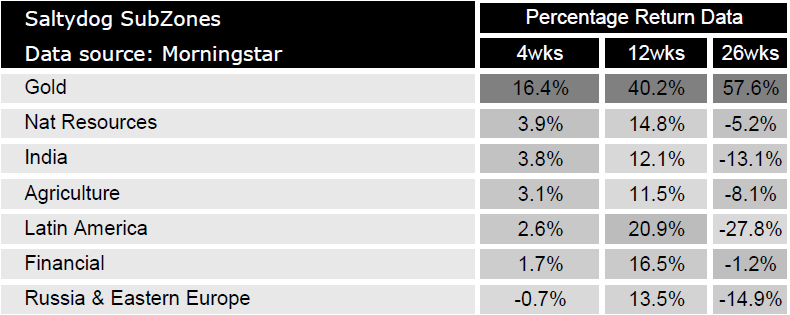

At Saltydog Investor, we track seven SubZones within the Specialist sector.

Past performance is not a guide to future performance.

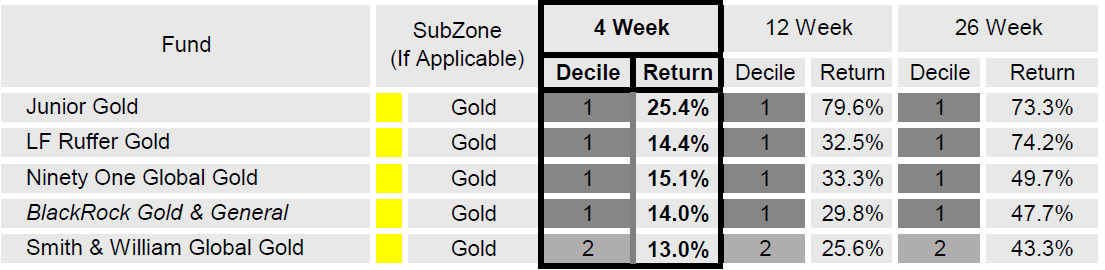

The leading SubZone is Gold, which is made up of five funds which currently sit at the top of our Specialist sector performance table.

These are funds that mainly invest in the shares of companies involved in the mining and processing of gold and other precious metals.

Past performance is not a guide to future performance.

At the end of February, when we were reducing all of the other holdings in our demonstration portfolios, we bought the Investec Global Gold fund, which has subsequently changed its name to Ninety One Global Gold. After one week it had gone down 9% and two weeks later it had dropped a further 15%.

Fortunately, it then started to recover and in April we increased our holding. When we reviewed our portfolios last week it was showing a gain of over 40%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.