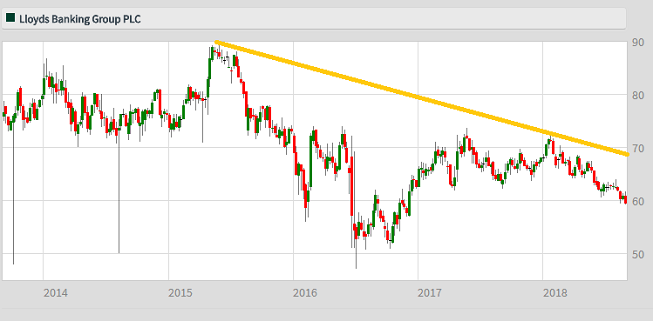

Lloyds and cheapest UK banks in the sector

5th September 2018 14:36

by Graeme Evans from interactive investor

There are clear headwinds and domestic bank stocks have underperformed, but Graeme Evans reports that things may not be as bad as people think.

With Brexit no-deal speculation dominating this summer's headlines, it's little surprise that shares in lenders including Lloyds have failed to kick on in the way many analysts and investors had hoped.

There's also been the flight from the Turkish lira, US-China trade wars and the downward momentum in UK house prices to satisfy the doom-mongers.

Despite this pessimism, little appears to have changed in terms of the fundamentals of the UK banking sector, particularly when our major lenders spent the summer reporting Q2 figures 11% ahead of consensus at an underlying profits level. This ranged from 5% at HSBC to 21% at Barclays.

While an impressive 84% of European banks achieved better than expected results in the quarter, shares in eurozone lenders are still down a chunky 20% in 2018. UK banks are off 11% but this outperformance against European peers still leaves them amongst the cheapest names in the sector.

Source: interactive investor Past performance is not a guide to future performance

In a research note published today, UBS banking analysts said it appeared that the market had become too obsessed by "tail risks" such as Brexit or Turkey, rather than focusing on the base case supporting the banking sector.

UBS added:

"Things are not, we think, as bad as the average newspaper might have one think."

They said European banking shares had fared worse than expected over the summer, but this had left it more positive about an eventual normalisation in risk appetite.

UBS points out that the base case is still for a continued recovery in the European economy, with bank balance sheets being cleaned up pretty quickly and loan losses significantly below forecasts in the UK.

The bank has "buy" recommendations on Barclays, Lloyds and The Royal Bank of Scotland amid expectations that improved confidence around the domestic outlook will, at some point, lead to strong capital generation and distributions.

The UBS price target for Lloyds is 80p, with Barclays at 235p and RBS at 300p. All three domestic banks are trading at above 7x forward earnings.

HSBC and Standard Life Aberdeen face FX translation headwinds and are rated “neutral” by the bank at 750p and 735p respectively.

• Chart of the week: Is this bank about to be hit for six?

• Are Lloyds Bank shares heading to 50p?

• Why RBS shares could be about to do something big

• What to make of Lloyds Bank results

UBS concedes that the risks of a hard or no deal Brexit have increased, but that its house view is still based on a Brexit transition period in which growth slows and inflation remains fairly elevated.

They are expecting the headlines to remain poor for the timebeing, but urged investors to be more attentive towards the data. UBS gave an example of last week's Nationwide house price index, which fell 0.5% in August.

The UBS analysts said: "Small monthly moves - particularly those in summer, in an illiquid asset class - are not important to house prices or how the UK banks fare.

"At an aggregate level the macroeconomic surprise indices we track are in positive territory for the UK and for Europe - indicating that on average macro indicators are coming in better than consensus forecasts."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.