Market snapshot: some markets have just hit a new high

25th June 2021 09:35

by Richard Hunter from interactive investor

It looks like the week is ending on a high note as markets react to US stimulus measures and comment from the UK central bank.

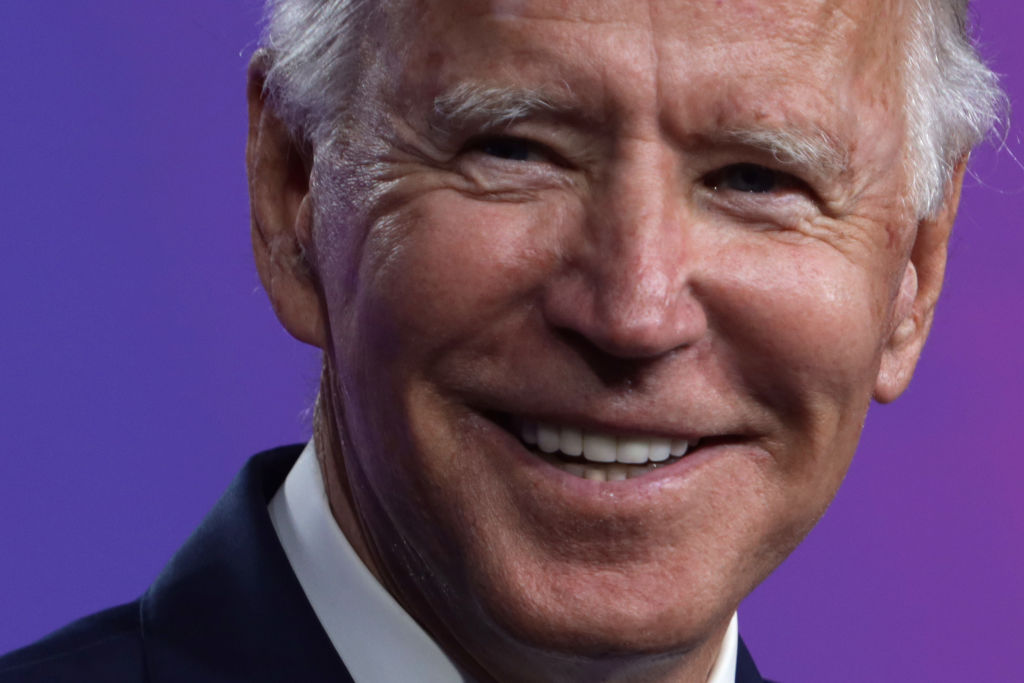

US economic stimulus has come from another direction in the form of US President Joe Biden's infrastructure deal which has just propelled some of the major indices to record highs.

The $1.2 trillion infrastructure deal, approved by the President, will provide a boost to roads, bridges, broadband, passenger and freight services. Quite apart from the further injection into revitalising the economy, the amount is less than the $3 trillion which had been sought by the President, thus having lower tax implications than had been thought to pay for it.

Meanwhile, some signs of inflation are emerging in the housing market as some raw materials are temporarily in short supply. The spectre of inflation is a constant theme, although on the whole comments over the week from the Federal Reserve have reiterated their stance on maintaining accommodative policy for now.

The generally positive news is currently lifting all boats, with the Dow Jones ahead by 11.7% in the year to date. Meanwhile, the S&P500 is up by 13.6% and the Nasdaq by 11.5%, with both of these indices hitting record closing highs.

News of the infrastructure plan also spilled over to the oil price in anticipation of further energy demand. With constrained supply and increasing demand to come from the US driving season and incrementally higher travel over the following months, the price has added 46% so far this year.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Check out our award-winning stocks and shares ISA

In the UK, inflation also remains a topic of some debate. The Monetary Policy Committee recognised stronger than expected growth and above-target inflation in leaving the interest rate and bond buying policy unchanged.

The MPC also believes that the current inflationary effects are transitory and, with an uneven recovery across the UK at present until the full easing of lockdown is reached, it is clearly adopting a wait and see approach.

The news dented sterling but was positively received by the equity market. The major indices continue to attract investor attention from home and abroad, with the FTSE100 currently ahead by 10.3% and the more domestically focused FTSE250 by 10% in the year to date.

If these generally positive economic conditions persist as the UK swings into full recovery mode, there could be further buying from institutional international investors since the market is still seen as undervalued compared to some of its global counterparts.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.