Morrisons fails to convince despite Ocado deal

It talks the talk, and a 6% dividend yield is attractive, but can this £50bn grocer walk the walk?

9th May 2019 12:25

by Graeme Evans from interactive investor

It talks the talk, and a 6% dividend yield is attractive, but can this £50 billion grocer walk the walk?

Morrisons (LSE:MRW) offered more evidence of its "ever-improving shape" today after a robust trading update and intriguing deal to re-write its online partnership with Ocado.

While the supermarket's shares may not have moved following today's developments, analysts took the news as another sign of the "sustained and balanced progress" made since 2015.

As well as continuing to produce steady growth at a time of competitive market conditions, the company also offers sustained cash generation and a forward dividend yield of 6.2%. Shares are currently at 211p after a lacklustre 2019 to date, although analysts at Macquarie and Jefferies believe they have the potential to be trading at 290p and 265p respectively.

Their optimism survived today's first-quarter update, with Morrisons reporting like-for-like sales growth from the retail estate of 0.2% compared with the market consensus of 0.5% higher. The company's wholesale supply offer, which has grown more quickly than expected following a partnership with McColl's, was slightly stronger than forecast after a 2.1% rise.

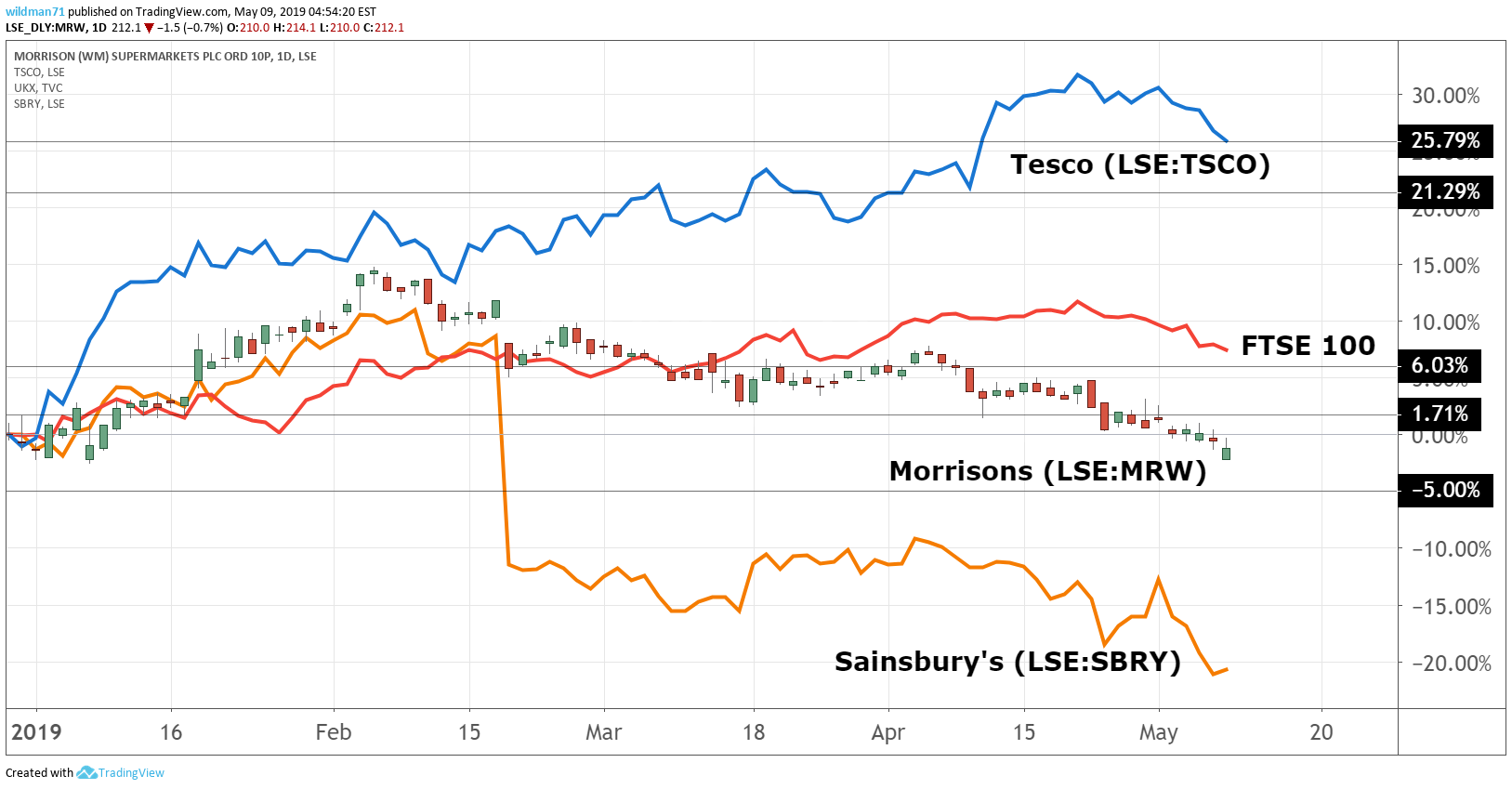

Source: TradingView Past performance is not a guide to future performance

Chief executive David Potts, who has revived the Bradford-based grocer since 2015 thanks to a focus on customer service, range enhancements and better stock availability, said he was satisfied with another quarter of positive like-for-like sales.

He added that the chain was becoming more competitive for customers, but warned that he expected market conditions to remain challenging. The second quarter will also be tough because the chain is up against comparatives from last summer's heatwave and World Cup.

The Morrisons CEO can also expect a fightback from Sainsbury's (LSE:SBRY) as counterpart Mike Coupe attempts to restore credibility in the City following the chain's failed Asda merger attempt.

Separately, Potts appears to have completed a shrewd piece of business today by revisiting the terms of the supermarket's Ocado agreement in the wake of a fire at the Andover customer fulfilment centre owned by its online distribution partner.

Morrisons will give up its share of capacity at Ocado's newest facility in Erith, south London until 2021 so that Ocado is able to mitigate the Andover fire impact.

Ocado shares rose more than 1% following the deal, with the recent FTSE 100 newcomer still trading close to all-time record highs at just below 1,400p.

For Morrisons, it will mean it won't have to pay the cost of ramping up the new Erith facility for two years, by which time the new facility should be operating at a higher capacity.

The two companies have also announced the end of their exclusive digital partnership, meaning the supermarket is free to pursue other "more profitable growth" opportunities.

Potts said: "We will keep growing Morrisons.com for our customers and save some cost, returning to the Erith CFC when it is more mature. Our new agreement allows us to have more than one digital partner, and opens the way for significant potential opportunities and partnerships in this important growth area for Morrisons."

Clive Black, retail analyst at house broker Shore Capital, continues to predict annual pre-tax profits of £442 million and EPS growth of 8.1% to 13.9p following today's developments.

He added: "Morrison is in ever-improving shape, in our view, supported by a very strong financial backbone."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.