Morrisons shares chased higher after Q1 results

Latest results cement Morrisons’ position as top grocer during the crisis, reports our head of markets.

12th May 2020 11:24

by Richard Hunter from interactive investor

Latest results cement Morrisons’ position as top grocer during the crisis, reports our head of markets.

The Covid-19 crisis is not the slam dunk for the supermarkets which many assume, but Morrisons (LSE:MRW) is nonetheless navigating the course with some aplomb.

Perhaps inevitably, first-quarter like-for-like sales are strongly ahead by 5.7%, driven in the vast majority by retail. Prior to the lockdown, consumers’ propensity to stockpile played a major role, even though this may in part simply have pulled some sales forward.

The company has upped its game on its online offering, while the increase of 17 Morrison stores on Amazon Prime Now to a more national 40 stores will bolster prospects. The strategic boost from any improvement at McColl’s (LSE:MCLS) (which the company is confident of delivering) will also feed through quickly.

- Chart of the week: is bombed-out BT finally a massive buy?

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

From a financial perspective, the business rates relief previously announced by the Government should largely cushion the blow of the extra costs which Morrisons is incurring and, in any event, the group has substantial access to liquidity and credit should the need arise.

Indeed, the company confirmed in March that a strong balance sheet position, with its store portfolio 87% freehold, free cash flow of around £300 million and currently running a pension surplus, were indicative of its strength. Morrisons also took the prudent step of deferring its special dividend payout at that time, although the ordinary dividend remains, with the current yield of 3.6% providing some attraction to those seeking income.

Furthermore, if companies are to be judged by their role as social benefactors during the crisis after the dust has settled, Morrisons will fare well. While its actions are not unique among the supermarkets, the raft of donations and actions it has taken, especially with regard to care homes, charities and local councils, will play out well and may by the same token engender the kind of customer loyalty for which all supermarkets strive.

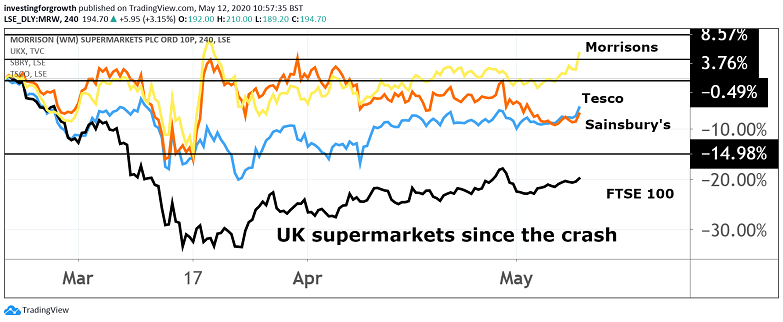

Source: TradingView. Past performance is not a guide to future performance.

The crisis is not a one-way opportunity, however, and there are significant associated costs. Morrisons has employed an additional 25,000 staff, ranging from in-store and manufacturing to home delivery and online to fulfil extra demand, while the traditionally busy Easter period came at the height of the outbreak and sales therefore suffered.

Equally, like-for-like fuel sales have been hammered by a general reduction in traffic, with a decline of 39% (and 70% since lockdown) having a real impact and muddying the overall picture.

Morrisons has a firm hand on the tiller at present and the share price performance has improved of late, with a 6% increase over the last three months. The shares still remain down 10% over the last year, although this compares favourably with the decline of 17.5% seen by the wider FTSE 100 index.

If there is a slightly limiting factor, it is that the company remains up against strong opposition and, as a result, there is seen to be better value elsewhere in the sector. Even so, the market consensus of the shares as a 'strong hold' is unlikely to be troubled after this update.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.