Most millennials and Gen Z have two or more pension pots, research finds

12th January 2022 12:04

by Rebecca O'Connor from interactive investor

Ahead of the Pensions Dashboard launch next year, we share research on the average number of pension pots at different ages.

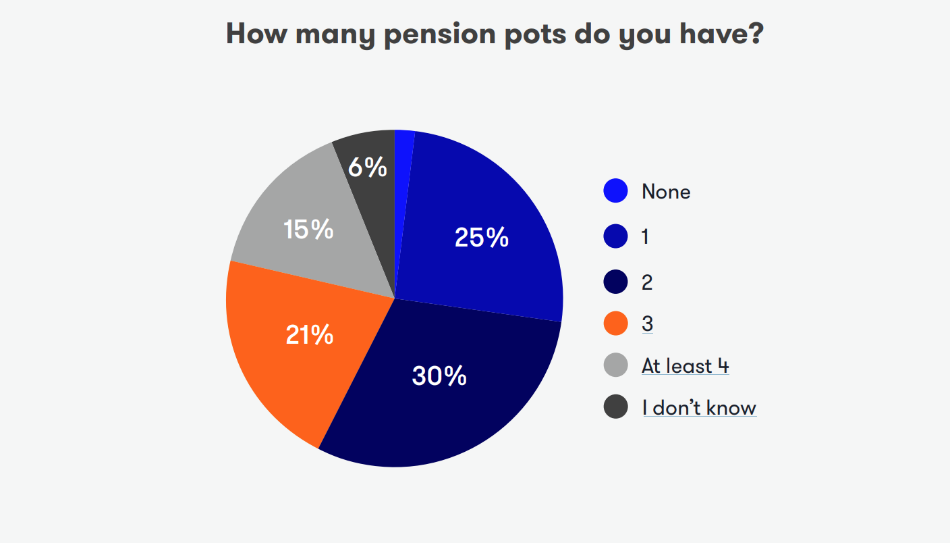

- Two-thirds (66%) of workers have more than one pension, with two pension pots being the most common (30%). More than 60% of 18 to 41-year olds have two or more pension pots

- 15% of working-age people have four or more and the proportion doesn’t change much with age – 13% of under 40s compared with 16% of over 40s - suggesting more frequent job moves among the younger generation, together with auto-enrolment, is having a significant impact on the experience of building up a pension

- One in 17 – 6% - did not know how many pension pots they had.

As the government’s Pensions Dashboards programme testing phase gets under way before it officially launches next year, research from interactive investor shows almost two-thirds (63%) of millennial and ‘Gen Z’ workers aged 18 to 41 have two or more pension pots.

Meanwhile the proportion of under 40s who have four or more pension pots, at 13%, is similar to the proportion of workers aged 40 and over (16%) with four or more pension pots. This suggests the greater mobility of the younger workforce and auto-enrolment is already making pension holdings more complex to manage for millennials (1980 to 1995) and Gen Z (those born between 1996 and 2010), who have the most to gain from seeing all their pensions in one place. The Department for Work and Pensions has previously estimated that people will have an average of 11 jobs over their working lives.

The findings on the average number of pension pots at different ages, from the interactive investor Great British Retirement Survey 2021, underscore the importance of the Dashboards programme, which is designed to bring information on all pension pots held by an individual, including information on costs and charges, as well as information on how much is in each old pension and the names of their providers.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “Younger workers tend to move more quickly between jobs than the older generation did earlier in their working lives. This change in the way careers are built – from ‘jobs for life’ to jobs for two or three years – occurring at the same time as auto-enrolment, means that as people build up experience and pay rises between different employers, they are also building up an increasingly complex pension history. Ten years after auto-enrolment was introduced, we are already seeing the effects, with more than half of 18 to 41-year olds having more than two pension pots.

“The Pensions Dashboards are due to launch in 2023 and will enable people to see information about all of their pensions in one place. Although this will be extremely useful, it doesn’t fully mitigate the need to keep all of your pension information for yourself. It will still be a good idea to keep documentation from different providers and pensions, as if you wish to make changes to any of your pensions, for example, to the underlying investments, you would still need to contact the providers directly.”

Notes to editors:

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.