Is M&S's 35-year stay in FTSE 100 really over?

A FTSE 100 original, M&S and another big name blue-chip are in trouble, writes our head of markets.

29th May 2019 13:22

by Richard Hunter from interactive investor

A FTSE 100 original, M&S and another big name blue-chip are in trouble, writes our head of markets.

The next FTSE 100 reshuffle is due to be announced on Wednesday 5th June (after reference to closing prices on 4th June) and then to take effect on Monday 24th June. As things currently stand, there are some potential surprises in store.

When the FTSE 100 was launched in its current guise in 1984, Marks & Spencer (LSE:MKS) was an original constituent. At current levels, that 35-year association could be coming to an end. The company's recent results gave proof, if it were needed, that M&S requires a significant shot in the arm to give it relevance in the modern day.

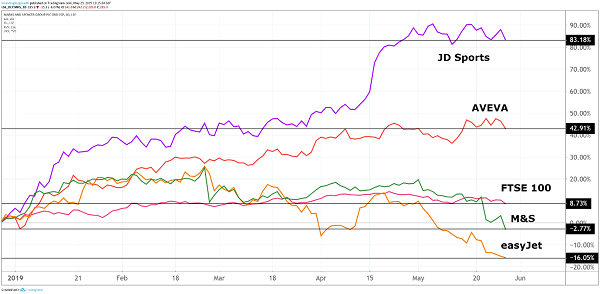

Amid all the planned changes, the shares have also been under pressure, having slumped 19% over the last year, and 17% in the last six months alone. It may well be that it is far too early to hang out the bunting on Marks & Spencer's aggressive modernisation ambitions, while the shares are a 'sell' in terms of market consensus.

Source: TradingView Past performance is not a guide to future performance

Meanwhile easyJet may also be grounded, which would end its own eight-year association with the premier index. As is often the case within the airline sector, headwinds abound. Although the company declares itself well prepared for Brexit, it cannot control the effects which a poor outcome could have on consumer confidence.

Meanwhile the overall margin between revenue and cost per seat remains wafer thin. These general concerns have weighed heavily on the shares, which have plunged 47% over the last year, and 31% in the last quarter alone. There have been some downgrades to the stock of late, which has resulted in the market consensus of the shares easing to a 'hold', albeit a strong one.

Software and engineering firm AVEVA Group (LSE:AVV) is a company on a roll. The shares have risen 45% over the last year, and over the last three years have added 115%. At the current market capitalisation of around £5.5 billion, all things being equal they are a shoe-in for inclusion for the FTSE 100 in June by our calculations, having narrowly missed out in the last couple of reshuffles.

The general view is that the shares are reassuringly expensive (they trade on a high multiple) but, despite the strength in the share price, the consensus of the company as a 'hold' is safe.

JD Sports (LSE:JD.) is a company where the complementary offering of online and physical stores is well-suited to the business model. The fairly recent purchase of US company Finish Line gives it exposure to a major new market. The expansion does not stop there, however, with moves also being made in Europe and the Asia Pacific region, all of which consolidates its strong UK position.

With such rapid growth, the market has anticipated this stellar trajectory to a large extent, with the shares having risen 63% over the last year and 59% in the last six months alone. Even so, appetite for the stock is undiminished, with the market consensus coming in at an extremely ‘strong buy’.

The fortunes of these four stocks could be further compounded as the leavers become subject to additional selling pressure as they are removed from index-tracking funds. Conversely, the joiners may enjoy upward buying pressure as they are added to those trackers.

With a few trading days still remaining until the deadline, these are not guaranteed risers and fallers – also in the mix is a potential promotion for Cineworld Group (LSE:CINE) and a possible demotion for Hikma Pharmaceuticals (LSE:HIK), depending on how those share prices perform in the next few sessions.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.