This new share gets the thumbs up

After a first look under the bonnet of this firm, our companies analyst likes what he sees.

18th October 2019 15:25

by Richard Beddard from interactive investor

After a first look under the bonnet of this firm, our companies analyst likes what he sees.

You're up to your digital neck in pdf files. You're looking at a company for the first time, aren't you?

Yep, I'm "initiating coverage", as they say, of Bloomsbury Publishing (LSE:BMY) so I've been digging the numbers out of the annual reports and doing some reading. Heavy going to be honest. Bloomsbury publishes bestsellers, but you can definitely put the annual reports down.

Harry Potter Bloomsbury? Bit of a one-trick pony? Bit twentieth century?

It's still going, so I guess that makes it twenty-first century. Anyway, what makes you say it's a one trick pony?

Go on then, name me one book that Bloomsbury has published by another author...

Hmmm... JK Rowling is still Bloomsbury's biggest money spinner, it was Potter's twentieth anniversary in 2017, but Bloomsbury publishes Sarah J Maas and Tom Kerridge, for example. It also publishes the Writers' & Artists' Yearbook, a publication close to my heart.

Sarah J who?

Maas. She's a young adult author, although she's working on an adult series now. It's been a few decades since either of us were in the young adult market and before you ask, Kerridge is a celebrity chef. Part of Bloomsbury's strategy is to focus on its biggest nine assets, led by Potter, Maas and Kerridge. That said, Potter dwarfs everything, there have been 500 million Harry Potter books sold and only 8 million Sarah J Maas books. Give her time, though, the first book was published in 2015, the film rights have been sold.

Incidentally, not all of those 500 million Harry Potter book sales were Bloomsbury's because Scholastic is the US publisher. The pain of not being Harry Potter's publisher across the English speaking world inspired the formation of Bloomsbury's US subsidiary, where it earns 29% of revenue. It also has offices in India and Australia.

Is Bloomsbury still dependent on Harry Potter then?

The company is a bit cagey about that. Pretty dependent I reckon, based on a few observations:

1. In 2019, five of Bloomsbury's top ten bestsellers were Harry Potter. The box set tops the list, and the others are new illustrated editions2. Children's books still account for more than 40% of revenue and a bigger proportion of profit, approaching 70%3. Profit margins in the Children's division are excellent, probably because of the Potter effect...

Here's the data from my spreadsheet:

| Revenue (£’000) | Profit (£’000) | Profit margin | ||||

|---|---|---|---|---|---|---|

| Division/Date | Feb-19 | Feb-18 | Feb-17 | Feb-16 | ||

| Children's trade | 65,800 | 9,784 | 15% | 17% | 18% | 14% |

| Adult trade | 33,454 | 891 | 3% | -1% | -2% | 2% |

| Academic & Professional | 41,245 | 3,131 | 8% | -1% | 5% | 11% |

| Special Interest | 21,156 | 713 | 3% | 10% | 4% | 11% |

| Content Services | 1,025 | -225 | -22% | -10% | 11% | 38% |

Wow. Looking at that table I wonder why Bloomsbury even bothers with adult books...

I must admit I have been wondering the same thing, in two of the last four years adult consumer titles lost money. Bloomsbury is trying to grow market share, though whether that will make it more profitable remains to be seen.

The main thrust of the company's strategy is in non-consumer, the bottom three categories in the table. Bloomsbury hopes to earn the majority of revenue from non-consumer titles in the not too distant future. It believes the academic market in particular is low risk, because it doesn't have to pay big advances to authors, and it sells subscriptions so the income is more dependable. Bloomsbury also says academic and professional publishing is higher margin, although due to heavy investment in digital products that's not obvious yet...

Academic publishing sounds completely different. That's risky, isn't it?

Maybe, but Bloomsbury has been building the academic and professional business for a long time. It acquired Methuen Drama in 2006, a list of plays, and since then it has used the bounty, or rather annuity, from Harry Potter to acquire more than 20 imprints and publishers, many of them academic and professional. Today it is the second biggest division earning 25% of revenue and 22% of profit.

What is relatively new is the Bloomsbury Digital Resources project, the digitisation of the titles it has acquired and their incorporation into more than twenty subject specific collections. The biggest seller to date, is Drama Online, incorporating Bloomsbury's own lists, Methuen Drama and Arden Shakespeare, other publishers' lists, and video from the Royal Shakespeare Company. But Bloomsbury has strong lists, particularly in the arts, humanities, and fashion. Starting in 2016, it has launched four or five new digital products a year.

So academic publishing is the next HP?

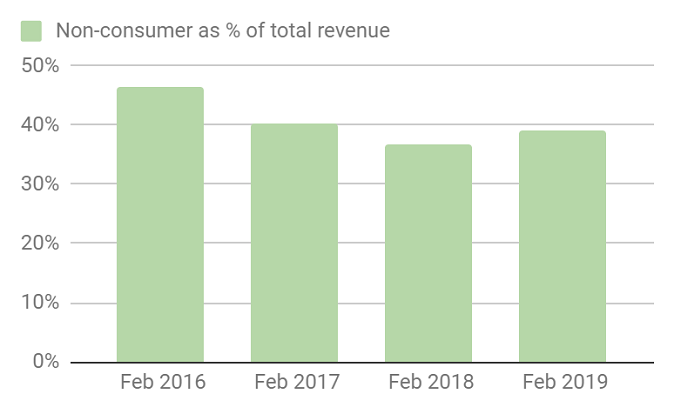

Somewhat embarrassingly a resurgent Potter has spearheaded a surge in consumer revenues, sending the proportion of total revenue earned by non-consumer titles down in three of the last for years:

That changed in 2019, when consumer revenue fell and non consumer revenue rose 7%, partly as a result of the acquisition of I. B. Tauris and partly due to the digitisation project. BDR earned revenue of £6.4 million, only 4% of Bloomsbury's total revenue in 2019, but it grew 34%. The company is targeting £15 million revenue and £5 million profit by February 2022, implying a profit margin of over 30%. To put that in perspective, the whole Academic & Professional division made a profit of just £3 million in 2019, and it made a loss the year before. Children's Trade, the most profitable division, brought in nearly £10 million operating profit.

It's jam tomorrow of course...

"Jam today and more Jam tomorrow" is becoming a catch phrase. You like Bloomsbury, don't you?

I do, but I am not infatuated. Shall we...?

Go on, tell us what you really think...

Does Bloomsbury make good money?

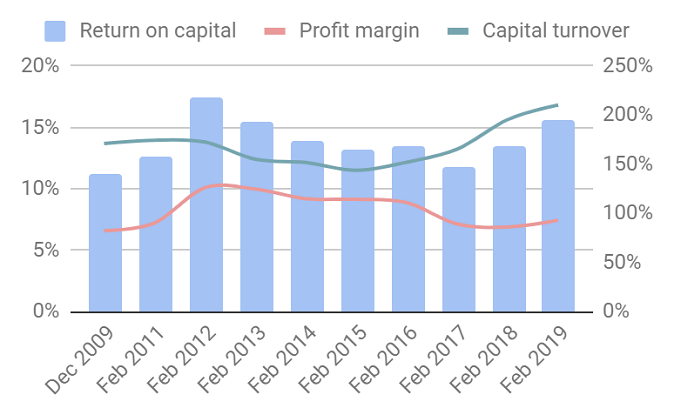

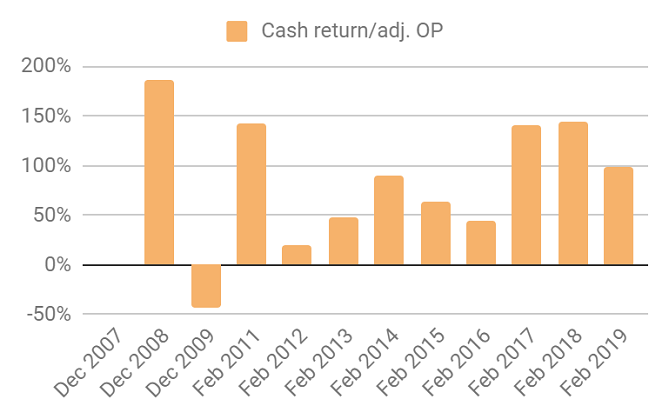

Over the last decade Bloomsbury has earned an average post-tax return on capital of 14%, and achieved cash conversion of 79%. On the face of it, it is a pretty healthy business. I would prefer the post-tax profit margin to creep back up to 10% from its current level of 7%, which it may well do as the Academic & Professional division becomes a reliable profit centre.

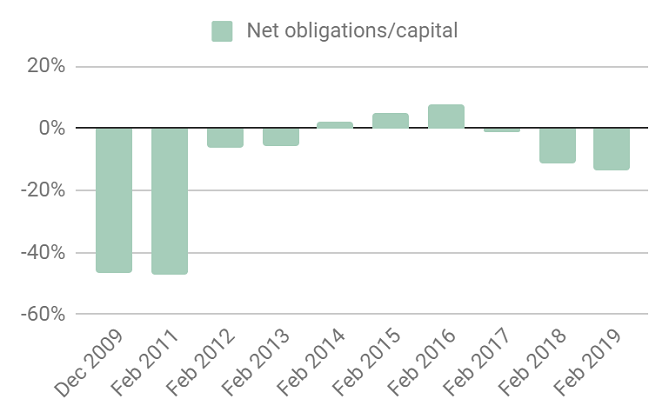

Taking into account the cost of acquisitions, the picture is less benign. Average Return on Total Invested Capital (operating capital plus goodwill and acquired intangible assets at cost) is just under 8%, which is barely adequate. Perhaps this is because Bloomsbury is still knitting many of the acquired titles together to make digital products for academic libraries.

In recent years, cash conversion has been high, the result of more efficient management of working capital as the company has reduced the amount of inventory it must hold.

Profitability and cash conversion has been sufficient to fund more than twenty acquisitions and new digital publications without the need external funding:

Bloomsbury is profitable enough. In future it could be more profitable...

Score: 2

What could prevent it from growing profitably?

The book business has faced two big challenges for the last two decades, Amazon, and Amazon. Amazon dominates online book sales, giving it power over publishers, and since ebook sales are entirely online, Amazon's stranglehold through its Kindle platform is even stronger. Book publishing is also something of a blockbuster business, which makes it risky.

The free publication of academic research through open access may undermine traditional publishers who charge for access and depend on copyright to defend their rights.

While Bloomsbury is adapting to these challenges (see below), they are a reminder of how competitive and open to disruption publishing is.

Score: 1

How will it overcome these challenges?

Despite the disruption of acquisitions and subsequent restructuring, Bloomsbury is growing profitably as it switches emphasis to academic and professional publishing.

Its non-consumer strategy is to acquire rights, digitise titles, and make them available internationally in the English speaking world, packaging them alongside open access titles in products it believes customers will continue to pay for.

Since the Bloomsbury Digital Resources 2020 project is in its early stages (it was launched in 2016) costs are high and returns are low, but that should change as products are launched and become established.

Bloomsbury has learned to coexist with Amazon by focussing on marketing and its relationships with it and other retailers. While the popularity of Harry Potter will wax and wane, it will probably remain a healthy source of profit indefinitely as new generations are introduced to the stories by their parents, who are themselves fans.

A hard Brexit, though, would bring extra costs as the company uses European printers.

Score: 2

Will we all benefit?

Bloomsbury has an appealing mantra: to publish books of originality. The board is very experienced, but founder and chief executive Nigel Newton and other executives receive high salaries, which are multiplied by the usual bonuses (up to 100%) and long term share incentives (also up to 100%). Reviews on Glassdoor, a recruitment site where staff review their employers, are not as gushing as I would like. Bloomsbury scores 3.2/5, and 57% of 39 employees would recommend Bloomsbury to a friend. The company does not disclose staff turnover, which makes me fear it is high.

Since the company has been restructuring, perhaps a certain amount of staff dissatisfaction is to be expected.

Score: 1

Are the shares cheap?

Fairly. A share price of 248p values the enterprise at just over £175 million, 15 times adjusted profit.

Score: 1

A score of 7.0 out of 10 means Bloomsbury is right on the cusp of good value, but this is my first brush with the company so it's a provisional score.

Bloomsbury publishes its results for the half year to August 2019 later this month, on 29 October.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.