Nine funds that stand out from the crowd

Saltydog Investor on the funds that have consistently delivered over the past three years.

10th August 2020 13:28

by Douglas Chadwick from ii contributor

Saltydog Investor on the funds that have consistently delivered over the past three years.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor we provide information designed to help self-directed investors manage their own portfolios.

We focus on funds, rather than stocks and shares, and provide performance data each week covering unit trusts, open-ended investment companies (OEICs), investment trusts and exchange traded funds (ETFs).

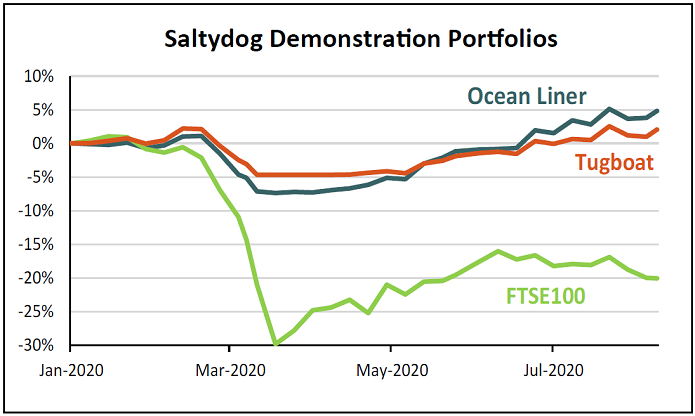

We also run a couple of demonstration portfolios, the Tugboat and the Ocean Liner, so that members can see how we interpret the data.

Usually, we focus on what has been performing well over the last six months and are particularly interested in what has happened in the last few weeks.

Although we do not necessarily make changes, we do review our holdings each week. This means that we can move quickly when we need to. This was very useful earlier in the year, as we were able to reduce our exposure to the stock markets from over 90% to virtually nothing in a couple of weeks. This helped us miss the worst of the latest stock market crash.

Past performance is not a guide to future performance.

While actively managing a portfolio on a weekly basis may suit some people, we are aware there are others who do not feel that they can allocate the time required. However, they may still appreciate our momentum-driven process of fund selection and want to avoid the potential hazards of a “buy and hold” strategy.

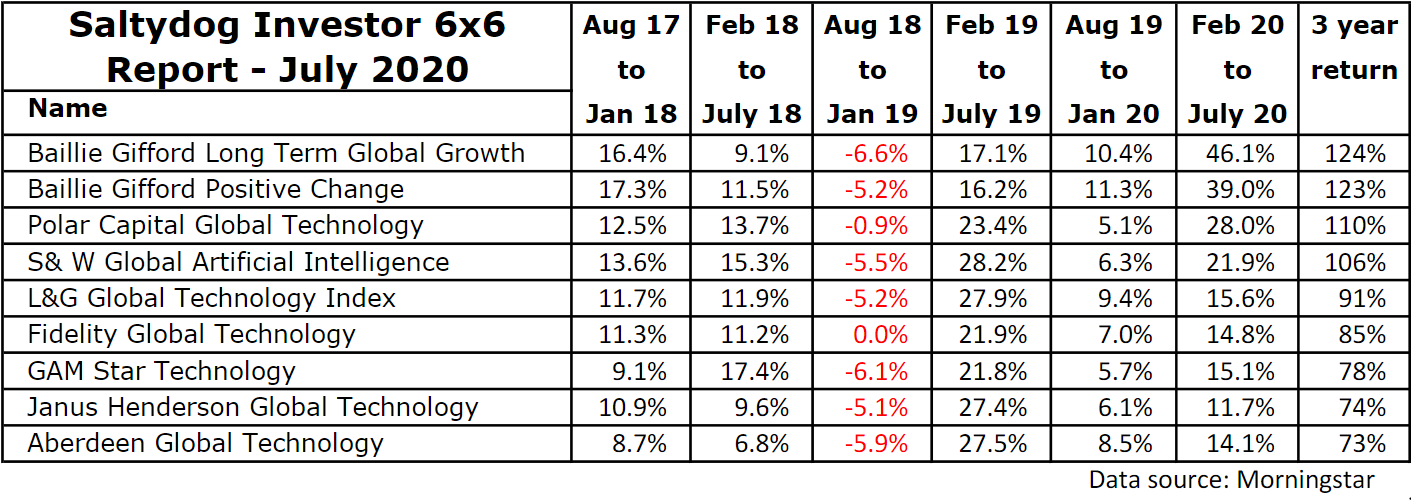

With this in mind, we developed our “6x6 Report”. Every three months, we look for funds that have achieved a gain of at least 5% every six months going back over the last three years.

When we produced the report in May (covering the three years from the beginning of May 2017 through until the end of April 2020), there were no funds that had achieved the target return in each of the six-month periods, but 10 funds had managed to do it in five of them.

In our latest analysis, which now goes up to the end of July, nine funds have managed to gain at least 5% in all but one of the six-month periods shown below.

Past performance is not a guide to future performance.

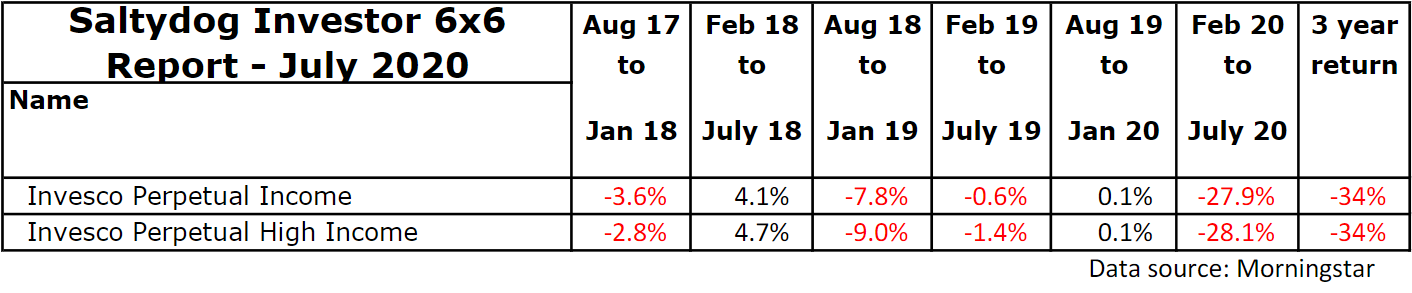

This is no mean feat. In fact, you are much more likely to find a fund that has not gained 5% in any of the six-month periods. There are over 80 funds that have failed this test, including two funds that for a long time were darlings of the “buy and hold” brigade. They have not even made a profit over the whole three-year period.

Past performance is not a guide to future performance.

The last six months includes the recent stock market crash triggered by the spread of the coronavirus and over 60% of the funds that we analysed are showing losses over this period.

The recovery has been led by the US and, in particular, by the technology sector. Funds investing in these areas have done consistently well in recent years and so it is no surprise that they feature at the top of our table.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.