No signs of retreat by Games Workshop

Its return on capital is "spectacular", ensuring this stock keeps its place on the investment frontline.

23rd August 2019 15:35

by Richard Beddard from interactive investor

Its return on capital is "spectacular", ensuring this stock keeps its place on the investment frontline.

Let us start this year's profile of Games Workshop (LSE:GAW) with a game of spot the difference, between a paragraph in the annual report for the year to May 2016:

"Games Workshop's ambitions remain clear: to make the best fantasy miniatures in the world and sell them globally at a profit, and it intends doing so forever."

And a very similar paragraph in the annual report for the year to May 2019:

"Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever."

Games Workshop is better known as Warhammer, the name of its two war games, Warhammer 40,000 (the futuristic one) and Warhammer Age of Sigmar (the fantasy one).

It is also the name of the stores where it recruits new customers and sells the models hobbyists collect and play with. Models are its principal source of income, but Warhammer also sells modelling equipment (paint mostly), magazines, and novels, and licenses its characters and stories to app and video game companies.

The company has established a team to bring Warhammer to TV and it has an animated series in the works that it will probably broadcast online on Warhammer TV.

How fantasy war games became a £1.5 billion business

Warhammer was born in the 1980s. It has constructed a rich mythology and attracted a large following so not surprisingly, since only Games Workshop can legally make Warhammer models, it is a very profitable business.

Over the last three years, though, Games Workshop has surprised investors, even those like me that had followed it for years before that. After a long period of stagnation, revenue has increased by 117% and profit has increased by 332%.

There are many reasons for Games Workshop's dramatic spurt: The simplification and reboot of the original Warhammer game as Warhammer Age of Sigmar, the adoption of cheaper to operate one-man stores, the switch to plastic and resin models that are more versatile than metal, a coordinated approach to marketing Warhammer online, and the introduction of starter kits (bundling models more affordably to get new recruits painting and playing).

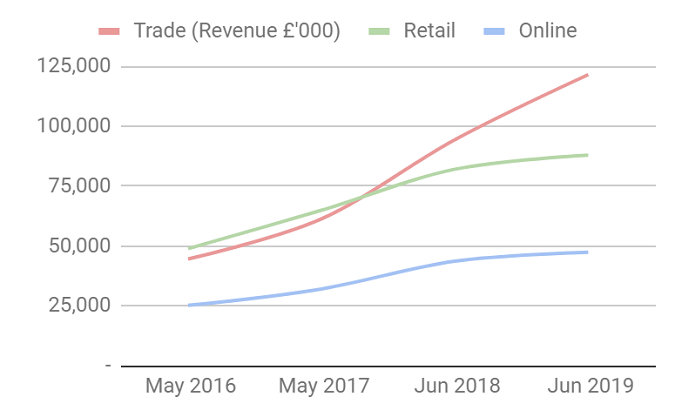

But the thing that really struck me in the annual report is how trade customers (independent stores) have overtaken Games Workshop's own retail stores as its main source of revenue:

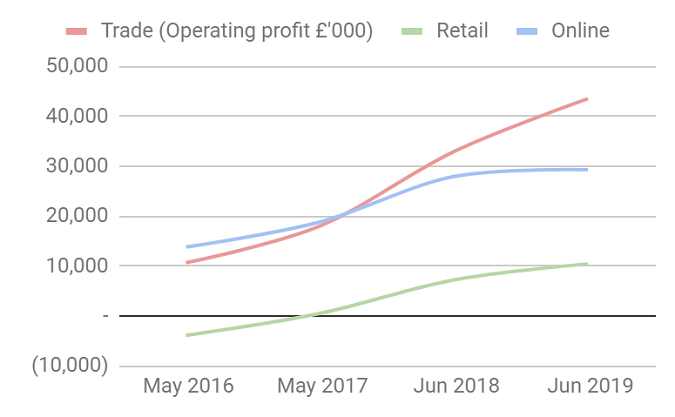

Profit from Trade sales has also overtaken Games Workshop’s highly profitable online sales to become its major source of profit:

At war with customers

Not many years ago Games Workshop seemed to be at war with its customers, or perhaps it would be more accurate to say some customers were at war with Games Workshop.

Hobbyists vented their frustrations online, including the comments sections of my articles. Their complaint was that Games Workshop was neglecting the Warhammer Game and gouging customers by charging high prices for ever more complicated intricate models.

To me at least, it seemed, Games Workshop was suspicious of everyone that had an opinion on its business: the media, shareholders, customers, and distributors.

Trade customers complained Games Workshop's terms were too restrictive. Like its HQ in Nottingham, which is styled like a fortress, the company had put up the barricades and did not seem to be listening. But the barricades have been lowered.

Open to opportunity

The blossoming of the trade channel, which may in part be because the company has targeted independent retailers directly at the expense of distributors, and the morphing of the mission statement, are two data points among many confirming my impression the company has gone from being insular, and sometimes at odds with customers, to open and determined to give customers what they want, while still making sure it makes a good profit.

This change is contemporaneous with the retirement of Tom Kirby, who had run the company for decades, and the elevation of Kevin Rountree, Games Workshop's former finance chief, to the chief executive role.

When I asked board members about licensing its intellectual property to video game makers at the AGM in 2016, I left with the impression the company treated partners with suspicion and that licensing would never be an integral part of the business.

Now the company says: "We are committed to making it easier than ever for people to discover, engage with and immerse themselves in our IP. Aided by a small, senior team we have already begun to find new partners, and new ways to help us bring the worlds of Warhammer to life like never before. Together, we'll continue to explore animation, live action and more."

The company seems to be taking a much more hands-on approach to TV, generating scripts internally and partnering with production companies. It is early days, but suddenly Games Workshop seems to be open to a multitude of opportunities including partnerships with over 2,300 schools, the UK Scouts, and the Duke of Edinburgh Award scheme.

It is reaching customers in the most unexpected places. Look carefully at this picture. In the small market town of Royston, the stockist is located in Barbara's Flowers, a florist:

Take a peek inside.

Does Games Workshop make good money?

Return on capital has increased in recent years from good to spectacular (15% to 45%/50%). Higher volumes mean the factory and stores are operating more efficiently, and the company's intention is to grow while sustaining operating profit margins. It is highly cash generative.

Score: 2

What could prevent it from growing?

Every year the company trots out the same spiel, that the main risk is management: "Problems will arise if the board allows egos and private agendas to rule".

It has never been clear to me whether the board extended that warning to itself, but until Rountree took over, the annual reports reeked of ego. The tone has softened (somewhat! There is still something distinctly "Games Workshop" about them).

Score: 2

How will it overcome these challenges?

Games Workshop owns a highly popular hobby. It just needs to foster it. That may sound easy, but the company is a manufacturer, global distributor and retailer. It has to do all the usual stuff associated with these activities efficiently and cope with the pace of growth, which has required it to open a new factory and commission a new warehouse in 2019.

Score: 2

Will we all benefit?

Games Workshop puts particular emphasis on recruiting and sustaining staff. Customers love the product, the board is far from greedy, and all employees share in the profit when the company does well as do shareholders, who receive larger dividends.

Score: 2

Are the shares cheap?

No. A share price of just over £45.50 values the enterprise at nearly £1.5 billion, about 22 adjusted profit in 2019.

Score: -0.8

Although the relatively high share price takes the shine off the investment, Games Workshop is almost uniquely in control of its own destiny. Chief executive Kevin Rountree says:

"To be realistic, I will continue to make no promises that we will continue to grow. That said, I do not see anything significant that will get in the way."

I agree, and a score of 7.2/10 is just about sufficient to recommend Games Workshop for long-term investment.

Richard owns shares in Games Workshop.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.