Is PageGroup shares crash a worry for us all?

Britain's recruitment sector has long been a canary in the coal mine for our economic health.

10th July 2019 12:36

by Graeme Evans from interactive investor

Britain's recruitment sector has long been a canary in the coal mine for our economic health.

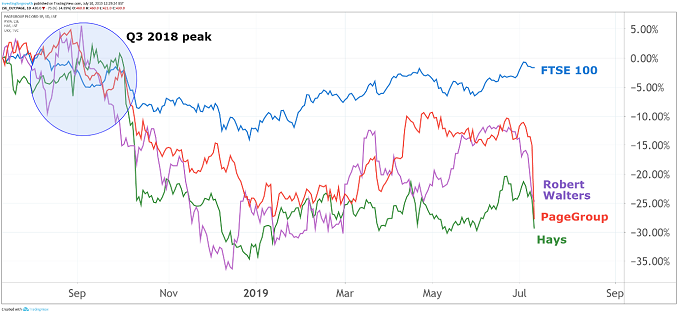

A record quarter at recruiter PageGroup (LSE:PAGE) today failed to mask growing investor anxiety about the impact of Brexit and China trade wars at one of the best dividend payers in the FTSE 250 index.

Shares tanked 15% to their lowest level in more than two years as Page said it expected 2019 operating profits to be towards the lower end of current market forecasts. Its UK business, which accounts for 16% of group profit, went into reverse after growing in the previous three quarters, while another key market for Page of Greater China saw profits decline 1%.

The recruitment firm is well used to weathering economic storms, having been around for more than 40 years, but investors will be increasingly worried that today's quarterly update signals something more serious for the industry and wider global economy.

Robert Walters also reported an 8% drop in gross profit for the UK yesterday, but this was offset by a strong performance overseas. As well as declining client confidence, the political turmoil in the UK means potential recruits are becoming much more wary about moving.

Page's worse-than-expected result in the UK and Asia, where social unrest in Hong Kong has posed a more recent challenge, meant gross profits of £224.6 million came in 1% below consensus. The growth of 7.4% compared with 11.7% in the first three months of the year.

Source: TradingView Past performance is not a guide to future performance

There were still plenty of positives in today's update, however, with 16 countries growing profits by more than 10%. This included record quarters in the United States after growth of 22% and a "standout performance" in Germany despite economic worries.

The company continues to boast a strong balance sheet, with net cash of £81 million in the quarter up from the previous three months. Analysts at Jefferies think this should mean Page is on track for another special dividend payment in the autumn.

The special payments began in 2015 as the benefits of the cyclical upturn and central banks' stimulus programmes started to mature. A £40.8 million special dividend of 12.73p was paid last year, representing a total dividend yield of 5.7% at the year end share price.

Jefferies has a price target of 590p but warns that earnings per share estimates are likely to decline by 3% or 4% following today's update. They add that consultant headcount reduced by 122 to 7,763 in the quarter in response to the market conditions, which may have a knock-on effect on net fee growth in the second half of the financial year.

Page admitted that economic conditions in a number of its regions were becoming tougher but said that it would continue to work on its long-term vision of 10,000 headcount, £1 billion of gross profit and £200 million to £250 million of operating profit. In the last financial year, it recorded gross profit of £814.9 million and operating profit of £142.5 million.

The group will continue to invest in markets where growth has been strongest, such as the US and India, but is mindful of the weaker economic conditions seen in much of continental Europe. It added:

"Our flexible business model enables us to react quickly to changes in market conditions by adjusting our headcount to focus on productivity and conversion."

The UK business operates under four brands, including the lower salary level Page Personnel, which now represents 25% of UK gross profit. This brand has proved more resilient, whereas the Michael Page business targeting more senior opportunities declined 6% in the quarter. Permanent placements account for around 69% of gross profit in the UK.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.