Pension pain for Arcadia staff – but final salary savers are 90% protected

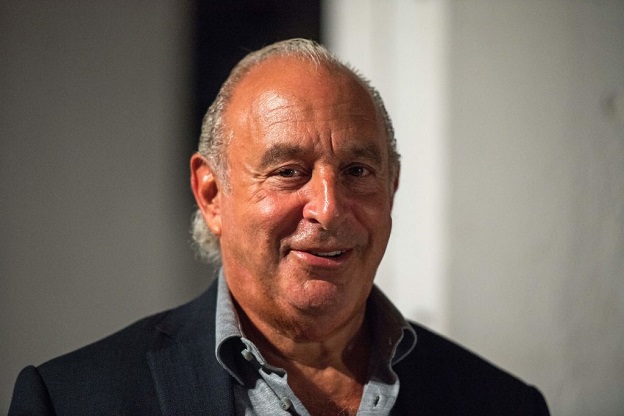

As Covid and internet shopping sink Philip Green’s retail empire, should other pensioners be worried?

1st December 2020 12:53

by Laura Miller from interactive investor

As Covid and internet shopping sink Philip Green’s retail empire, should other pensioners be worried?

Savers worried about their pensions if their employer collapses like Topshop owner Arcadia are being warned against making knee-jerk decisions, as most of their money is protected.

The collapse of Topshop owner Arcadia is likely to result in a cut in the value of the pensions of thousands of shop workers who are part of the company’s defined benefit, or ‘final salary’, scheme.

Joe Dabrowski, head of defined benefit at the Pension and Lifetime Savings Association said the news “will be incredibly worrying for its current workers and pension scheme members”.

- Pensions jargon buster

- Are you saving enough for retirement? Our pension calculator can help you find out

- What I did when a market crash caused my pension pot to plummet

Savers into defined benefit schemes at other companies may now also fear for their own nest eggs. Arcadia is the latest in a series of businesses to have entered administration because of the economic impact of coronavirus.

The good news is even though workers at a company that fails will likely not get as much pension, compared to if the company had survived – as defined benefit pension savers the vast majority of their retirement funds are protected.

“The most important thing for concerned scheme members to know is that their final salary pensions will be protected by the Pension Protection Fund,” said Dabrowski, the pensions lifeboat, which financially strong, and already looks after more than 300,000 members’ pensions.

Retirees who find their pension scheme ends up in the Pension Protection Fund, and who are already receiving their benefits, will continue to receive them. Deferred members, and those who are yet to retire, will get 90% of their expected income, up to a cap of around £40,000 a year.

Becky O’Connor, head of pensions and savings at interactive investor, said despite the Arcadia news, savers should keep trust in their workplace pension, because it is one of the best ways to save for retirement.

“The majority of workplace pension schemes are now in defined contribution schemes, so people with this type in particular should have no reason to be put off workplace pension investing because of news like the Arcadia collapse,” she said.

Defined benefit schemes like the Arcadia one can be very valuable too, she said, “as they pay out a guaranteed amount and the PPF exists to protect the majority of employees’ benefits”.

- Generating an income at retirement: how this writer is doing it

- Millions of savers face decision time on public sector pensions

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Savers who aren’t sure what type of scheme their employer has should check with their HR department. “You may also have old workplace schemes that could be defined benefit, even if you are in defined contribution with your current employer, so check these, too,” O’Connor added.

Pension savers can also go to the Money and Pension Advice website for more information. Nick Hill, customer advisory manager at the Money and Pensions Service, encouraged anyone worried “before making any decisions about pensions, particularly at a stressful time, to talk to our experts who will be happy to help”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.