Pessimism offers chance to buy these two defensive titans

After profiting from these defensive stocks last year, our overseas investing expert would buy again.

18th March 2020 12:41

by Rodney Hobson from interactive investor

After profiting from these defensive stocks last year, our overseas investing expert would buy again.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Retailing has been a tough sector, with intense competition and the rise of online sales squeezing margins for those with physical outlets. Yet this sector has held up better than most during the coronavirus crisis and rightly so, too. It could be the first to get back to normal.

Some sections of the economy will inevitably suffer from lost revenue that cannot be recouped later. Airlines are an obvious example. Others offer a defensive stance in the current crisis because they supply goods or services that we cannot manage without.

Indeed, sales may actually be enhanced in the short term by panic buying. Pharmaceuticals are one example. Retailers are another.

The United States is behind China and Europe in the spread of Covid-19 and coping with its effects. Now that even President Donald Trump is alive to the consequences, the country does have the opportunity of learning from the experiences of other nations in dampening the effects.

The US economy has been particularly resilient since the financial crisis of 2008, so although it is likely to tip into recession in the summer and autumn, fears of a 5% contraction in the second quarter, as suggested by Goldman Sachs (NYSE:GS), will probably prove to be too pessimistic.

- The single most important concept for every investor

- A coronavirus panic-buy trade

- Want to buy and sell international shares? It’s easy to do. Here’s how

Walmart (NYSE:WMT) is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores and grocery stores.

It owns the ASDA supermarket chain in the UK. It is still owned 51% by the family of Sam Walton, who founded the company in 1962.

Fourth-quarter results to 31 January were admittedly a bit mixed. The period started and ended strongly, but there was “some softness” in general merchandise in the US stores and key international markets, so although revenue was 2.1% higher, pre-tax profits were up only 0.2%, from $5.66 billion to $5.67 billion.

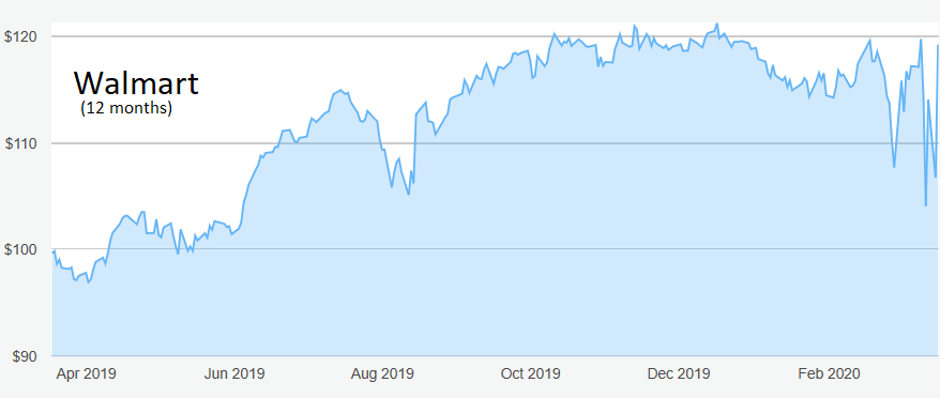

Source: interactive investor Past performance is not a guide to future performance

Walmart declared dividends totalling $2.12 per share for the year as a whole, a 1.9% rise from $2.08. An annual dividend of $2.16 is proposed for the current year, based on predicted sales growth of about 3% and earnings per share up at least 1.5% and possibly as much as 4.5%.

Investors should bear in mind that while China was already in the grip of the coronavirus outbreak when this forecast was made, the effects had not yet spread to the rest of the world.

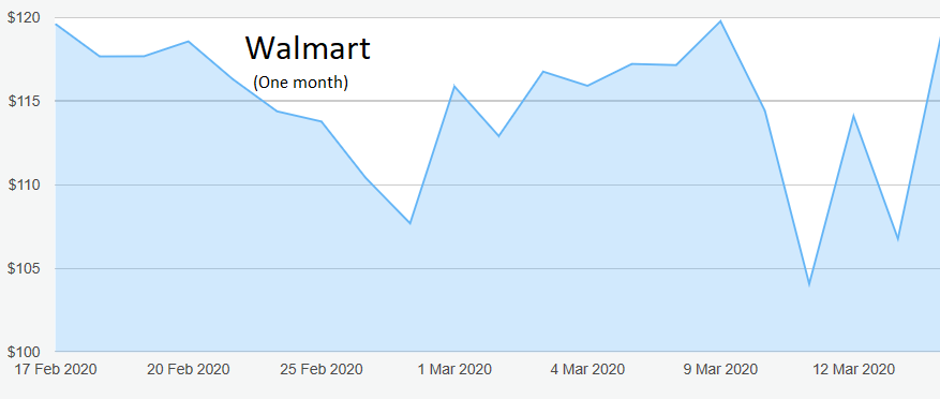

The shares have held above $100 for the past 11 months and peaked at $121 in November and again in December. Although they have had a wild ride over the past month, swinging between $120 and $104, they are currently trading around $119, giving a yield of about 2%.

Source: interactive investor Past performance is not a guide to future performance

An alternative is discount stores chain Target (NYSE:TGT), one of the largest American retailers and one with a loyal customer base.

Target is a one-stop discount department store with sales split fairly evenly across food and drink; clothing and accessories; home furnishing and décor; beauty; plus a wide-ranging division that includes sports equipment, electronics and jewellery.

This spread provides a hedge against a downturn in any particular department, so it is no surprise that the group has a strong record of rising profits and dividends.

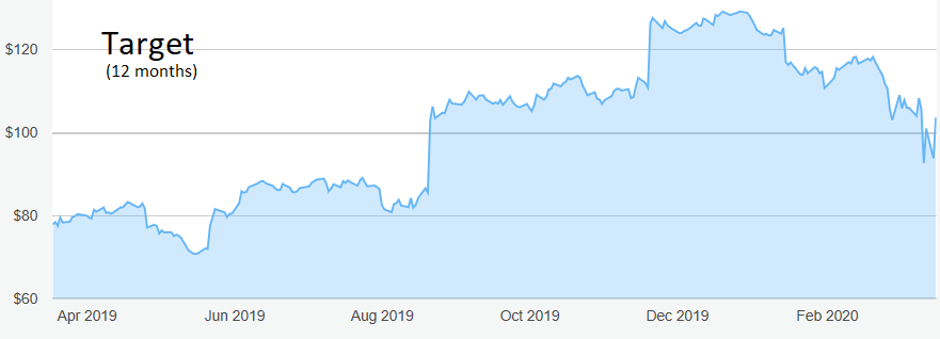

Source: interactive investor Past performance is not a guide to future performance

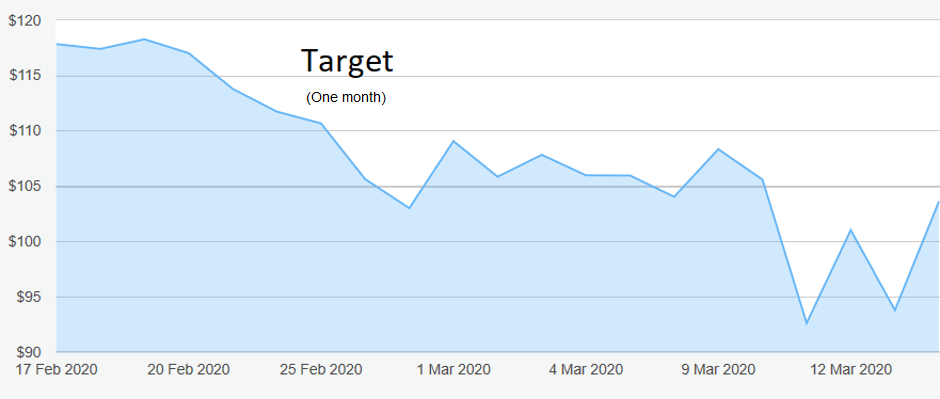

As with Walmart, the shares have had a roller coaster ride. I tipped them at $86.50 last June, saying buy up to $90. They have since been as high as $129 but recent falls mean they are available at $103, where they offer a yield of 2.8%.

Source: interactive investor Past performance is not a guide to future performance

Hobson’s choice: On 4 December, well before the Covid-19 crisis broke, I suggested buying Walmart as long as the shares remained under the $121 peak.

That advice still stands. I am raising my maximum buying price on Target to $108, which has proved a resistance point recently.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.