A possible recovery stock for 2021

Running airports and toll roads could be lucrative again when the virus is under control.

9th December 2020 09:34

by Rodney Hobson from interactive investor

Running airports and toll roads has been lucrative in the past and our overseas investing expert thinks it could be again when the virus is under control.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The Covid-19 crisis has been particularly tough for Paris-based Vinci (EURONEXT:DG), one of the world’s largest investors in transport infrastructure. No wonder the shares have struggled to recover. But if vaccination brings the coronavirus under control, this could be a recovery stock next year.

Transport, along with hospitality, has been the hardest hit sector across the globe, with passenger air traffic almost grinding to a halt and road and rail heavily underused. Vinci is the world’s second-largest airport operator in terms of passenger numbers, and the 45 airports on its books – including a 50.01% stake in London Gatwick acquired two years ago – contribute most of its operating profit.

The construction side has also suffered. It designs, builds and manages transport systems, buildings and water, energy and communications networks.

- Investors given a taste of how no-deal Brexit will hit markets

- Europe’s stock market: an introduction to investing on the continent

- Want to buy and sell international shares? It’s easy to do. Here’s how

The first half of the year was particularly tough, though it could have been worse. A strong start was more than offset by a poor second quarter of lockdowns in France, where Vinci operates the road toll system, and elsewhere. Revenue was 15% lower at €18.5 billion in the six months to 30 June compared with the same period of 2019.

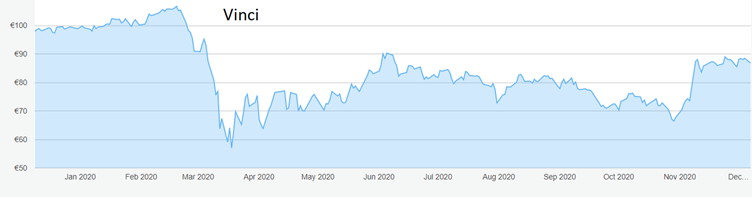

Source: interactive investor. Past performance is not a guide to future performance.

Even so, the order book actually grew by 18% to €42.9 billion and chief executive and chairman Xavier Huillard was able to forecast a less pronounced decline in the second half.

And so it seemed, as the third quarter showed a clear improvement on the second quarter, with revenue down only 6.4% at €12.3 billion. Huillard thought, quite reasonably, that Vinci’s operations were returning to normal, with the order book holding steady.

However, the second wave of Covid-19 was already building and new travel restrictions reduced forecasts for the airport division in particular. There will inevitably be a further hit to profits, though not as bad as in the first half.

Traffic on VINCI Autoroutes' interurban networks, which had bounced back close to 2019 levels during the summer, recorded a 20% drop over the first 10 months of 2020 compared with the same period the previous year. The worst week was November 2-8, when traffic fell 48% after France went into its second lockdown and tougher travel restrictions came into force.

As a result, Vinci has downgraded its forecast for motorway traffic for the full year to a contraction of 20-25%.

Next year should see a gradual recovery, although figures will probably remain below those for 2019. Traffic is expected to return quickly to normal levels, as it did in June when the first French lockdown was lifted, although airport numbers will be much slower to recover – they were down 96% in the second quarter and were still 79% adrift in the third quarter.

Over the first nine months of the year, passenger numbers across all airports has fallen 68% compared with the first nine months of 2019. Undaunted, Vinci is pressing on with growing the business and winning contracts. Seymour White, its Australian construction subsidiary, is half of a joint venture that last month won a €900 million contract to deliver Sydney Gateway, around Sydney Airport, building and upgrading roads, bridges, and a transport interchange.

- Is AstraZeneca set for new record with Covid-19 treatment?

- Murray International Trust: stocks I bought after the crash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The shares suffered heavily in the spring downturn, falling from a peak of €106.75 to €57 in pretty short order, and the subsequent recovery has been muted, with the shares twice running out of steam at around €90.

The way ahead is far from clear cut, but Vinci has the financial strength to weather the storm and come out stronger.

Hobson’s choice: Buy up to €90, the recent ceiling. If that can be broken there is a good chance of topping €100 again. The downside should be limited to €82. Investors may have to be patient as it will take time to turn things around.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.