Prudential shares dive as sales plunge in Q1

Pru is taking drastic action to cope with the economic shock of pandemic, reports our head of markets.

14th May 2020 12:06

by Richard Hunter from interactive investor

Pru is taking drastic action to cope with the economic shock of pandemic, reports our head of markets.

Prudential (LSE:PRU) Asia exposure has been both a blessing and a curse over recent months but, for the long-term, the proposition remains firmly intact.

Even prior to the pandemic, which of course emanated from the region, Asia had become something of a minefield, with political unrest in Hong Kong and the ongoing trade spat between the US and China adding to concerns of a Chinese economy which was showing signs of coming off the boil.

The subsequent economic shock has resulted in overall Asian sales declining by 24% during the first quarter of 2020, with Hong Kong and China contributing dips of 50% and 19% respectively.

As such, Prudential has moved to accommodate the new environment, with some innovative twists. Its 'Pulse by Prudential' app, which had been downloaded by 1.3 million people in mid-March, is now up to four million. It is also aiming to change the ratio of those customers dealing with the company in person by establishing a virtual alternative.

Indeed, even at this early stage, Prudential estimates that two-thirds of products in Asia are now capable of being sold virtually.

Not that customers have been rushing for the exit during the crisis, as a first-quarter customer retention rate of 97% testifies. In the meantime, the benefits of geographical diversification have become evident as strong growth has been witnessed in Indonesia, Thailand and Singapore.

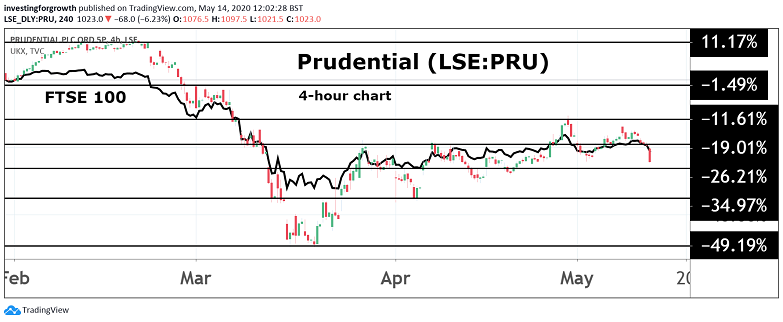

Source: TradingView. Past performance is not a guide to future performance.

From an investment perspective, the strength of the balance sheet is unquestionable, with a solvency surplus of 302% and a dividend yield of 3.5% also attractive in an interest rate environment, which is now at all-time historical lows.

The insurance sector has had a number of companies which have either chosen, or have been guided, to defer their dividends. But Prudential’s new-found focus on Asia following the demerger of M&G Prudential, its UK and European savings and investments business, likely gives the company an exemption.

In the background, the group continues to evaluate the planned minority IPO of its Jackson unit in the US, where an increase in sales of 25% over this period should add to the attractiveness of the business to potential investors, as well as providing Prudential with a further capital boost.

Be first to watch our interviews with fund manager like Nick Train and Keith Ashworth-Lord, plus leading City analysts and our own experts.

Just click here now.

Despite the inevitable disappointment of recent trading, the longer-term strategy of tapping into the health, protection and savings markets of a burgeoning region, remains appealing. If the Chinese and Hong Kong economies are beginning to normalise, Prudential will be well placed to benefit.

In the meantime, a share price decline of 35% over the last year, as compared to a drop of 18% for the wider FTSE 100 index, has not detracted from investor appetite for the company on future prospects, with the market consensus as a ‘strong buy’ reflecting high hopes.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.