The £17,000 difference fees can have on an ISA

Data reveals the astonishing compounding effect of platform charges.

23rd February 2024 10:27

by Myron Jobson from interactive investor

- Analysis of platform fees shows £17,000 difference in ISA wealth over a 10-year time frame.

- Data highlights the effect fees can on investment portfolios.

As the tax year end comes into view on the horizon, interactive investor, the UK’s second-largest platform, has analysed data demonstrating the huge impact platform fees have on customers’ ISAs.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

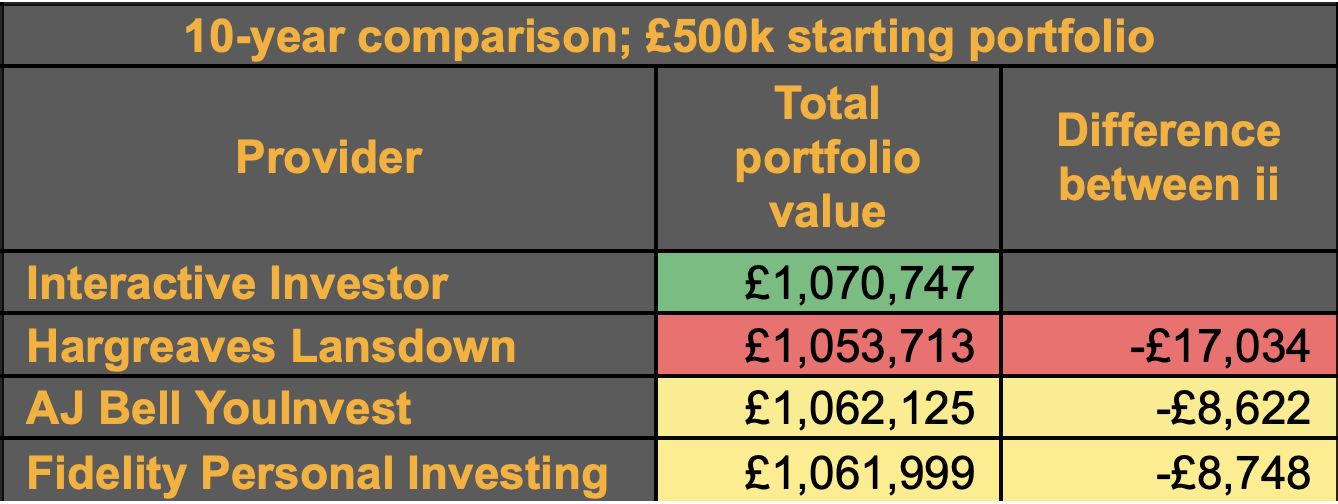

ii has run the numbers, with the help of consultancy the lang cat, and found that percentage-based fees paid on a £500,000 ISA portfolio in accumulation can have a negative compounding effect equating to as much as £17,000. This is compared to interactive investor’s Investor Plan account’s flat fee of £11.99 per month.

This scenario is based on a £500,000 portfolio, assuming yearly investment growth of 5% over a 10-year period and 2% inflation, with annual contributions of £20,000 (the annual ISA limit). It also assumes the example investment portfolios are made up of 50% funds and 50% shares with 12 regular fund trades and 12 regular share trades each year. It assumes fees are deducted monthly and the portfolio contributions are also made monthly.

The analysis compared interactive investor’s platform fee with Hargreaves Lansdown, AJ Bell and Fidelity Personal Investing.

The difference in total portfolio value between the client with Hargreaves Lansdown and interactive investor is £17,034. A customer with Fidelity Personal Investing would be £8,748 worse off, while an AJ Bell customer would be £8,622 less wealthy.

Myron Jobson, Senior Personal Finance Analyst, interactive investor says: “Platform and investing fees matter. This analysis proves the impact fees can have on portfolios and affects the amount of wealth people accumulate over time.

“A lot of column inches are dedicated to the impact of compounding over time on investments and how it helps stimulate growth, which is important for investors to make the most of, but the opposite is also true when it comes to fees dragging the portfolio back. It’s crucial investors are aware of what they’re paying, how much they’re paying and how they’re paying it.”

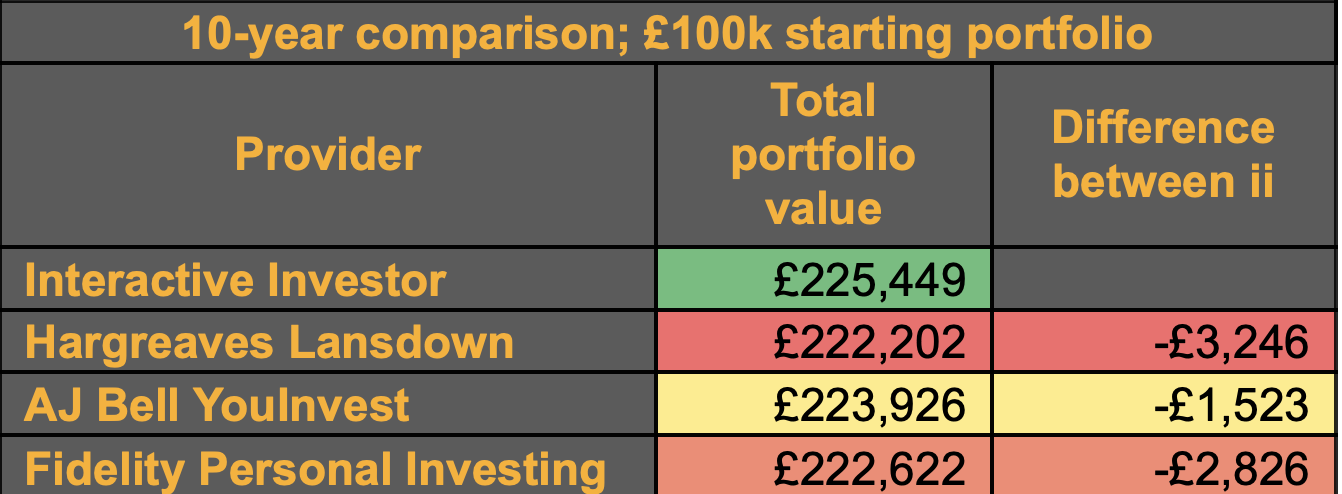

With a more modest portfolio starting point and annual contributions, the difference in portfolio size is still stark. The portfolio below makes the same inflationary and investment growth assumptions (2% and 5% respectively) but has a starting point of £100,000 with £5,000 annual contributions.

Myron Jobson adds: “The two tables show the significant impact fees can have on a range of portfolio sizes. No matter the size of your investment portfolio, charges can have a material impact on your ability to reach your investment and savings goals, particularly over the medium and longer term.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.