Public sector high earners could face flat rate pension squeeze

A think tank has crunched the numbers on the controversial matter of flat rate tax relief on pensions.

26th July 2021 12:05

by Alex Sebastian from interactive investor

A think tank has crunched the numbers on the controversial matter of flat rate tax relief on pensions. Here’s what they found.

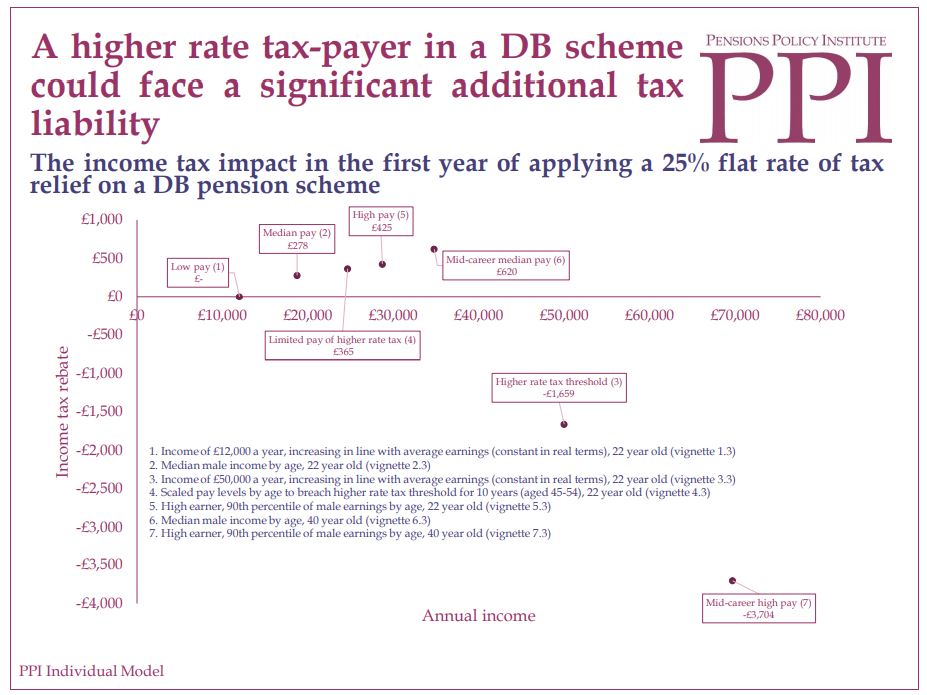

Public sector workers on relatively high salaries could face a squeeze on their pensions if flat rate tax relief proposals make it into law, a new report has warned.

The Pensions Policy Institute (PPI) has run the numbers and found members of a defined benefit pension scheme, who would pay additional tax if flat rate relief was implemented at 30%, could find their lifetime income reduced by 4.6%. This equates to around £2,000 a year.

An alternative approach for them might be through a scheme pays arrangement, with a subsequent reduction in benefit accrual. In this scenario, for a member earning £60,000, the additional tax liability would be around £1,800 a year.

- Pensions jargon buster

- Will ‘transitory’ inflation start to be worryingly persistent soon?

- Are you saving enough for retirement? Our pension calculator can help you find out

The PPI is a think tank which aims to come up with answers to tricky questions within the pension laws. Established in 2001, it claims to conduct “rigorous research from an independent, long-term perspective.”

Source: Pensions Policy Institute

Pensions tax relief is a political hot potato that many governments have wrestled with. Allowing people to reduce their tax burden by investing in their pension costs taxpayers around £40 billion a year.

The controversy stems from the fact that ultimately all taxpayers foot the bill, but it tends to benefit the well-off much more than the poor because it is tied to income levels.

Defined benefit, or so-called final salary schemes are those which offer members a set amount of pension income regardless of how the investments in the fund perform. They are a thing of the past in the private sector as in many cases they create unmeetable obligations for companies.

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

- How our five model portfolios are faring as the value rally starts to cool

Defined benefit schemes remain widespread across the public sector however, as they are underwritten by taxpayers.

Defined contribution schemes are the norm now, and only offer members a specific contribution to their pension each month, or year. The size of the pension pot depends on how well the investments in it do.

Implementing a flat rate of tax relief to defined contribution pension schemes would require a tax rebate or additional liability for members, the PPI report pointed out. It also warned that pension scheme members who are due a rebate may not benefit from it if they do not actively claim it.

The research also looked at the potential impact on defined contributions schemes. The think tank found a flat rate of tax relief would necessitate making employer pension contributions a taxable benefit, otherwise higher rate taxpayers would get more tax relief through salary sacrifice.

On the upside, the PPI report found that flat rate tax relief could be used to allow non-taxpayers to benefit from tax relief where they currently miss out.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.