Ready for action if conditions deteriorate

After a mixed July, the Saltydog analyst is poised for action should market volatility continue.

5th August 2019 13:24

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a mixed July, the Saltydog analyst is poised for action should market volatility continue.

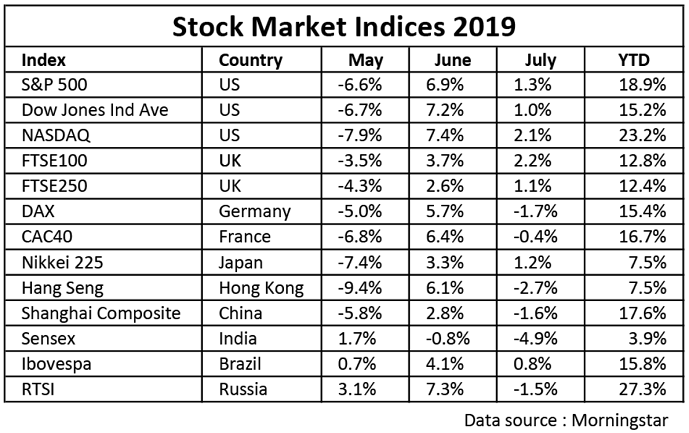

After a good start to the year, with the leading stock markets around the world making double-digit gains, there was a sharp correction in May. The trade war between America and China put downward pressure on global equities, and the MSCI World Index fell by more than 6% in one month.

In June there was a strong recovery. President Trump and Xi Jinping agreed to resume negotiations and Donald Trump postponed adding tariffs on an additional $300 billion of Chinese imports. The Chair of the Federal Reserve gave further support to the markets saying that "as always, we will act as appropriate to sustain the expansion".

The MSCI World Index bounced back to where it was at the end of April.

July was more mixed. The US and UK indices went up, along with the Japanese Nikkei 225 and the Brazilian Ibovespa, but some of the other major markets suffered losses.

Right at the end of July the Federal Reserve lowered interest rates by 0.25%, the first reduction for over ten years, which should have boosted the markets. However, it had been so widely anticipated that markets actually fell when Jerome Powell went on to say that the rate cut move was not the beginning of a lengthy rate-cutting cycle.

The next day President Trump created another maelstrom, announcing that "The US will start, on September 1st, putting a small additional tariff of 10% on the remaining $300 billion of goods and products coming from China into our country. This does not include the $250 billion already tariffed at 25%".

Markets have reacted badly and so far in August all of the major stock markets have seen a sharp decline - the FTSE 100 is down over 4%.

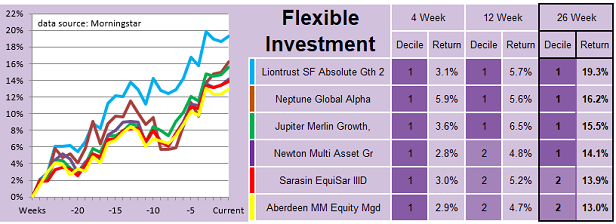

Both of our demonstration portfolios ended July at all time highs. Last week we only made a few minor adjustments; we added to our holdings in funds from the 'Mixed Investment 40-85% Shares' and 'Technology and Telecommunications' sectors, and selected a new fund from the 'Flexible' sector.

We invested in the Liontrust Sustainable Future Absolute Growth fund four weeks ago and last week added the Neptune Global Alpha fund.

With markets tumbling it will be interesting to see what our analysis of last week will show. If markets don't start to recover, then we will need to consider reducing some of our holdings.

The gold funds, which I highlighted last week, have continued to perform well. The Investec Global Gold fund went up by over 5% on Friday, and has now gained nearly 25% since we invested in it in June.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.