Record-breaking Nvidia becomes world’s biggest company again

Despite any number of potential headwinds, the AI computer chip giant is up over 75% since the April tariff crash low. City writer Graeme Evans assesses its latest rally.

26th June 2025 12:40

by Graeme Evans from interactive investor

Wall Street leader NVIDIA Corp (NASDAQ:NVDA) today had a $4 trillion price tag in its sights after the re-emergence of the AI trade powered shares more than 60% from April’s post-Liberation Day lows.

The semiconductor giant has been the best performing of the Magnificent Seven over the past three months, allowing it to overtake Microsoft Corp (NASDAQ:MSFT) as the world’s most valuable company.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Nvidia closed last night worth $3.77 trillion after shares hit a record $154.45, a rise of 4% in a session when analysts at Loop Capital lifted their price target from $175 to $250. In early April, during Trump’s tariff crash, you could have picked up stock for under $87.

Source: TradingView. Past performance is not a guide to future performance.

The performance capped another strong showing by the tech sector as the Nasdaq 100 notched its second record high since February and the S&P 500 index stood within 1% of its peak. Pre-market dealings pointed to further gains by Nvidia and the tech sector later today.

The milestones for the chip giant and the Nasdaq have been reached despite heightened uncertainty.

UBS Global Wealth Management said: “Only two weeks remain before the deadline to reach trade deals with major US trading partners, and potential tariffs on semiconductors are looming. Tensions in the Middle East could still escalate again.

“But the secular trend of artificial intelligence remains robust, and recent adoption and monetisation trends should underpin the next leg of the AI rally amid a supportive backdrop.”

- Buy the dip at top 50 stock plus another chance to trade Tesla

- How minimum pension age rise to 57 might affect you

It highlighted the US Census Bureau’s latest report that tracks AI adoption across 1.2 million firms in the US, which showed another step up in companies’ use of the technology.

AI adoption rates rose to 9.2% in the second quarter of this year, from 7.4% in the previous three-month period and 5.7% in the December 2024 quarter.

UBS said: “This means AI adoption is likely to soon cross the 10% threshold that took US e-commerce 24 years to reach.”

It added that dollar weakness served as a tailwind as overseas sales account for over 50% of US tech companies’ revenues: “This means profits earned abroad would translate into a direct boost in bottom lines, supporting a strong earnings outlook driven by rising AI spending.”

Having initially been one of the worst hit stocks of the Trump administration, Nvidia shares have fought back to stand 15% higher for the year to date.

- Stockwatch: time to buy this off-radar share

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Sentiment has more than overcome the impact of White House restrictions on H20 chip exports to China, which meant Nvidia incurred a $4.5 billion charge in May’s first-quarter results due to excess inventory and purchase obligations.

In another set of forecast-beating results, revenues lifted to $44.1 billion for a 69% increase on the same quarter a year ago. A quarterly dividend payment of $0.01 is due on 3 July.

Nvidia added the Blackwell NVL72 AI supercomputer - a “thinking machine” designed for reasoning - was now in full-scale production across system makers and cloud service providers.

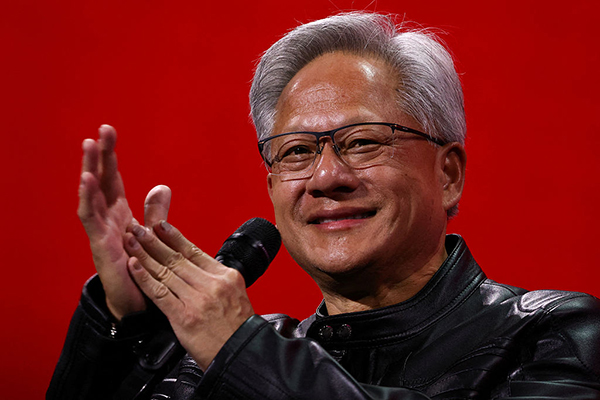

Chief executive and founder Jensen Huang (pictured) described global demand for Nvidia’s AI infrastructure as “incredibly strong”.

He added: “Countries around the world are recognising AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the center of this profound transformation.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.