Buy the dip at top 50 stock plus another chance to trade Tesla

He’s called this trade right more than once before, and now analyst Rodney Hobson has spotted a chance to do it again. He also shares his view on Elon Musk’s highly-rated car company.

25th June 2025 07:52

by Rodney Hobson from interactive investor

Falling consumer confidence has had an unfortunate impact on the world’s largest restaurant owner and operator. However, shares in McDonald's Corp (NYSE:MCD), which make the S&P top 50 measured by market size, look to be settling after a torrid few weeks and now could be a good time to consider buying.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The rot set in at the start of May when the fast-food chain reported net income down 3.2% to just under $1.9 billion in the first three months of 2025. Revenue slipped 3.5% to just shy of $6 billion.

This was not down to anti-American feeling stoked up by US President Donald Trump’s penchant for annoying friend and foe, near and far, with impunity. While global comparable sales did fall 1%, the real damage was surprisingly done in the United States, which saw a 3.6% slump.

McDonald’s boss Chris Kempczinski reckons consumers are grappling with uncertainty. You can say that again. During the first quarter it was the on-off tariffs, during the second it has been a ramping up of tension in the Middle East with the knock-on effect of soaring oil prices, which put up the cost of everything.

Yet consumers have a habit of learning to cope with the changing tides, and in most countries they are not suffering yet from squeezed wages and sharply rising unemployment, while interest rates in the US, Europe and the UK have retreated, albeit stutteringly, from the recent peak.

- When fund managers whisper, listen up

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Customers "can always count on McDonald's for both exciting new menu items and delicious favourites for exceptional value, from a brand they love," Kempczinski claims. And certainly McDonald’s seems to ride out all criticism of fast food in general being poor in taste or nutrition. The company does have a knack off finding new ways and new advertising to lure in the faithful.

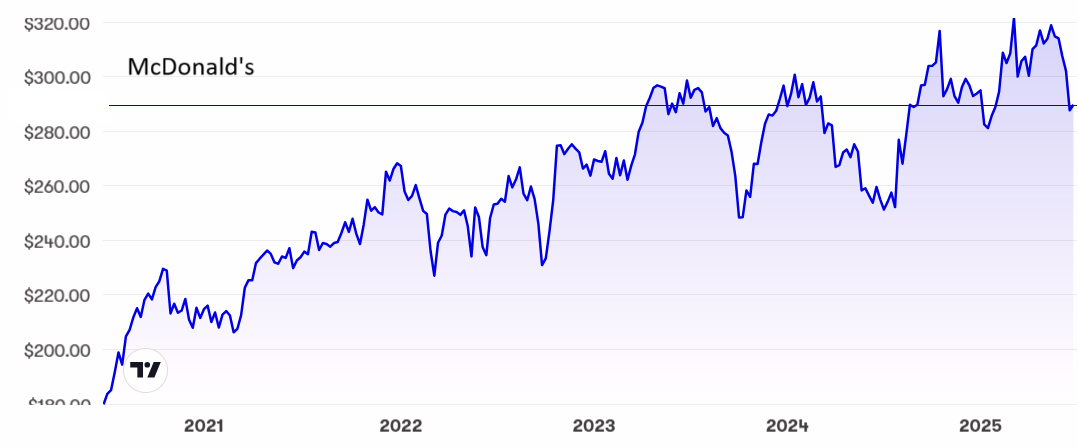

Source: interactive investor. Past performance is not a guide to future performance.

Several times already this year the shares have bumped up against a solid ceiling at $320 but have now slipped back to around $290, which has proved to be a floor several times over the past 12 months and should hold again. The price/earnings (PE) ratio is not too challenging at 25 and there is a reasonable yield of 2.4%.

Hobson’s choice: Fears over McDonald’s look overdone. I recommended buying at $244 and again at $280 in January after a dip similar to the current one. This is another chance to buy.

- Global economic outlook: trade and fiscal policy on trial

- Navigating a volatile macro and market regime

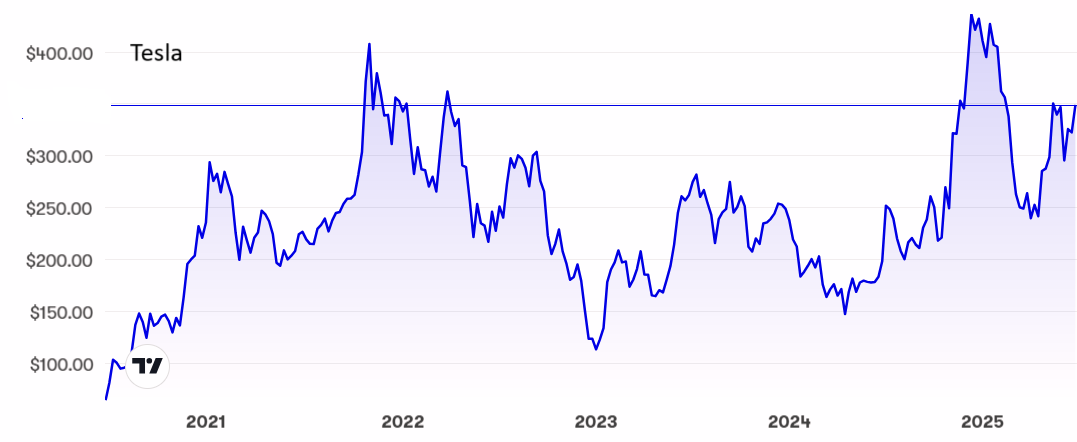

Update: If you want to know what the triumph of hope over reality looks like, try the Tesla Inc (NASDAQ:TSLA) share price. Reality drove the shares down from a ludicrous peak of $480 last December to a still optimistic $222 in March, as the bromance between Tesla boss Elon Musk and US President Donald Trump unravelled.

Four times the triple twos held as a floor and then hope took over from reality. The stock then gained more than 50% to hit $360. Yet the damage from Trump’s tariffs bouncing up and down like yoyos persists and the truce between Musk and Trump is fragile.

Source: interactive investor. Past performance is not a guide to future performance.

Trump does not need Musk or his financial support for at least another three years, even if the president finds some way round the US constitution and stands again. Apart from any vendetta that Trump may conduct against Musk, there are serious considerations such as a backlash in Canada and Europe against Musk, increased competition from other car makers and the lukewarm reception for Tesla’s upgrade to its Model Y.

Electric vehicles need to keep selling to generate cash for Tesla’s venture into robotics. The whole enterprise looks stretched much too far.

At the current share price of $340 the PE is massive at 180 and there is no prospect of a dividend when cash is being guzzled by an increasingly demanding business. My previous advice that this stock is fun for short-term speculators but a clear sell for serious investors remains in force.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.